Janney Montgomery Scott LLC acquired a new stake in PDF Solutions, Inc. (NASDAQ:PDFS - Free Report) during the second quarter, according to its most recent filing with the Securities & Exchange Commission. The firm acquired 44,198 shares of the technology company's stock, valued at approximately $945,000. Janney Montgomery Scott LLC owned about 0.11% of PDF Solutions as of its most recent SEC filing.

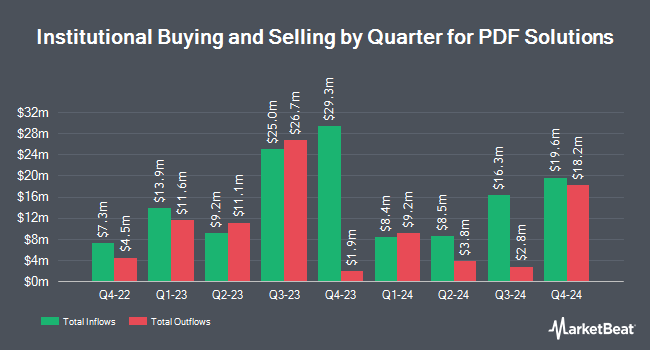

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. State of Alaska Department of Revenue raised its holdings in shares of PDF Solutions by 8.5% in the second quarter. State of Alaska Department of Revenue now owns 18,645 shares of the technology company's stock valued at $397,000 after purchasing an additional 1,458 shares during the last quarter. Significant Wealth Partners LLC raised its holdings in shares of PDF Solutions by 48.2% in the second quarter. Significant Wealth Partners LLC now owns 18,663 shares of the technology company's stock valued at $399,000 after purchasing an additional 6,067 shares during the last quarter. Wealth Enhancement Advisory Services LLC raised its holdings in shares of PDF Solutions by 18.1% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 12,115 shares of the technology company's stock valued at $279,000 after purchasing an additional 1,855 shares during the last quarter. Silverberg Bernstein Capital Management LLC raised its holdings in shares of PDF Solutions by 27.6% in the second quarter. Silverberg Bernstein Capital Management LLC now owns 418,783 shares of the technology company's stock valued at $8,954,000 after purchasing an additional 90,467 shares during the last quarter. Finally, Kings Path Partners LLC increased its holdings in PDF Solutions by 34.1% during the second quarter. Kings Path Partners LLC now owns 22,850 shares of the technology company's stock worth $489,000 after buying an additional 5,810 shares during the last quarter. 79.51% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research firms have issued reports on PDFS. Weiss Ratings reaffirmed a "hold (c-)" rating on shares of PDF Solutions in a research report on Wednesday, October 8th. Wall Street Zen cut PDF Solutions from a "buy" rating to a "hold" rating in a report on Saturday, July 26th. DA Davidson reiterated a "buy" rating and set a $24.00 price target on shares of PDF Solutions in a report on Tuesday, September 23rd. Finally, Rosenblatt Securities reiterated a "buy" rating and set a $31.00 price target on shares of PDF Solutions in a report on Tuesday, August 5th. Three analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $33.33.

Check Out Our Latest Report on PDFS

PDF Solutions Price Performance

NASDAQ:PDFS opened at $26.52 on Wednesday. PDF Solutions, Inc. has a one year low of $15.91 and a one year high of $33.42. The company has a market cap of $1.05 billion, a P/E ratio of 1,326.66 and a beta of 1.54. The firm's fifty day moving average price is $21.99 and its two-hundred day moving average price is $20.73. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.37 and a quick ratio of 2.37.

PDF Solutions Profile

(

Free Report)

PDF Solutions, Inc provides proprietary software and physical intellectual property products for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, China, Japan, and internationally. The company offers Exensio software products, such as Manufacturing Analytics that store collected data in a common environment with a consistent view for enabling product engineers to identify and analyze production yield, performance, reliability, and other issues; Process Control that provides failure detection and classification capabilities for monitoring, alarming, and controlling manufacturing tool sets; Test Operations that offer data collection and analysis capabilities; and Assembly Operations that provide device manufacturers with the capability to link assembly and packaging data, including fabrication and characterization data over the product life cycle.

Recommended Stories

Want to see what other hedge funds are holding PDFS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for PDF Solutions, Inc. (NASDAQ:PDFS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PDF Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PDF Solutions wasn't on the list.

While PDF Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.