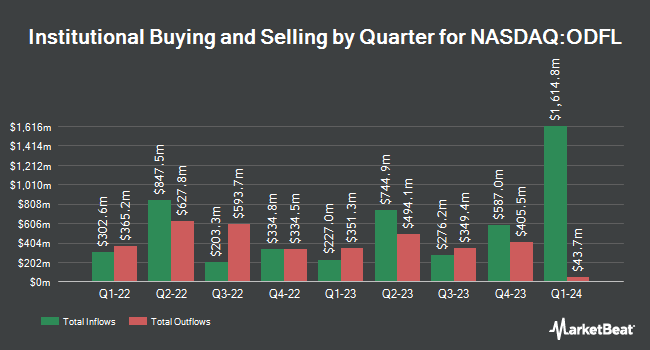

Janney Montgomery Scott LLC reduced its holdings in Old Dominion Freight Line, Inc. (NASDAQ:ODFL - Free Report) by 14.5% in the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 77,802 shares of the transportation company's stock after selling 13,151 shares during the quarter. Janney Montgomery Scott LLC's holdings in Old Dominion Freight Line were worth $12,627,000 at the end of the most recent reporting period.

Several other large investors also recently modified their holdings of ODFL. GAMMA Investing LLC grew its holdings in shares of Old Dominion Freight Line by 48.7% during the first quarter. GAMMA Investing LLC now owns 3,109 shares of the transportation company's stock worth $514,000 after buying an additional 1,018 shares in the last quarter. Wealth Enhancement Advisory Services LLC grew its holdings in shares of Old Dominion Freight Line by 9.5% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 17,595 shares of the transportation company's stock worth $2,911,000 after buying an additional 1,529 shares in the last quarter. Cambridge Investment Research Advisors Inc. grew its holdings in shares of Old Dominion Freight Line by 5.1% during the first quarter. Cambridge Investment Research Advisors Inc. now owns 9,110 shares of the transportation company's stock worth $1,507,000 after buying an additional 443 shares in the last quarter. Golden State Wealth Management LLC grew its holdings in shares of Old Dominion Freight Line by 29.0% during the first quarter. Golden State Wealth Management LLC now owns 2,388 shares of the transportation company's stock worth $395,000 after buying an additional 537 shares in the last quarter. Finally, Wilkinson Global Asset Management LLC grew its holdings in shares of Old Dominion Freight Line by 6.0% during the first quarter. Wilkinson Global Asset Management LLC now owns 107,819 shares of the transportation company's stock worth $17,839,000 after buying an additional 6,133 shares in the last quarter. 77.82% of the stock is currently owned by institutional investors.

Old Dominion Freight Line Price Performance

Old Dominion Freight Line stock opened at $141.33 on Friday. Old Dominion Freight Line, Inc. has a one year low of $133.69 and a one year high of $233.26. The stock's fifty day moving average price is $147.58 and its two-hundred day moving average price is $156.65. The company has a debt-to-equity ratio of 0.04, a current ratio of 1.38 and a quick ratio of 1.38. The firm has a market cap of $29.70 billion, a PE ratio of 27.60, a price-to-earnings-growth ratio of 3.28 and a beta of 1.19.

Old Dominion Freight Line (NASDAQ:ODFL - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The transportation company reported $1.27 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.29 by ($0.02). Old Dominion Freight Line had a net margin of 19.42% and a return on equity of 25.94%. The business had revenue of $1.41 billion during the quarter, compared to the consensus estimate of $1.43 billion. During the same quarter in the previous year, the business posted $1.48 EPS. The company's revenue for the quarter was down 6.1% on a year-over-year basis. As a group, research analysts expect that Old Dominion Freight Line, Inc. will post 5.68 EPS for the current fiscal year.

Old Dominion Freight Line Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, September 17th. Stockholders of record on Wednesday, September 3rd were paid a $0.28 dividend. The ex-dividend date was Wednesday, September 3rd. This represents a $1.12 annualized dividend and a dividend yield of 0.8%. Old Dominion Freight Line's dividend payout ratio (DPR) is presently 21.88%.

Analyst Ratings Changes

A number of research analysts recently issued reports on the company. Stifel Nicolaus decreased their price objective on Old Dominion Freight Line from $183.00 to $168.00 and set a "buy" rating for the company in a report on Thursday, July 31st. Vertical Research upgraded Old Dominion Freight Line from a "hold" rating to a "buy" rating and set a $170.00 price objective for the company in a report on Thursday, July 31st. Citigroup decreased their price target on Old Dominion Freight Line from $174.00 to $173.00 and set a "buy" rating for the company in a research note on Wednesday, September 10th. TD Cowen decreased their price target on Old Dominion Freight Line from $166.00 to $159.00 and set a "hold" rating for the company in a research note on Thursday, July 31st. Finally, UBS Group raised their price target on Old Dominion Freight Line from $155.00 to $164.00 and gave the company a "neutral" rating in a research note on Friday. Eight analysts have rated the stock with a Buy rating, fifteen have assigned a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, Old Dominion Freight Line has a consensus rating of "Hold" and a consensus target price of $166.52.

Check Out Our Latest Stock Analysis on Old Dominion Freight Line

Old Dominion Freight Line Company Profile

(

Free Report)

Old Dominion Freight Line, Inc operates as a less-than-truckload motor carrier in the United States and North America. The company offers regional, inter-regional, and national less-than-truckload services, as well as expedited transportation. It also provides various value-added services, including container drayage, truckload brokerage, and supply chain consulting.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Old Dominion Freight Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Dominion Freight Line wasn't on the list.

While Old Dominion Freight Line currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.