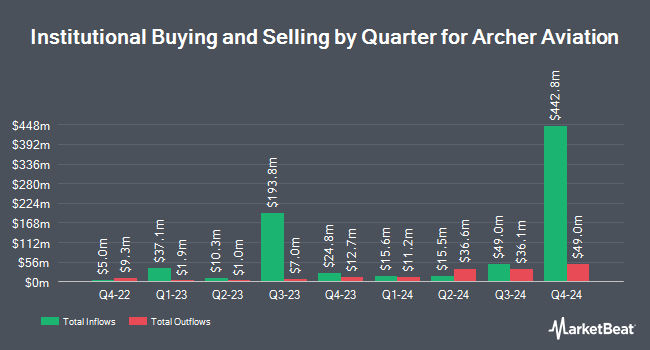

Janney Montgomery Scott LLC lowered its position in Archer Aviation Inc. (NYSE:ACHR - Free Report) by 50.8% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 40,181 shares of the company's stock after selling 41,500 shares during the quarter. Janney Montgomery Scott LLC's holdings in Archer Aviation were worth $436,000 at the end of the most recent reporting period.

Other hedge funds have also recently modified their holdings of the company. Allworth Financial LP grew its holdings in shares of Archer Aviation by 87.0% in the first quarter. Allworth Financial LP now owns 3,577 shares of the company's stock valued at $25,000 after purchasing an additional 1,664 shares during the period. Strs Ohio purchased a new stake in shares of Archer Aviation in the first quarter valued at about $27,000. Tidemark LLC grew its holdings in shares of Archer Aviation by 100.0% in the first quarter. Tidemark LLC now owns 4,000 shares of the company's stock valued at $28,000 after purchasing an additional 2,000 shares during the period. Caitong International Asset Management Co. Ltd purchased a new stake in shares of Archer Aviation in the first quarter valued at about $31,000. Finally, ORG Partners LLC purchased a new stake in shares of Archer Aviation in the first quarter valued at about $32,000. Hedge funds and other institutional investors own 59.34% of the company's stock.

Archer Aviation Stock Down 5.3%

Shares of ACHR opened at $11.24 on Friday. The stock has a market capitalization of $7.25 billion, a PE ratio of -8.33 and a beta of 3.06. Archer Aviation Inc. has a 1 year low of $2.98 and a 1 year high of $14.62. The company has a debt-to-equity ratio of 0.05, a quick ratio of 22.30 and a current ratio of 22.30. The company's 50-day simple moving average is $9.97 and its 200-day simple moving average is $9.82.

Archer Aviation (NYSE:ACHR - Get Free Report) last issued its quarterly earnings results on Monday, August 11th. The company reported ($0.36) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.24) by ($0.12). Analysts forecast that Archer Aviation Inc. will post -1.32 earnings per share for the current fiscal year.

Insider Activity

In related news, insider Eric Lentell sold 48,936 shares of the company's stock in a transaction that occurred on Monday, August 18th. The shares were sold at an average price of $9.83, for a total transaction of $481,040.88. Following the sale, the insider directly owned 47,518 shares in the company, valued at approximately $467,101.94. This represents a 50.74% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Tosha Perkins sold 42,775 shares of the company's stock in a transaction that occurred on Monday, August 18th. The stock was sold at an average price of $9.83, for a total transaction of $420,478.25. Following the sale, the insider owned 295,337 shares in the company, valued at $2,903,162.71. The trade was a 12.65% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 188,068 shares of company stock valued at $1,848,708 over the last three months. 7.65% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of brokerages recently issued reports on ACHR. JPMorgan Chase & Co. upped their price objective on shares of Archer Aviation from $9.00 to $10.00 and gave the company a "neutral" rating in a report on Friday, August 1st. HC Wainwright reissued a "buy" rating and issued a $18.00 price objective on shares of Archer Aviation in a report on Tuesday, August 12th. Weiss Ratings reaffirmed a "sell (d-)" rating on shares of Archer Aviation in a research report on Wednesday, October 8th. Needham & Company LLC reaffirmed a "buy" rating and issued a $13.00 target price on shares of Archer Aviation in a research report on Tuesday, August 12th. Finally, Canaccord Genuity Group reaffirmed a "buy" rating on shares of Archer Aviation in a research report on Thursday, July 17th. Seven equities research analysts have rated the stock with a Buy rating, one has given a Hold rating and one has given a Sell rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $13.43.

Read Our Latest Stock Analysis on ACHR

Archer Aviation Profile

(

Free Report)

Archer Aviation Inc, together with its subsidiaries, engages in designs, develops, and operates electric vertical takeoff and landing aircraft for use in urban air mobility. The company was formerly known as Atlas Crest Investment Corp. and changed its name to Archer Aviation Inc The company is headquartered in San Jose, California.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Archer Aviation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Archer Aviation wasn't on the list.

While Archer Aviation currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.