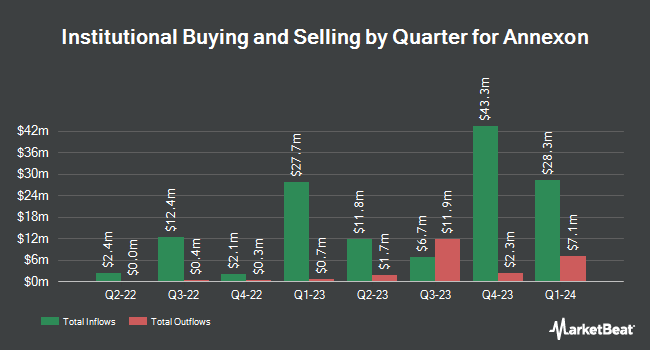

J. Safra Sarasin Holding AG grew its position in shares of Annexon, Inc. (NASDAQ:ANNX - Free Report) by 49.9% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 381,441 shares of the company's stock after purchasing an additional 126,903 shares during the period. J. Safra Sarasin Holding AG owned about 0.35% of Annexon worth $915,000 at the end of the most recent reporting period.

Other hedge funds have also recently added to or reduced their stakes in the company. Nuveen LLC bought a new stake in Annexon during the first quarter worth about $670,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC bought a new stake in Annexon during the fourth quarter worth about $252,000. California State Teachers Retirement System lifted its stake in Annexon by 849.0% during the fourth quarter. California State Teachers Retirement System now owns 66,375 shares of the company's stock worth $341,000 after purchasing an additional 59,381 shares during the last quarter. Wellington Management Group LLP lifted its stake in Annexon by 32.9% during the first quarter. Wellington Management Group LLP now owns 356,480 shares of the company's stock worth $688,000 after purchasing an additional 88,314 shares during the last quarter. Finally, Millennium Management LLC increased its holdings in shares of Annexon by 114.3% in the fourth quarter. Millennium Management LLC now owns 155,676 shares of the company's stock worth $799,000 after buying an additional 83,021 shares during the period.

Annexon Stock Performance

ANNX stock opened at $3.19 on Friday. Annexon, Inc. has a fifty-two week low of $1.28 and a fifty-two week high of $7.85. The business's 50 day moving average price is $2.48 and its two-hundred day moving average price is $2.26. The company has a market capitalization of $350.55 million, a price-to-earnings ratio of -2.47 and a beta of 1.36.

Annexon (NASDAQ:ANNX - Get Free Report) last posted its earnings results on Thursday, August 14th. The company reported ($0.34) earnings per share for the quarter, topping analysts' consensus estimates of ($0.36) by $0.02. Sell-side analysts forecast that Annexon, Inc. will post -0.96 earnings per share for the current year.

Analysts Set New Price Targets

Several research analysts have recently commented on ANNX shares. Zacks Research upgraded Annexon from a "strong sell" rating to a "hold" rating in a report on Monday, August 18th. HC Wainwright reiterated a "buy" rating and issued a $14.00 price objective on shares of Annexon in a report on Friday, August 15th. Finally, Weiss Ratings reiterated a "sell (d-)" rating on shares of Annexon in a report on Saturday, September 27th. Three research analysts have rated the stock with a Buy rating, one has assigned a Hold rating and one has issued a Sell rating to the company. According to data from MarketBeat, the company has a consensus rating of "Hold" and an average target price of $12.50.

Get Our Latest Research Report on ANNX

Annexon Company Profile

(

Free Report)

Annexon, Inc, a clinical-stage biopharmaceutical company, discovers and develops medicines for treating inflammatory-related diseases. Its lead candidate is ANX005, an investigational full-length monoclonal antibody, which is in Phase 3 clinical trial for the treatment of patients with guillain-barré syndrome; completed Phase II clinical trial for treating Huntington's disease; and in Phase II clinical trial for the treatment of amyotrophic lateral sclerosis.

Further Reading

Want to see what other hedge funds are holding ANNX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Annexon, Inc. (NASDAQ:ANNX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Annexon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Annexon wasn't on the list.

While Annexon currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.