Jag Capital Management LLC cut its holdings in Natera, Inc. (NASDAQ:NTRA - Free Report) by 27.6% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 93,849 shares of the medical research company's stock after selling 35,830 shares during the quarter. Natera makes up about 1.8% of Jag Capital Management LLC's investment portfolio, making the stock its 20th largest position. Jag Capital Management LLC owned approximately 0.07% of Natera worth $15,855,000 at the end of the most recent quarter.

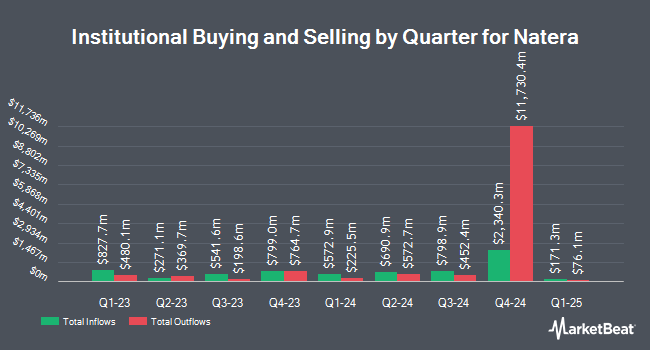

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Price T Rowe Associates Inc. MD boosted its holdings in Natera by 56.3% in the first quarter. Price T Rowe Associates Inc. MD now owns 10,537,743 shares of the medical research company's stock valued at $1,490,144,000 after purchasing an additional 3,795,315 shares during the last quarter. Nuveen LLC acquired a new position in shares of Natera during the 1st quarter worth approximately $113,375,000. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its holdings in shares of Natera by 140.4% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,253,790 shares of the medical research company's stock worth $177,298,000 after buying an additional 732,156 shares during the last quarter. JPMorgan Chase & Co. raised its stake in shares of Natera by 9.9% in the 1st quarter. JPMorgan Chase & Co. now owns 7,361,963 shares of the medical research company's stock valued at $1,041,055,000 after acquiring an additional 660,538 shares during the period. Finally, Ninety One UK Ltd lifted its position in shares of Natera by 149.1% during the second quarter. Ninety One UK Ltd now owns 562,985 shares of the medical research company's stock worth $95,111,000 after purchasing an additional 336,985 shares in the last quarter. Hedge funds and other institutional investors own 99.90% of the company's stock.

Natera Price Performance

Shares of NTRA opened at $174.17 on Tuesday. Natera, Inc. has a 12-month low of $117.27 and a 12-month high of $183.00. The stock has a market capitalization of $23.90 billion, a P/E ratio of -91.19 and a beta of 1.74. The firm's 50 day moving average is $165.33 and its 200-day moving average is $157.54.

Natera (NASDAQ:NTRA - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The medical research company reported ($0.74) EPS for the quarter, missing the consensus estimate of ($0.60) by ($0.14). The company had revenue of $546.60 million for the quarter, compared to analyst estimates of $476.84 million. Natera had a negative return on equity of 22.22% and a negative net margin of 12.89%.The business's revenue for the quarter was up 32.2% compared to the same quarter last year. During the same quarter in the prior year, the business posted ($0.30) earnings per share. Natera has set its FY 2025 guidance at EPS. As a group, equities research analysts forecast that Natera, Inc. will post -1.49 EPS for the current fiscal year.

Analysts Set New Price Targets

NTRA has been the subject of a number of analyst reports. Stephens reiterated an "overweight" rating and set a $183.00 target price on shares of Natera in a research note on Friday, August 15th. Weiss Ratings reissued a "sell (d-)" rating on shares of Natera in a research note on Wednesday, October 8th. Wells Fargo & Company assumed coverage on Natera in a report on Monday, September 22nd. They issued an "equal weight" rating and a $175.00 target price on the stock. Barclays reiterated an "overweight" rating and set a $210.00 price objective (up previously from $190.00) on shares of Natera in a research report on Friday, August 8th. Finally, Royal Bank Of Canada set a $268.00 price objective on shares of Natera and gave the stock an "outperform" rating in a report on Tuesday, September 2nd. One equities research analyst has rated the stock with a Strong Buy rating, seventeen have issued a Buy rating, one has given a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, Natera currently has an average rating of "Moderate Buy" and a consensus target price of $192.88.

Check Out Our Latest Stock Analysis on NTRA

Insiders Place Their Bets

In other Natera news, insider Solomon Moshkevich sold 3,000 shares of the company's stock in a transaction on Friday, August 1st. The stock was sold at an average price of $132.89, for a total transaction of $398,670.00. Following the transaction, the insider owned 123,059 shares of the company's stock, valued at approximately $16,353,310.51. This represents a 2.38% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Rowan E. Chapman sold 2,750 shares of the firm's stock in a transaction that occurred on Thursday, August 28th. The shares were sold at an average price of $166.99, for a total transaction of $459,222.50. Following the completion of the transaction, the director directly owned 6,015 shares in the company, valued at approximately $1,004,444.85. The trade was a 31.37% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 72,464 shares of company stock valued at $10,963,125. 5.63% of the stock is owned by corporate insiders.

About Natera

(

Free Report)

Natera, Inc, a diagnostics company, develops and commercializes molecular testing services worldwide. Its products include Panorama, a non-invasive prenatal test that screens for chromosomal abnormalities of a fetus, as well as in twin pregnancies; Horizon carrier screening test for individuals and couples determine if they are carriers of genetic variations that cause certain genetic conditions; Vistara single-gene NIPT screens for 25 single-gene disorders that cause severe skeletal, cardiac, and neurological conditions; Spectrum, preimplantation genetic tests for couples undergoing IVF; Anora that analyzes miscarriage tissue from women; Empower, a hereditary cancer screening test; and non-invasive prenatal paternity product, which allows a couple to establish paternity without waiting for the child to be born.

See Also

Want to see what other hedge funds are holding NTRA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Natera, Inc. (NASDAQ:NTRA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Natera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Natera wasn't on the list.

While Natera currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report