Jefferies Financial Group Inc. trimmed its stake in Cardinal Health, Inc. (NYSE:CAH - Free Report) by 72.8% in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 58,778 shares of the company's stock after selling 157,269 shares during the period. Jefferies Financial Group Inc.'s holdings in Cardinal Health were worth $8,098,000 at the end of the most recent reporting period.

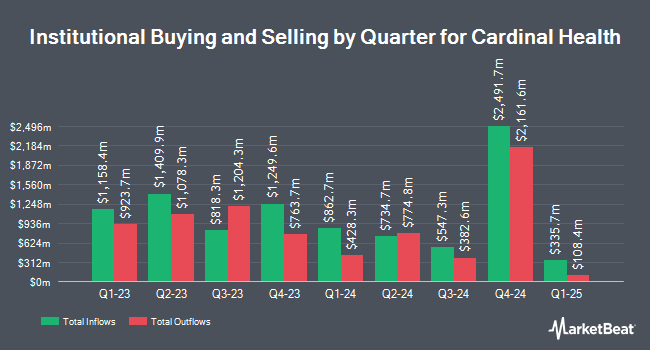

Several other institutional investors have also added to or reduced their stakes in the company. Marshall Wace LLP raised its holdings in Cardinal Health by 154.6% during the 4th quarter. Marshall Wace LLP now owns 3,151,736 shares of the company's stock valued at $372,756,000 after buying an additional 1,913,892 shares during the period. Castlekeep Investment Advisors LLC acquired a new position in Cardinal Health during the 4th quarter valued at approximately $141,963,000. GAMMA Investing LLC increased its holdings in shares of Cardinal Health by 17,589.1% during the 1st quarter. GAMMA Investing LLC now owns 964,941 shares of the company's stock valued at $132,940,000 after purchasing an additional 959,486 shares in the last quarter. Junto Capital Management LP acquired a new stake in Cardinal Health in the 4th quarter valued at $92,811,000. Finally, Woodline Partners LP acquired a new stake in shares of Cardinal Health in the fourth quarter worth approximately $87,144,000. Hedge funds and other institutional investors own 87.17% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on the stock. Evercore ISI reissued an "outperform" rating and issued a $180.00 price target (up previously from $175.00) on shares of Cardinal Health in a research note on Thursday, June 12th. Morgan Stanley lifted their price objective on Cardinal Health from $181.00 to $190.00 and gave the company an "overweight" rating in a research note on Wednesday, July 16th. UBS Group increased their target price on Cardinal Health from $150.00 to $160.00 and gave the stock a "buy" rating in a research note on Tuesday, April 29th. Wells Fargo & Company raised shares of Cardinal Health from an "equal weight" rating to an "overweight" rating and raised their price objective for the company from $136.00 to $179.00 in a research note on Tuesday, June 3rd. Finally, Citigroup reaffirmed a "neutral" rating and set a $170.00 price objective (up previously from $157.00) on shares of Cardinal Health in a research report on Friday, June 13th. Three analysts have rated the stock with a hold rating and twelve have given a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $158.07.

Read Our Latest Research Report on CAH

Cardinal Health Trading Up 1.7%

Shares of NYSE:CAH traded up $2.64 during midday trading on Monday, hitting $158.64. The stock had a trading volume of 1,639,340 shares, compared to its average volume of 1,711,515. The company has a market capitalization of $37.86 billion, a PE ratio of 24.75, a P/E/G ratio of 1.55 and a beta of 0.67. Cardinal Health, Inc. has a 1 year low of $96.05 and a 1 year high of $168.44. The stock has a 50 day moving average price of $159.74 and a two-hundred day moving average price of $142.94.

Cardinal Health (NYSE:CAH - Get Free Report) last released its earnings results on Thursday, May 1st. The company reported $2.35 EPS for the quarter, beating analysts' consensus estimates of $2.15 by $0.20. Cardinal Health had a negative return on equity of 68.84% and a net margin of 0.70%. The company had revenue of $54.88 billion during the quarter, compared to the consensus estimate of $55.33 billion. During the same quarter last year, the company earned $2.08 earnings per share. Cardinal Health's quarterly revenue was up .0% compared to the same quarter last year. As a group, equities analysts expect that Cardinal Health, Inc. will post 7.95 EPS for the current year.

About Cardinal Health

(

Free Report)

Cardinal Health, Inc operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home.

Featured Stories

Before you consider Cardinal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Health wasn't on the list.

While Cardinal Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.