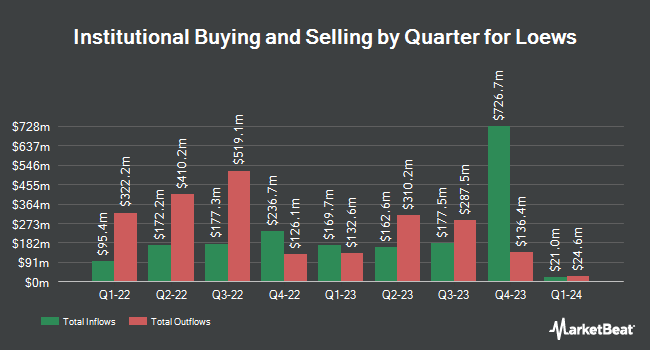

Jane Street Group LLC grew its position in shares of Loews Corporation (NYSE:L - Free Report) by 218.1% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 142,050 shares of the insurance provider's stock after purchasing an additional 97,391 shares during the quarter. Jane Street Group LLC owned approximately 0.07% of Loews worth $13,056,000 as of its most recent SEC filing.

Several other institutional investors also recently bought and sold shares of L. GAMMA Investing LLC lifted its holdings in Loews by 10,114.9% in the 1st quarter. GAMMA Investing LLC now owns 672,138 shares of the insurance provider's stock worth $61,776,000 after buying an additional 665,558 shares during the period. Nuveen LLC purchased a new stake in Loews in the 1st quarter worth approximately $34,166,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its holdings in Loews by 17.1% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,423,409 shares of the insurance provider's stock worth $120,549,000 after buying an additional 207,568 shares during the period. Northern Trust Corp lifted its holdings in Loews by 7.2% in the 1st quarter. Northern Trust Corp now owns 2,249,036 shares of the insurance provider's stock worth $206,709,000 after buying an additional 151,428 shares during the period. Finally, Millennium Management LLC lifted its holdings in Loews by 140.4% in the 1st quarter. Millennium Management LLC now owns 251,175 shares of the insurance provider's stock worth $23,085,000 after buying an additional 146,695 shares during the period. 58.33% of the stock is currently owned by hedge funds and other institutional investors.

Loews Trading Down 0.5%

NYSE L traded down $0.51 on Friday, hitting $96.53. The company's stock had a trading volume of 2,314,098 shares, compared to its average volume of 715,779. The firm has a market cap of $20.02 billion, a P/E ratio of 15.35 and a beta of 0.73. The company has a current ratio of 0.33, a quick ratio of 0.33 and a debt-to-equity ratio of 0.43. The company's 50-day simple moving average is $94.43 and its 200 day simple moving average is $90.17. Loews Corporation has a 52-week low of $75.16 and a 52-week high of $98.33.

Loews (NYSE:L - Get Free Report) last released its earnings results on Monday, August 4th. The insurance provider reported $1.87 EPS for the quarter. Loews had a return on equity of 7.43% and a net margin of 7.47%.The company had revenue of $4.56 billion during the quarter.

Loews Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, September 2nd. Stockholders of record on Wednesday, August 20th were paid a $0.0625 dividend. The ex-dividend date was Wednesday, August 20th. This represents a $0.25 annualized dividend and a dividend yield of 0.3%. Loews's payout ratio is currently 3.97%.

About Loews

(

Free Report)

Loews Corporation provides commercial property and casualty insurance in the United States and internationally. The company offers specialty insurance products, such as management and professional liability, and other coverage products; surety and fidelity bonds; property insurance products that include standard and excess property, marine and boiler, and machinery coverages; and casualty insurance products, such as workers' compensation, general and product liability, and commercial auto, surplus, and umbrella coverages.

See Also

Before you consider Loews, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Loews wasn't on the list.

While Loews currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.