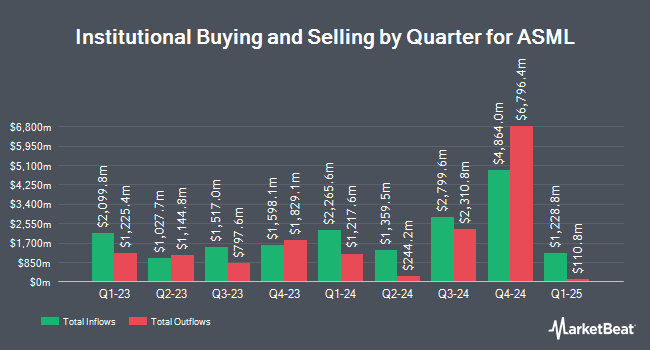

Jefferies Financial Group Inc. increased its position in ASML Holding N.V. (NASDAQ:ASML - Free Report) by 251.5% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 1,891 shares of the semiconductor company's stock after purchasing an additional 1,353 shares during the quarter. Jefferies Financial Group Inc.'s holdings in ASML were worth $1,253,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors also recently modified their holdings of ASML. GAMMA Investing LLC boosted its position in shares of ASML by 70,115.5% during the first quarter. GAMMA Investing LLC now owns 1,400,800 shares of the semiconductor company's stock valued at $9,282,120,000 after buying an additional 1,398,805 shares during the last quarter. First Manhattan CO. LLC. lifted its position in ASML by 59.4% during the fourth quarter. First Manhattan CO. LLC. now owns 439,890 shares of the semiconductor company's stock valued at $307,374,000 after purchasing an additional 163,945 shares during the period. Hyperion Asset Management Ltd boosted its holdings in ASML by 63.9% in the fourth quarter. Hyperion Asset Management Ltd now owns 297,882 shares of the semiconductor company's stock worth $206,456,000 after purchasing an additional 116,121 shares during the last quarter. Brown Advisory Inc. grew its position in ASML by 29.0% in the 1st quarter. Brown Advisory Inc. now owns 440,728 shares of the semiconductor company's stock worth $292,040,000 after purchasing an additional 99,199 shares during the period. Finally, Nan Shan Life Insurance Co. Ltd. raised its stake in ASML by 3,694.5% during the 4th quarter. Nan Shan Life Insurance Co. Ltd. now owns 72,892 shares of the semiconductor company's stock valued at $50,520,000 after buying an additional 70,971 shares during the last quarter. 26.07% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on ASML shares. Erste Group Bank restated a "hold" rating on shares of ASML in a research report on Wednesday, July 23rd. Citigroup reiterated a "buy" rating on shares of ASML in a research note on Monday, May 19th. Susquehanna lowered their price target on shares of ASML from $1,100.00 to $965.00 and set a "positive" rating on the stock in a report on Thursday, April 17th. New Street Research raised shares of ASML from a "neutral" rating to a "buy" rating in a report on Thursday, July 24th. Finally, DZ Bank cut ASML from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, July 16th. Seven analysts have rated the stock with a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $923.80.

Read Our Latest Stock Analysis on ASML

ASML Stock Performance

Shares of ASML traded up $1.04 during mid-day trading on Wednesday, reaching $690.67. The company had a trading volume of 1,203,838 shares, compared to its average volume of 1,759,652. The stock has a 50 day moving average of $760.31 and a two-hundred day moving average of $725.63. ASML Holding N.V. has a 52-week low of $578.51 and a 52-week high of $945.05. The stock has a market capitalization of $271.72 billion, a P/E ratio of 28.83, a PEG ratio of 1.42 and a beta of 1.76. The company has a quick ratio of 0.81, a current ratio of 1.43 and a debt-to-equity ratio of 0.21.

ASML (NASDAQ:ASML - Get Free Report) last posted its quarterly earnings results on Wednesday, July 16th. The semiconductor company reported $4.55 earnings per share for the quarter, missing analysts' consensus estimates of $5.94 by ($1.39). The business had revenue of $8.94 billion for the quarter, compared to analyst estimates of $8.72 billion. ASML had a return on equity of 49.47% and a net margin of 26.95%. The business's revenue was up 23.2% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $4.01 earnings per share. On average, analysts expect that ASML Holding N.V. will post 25.17 earnings per share for the current year.

ASML Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, August 6th. Investors of record on Tuesday, July 29th will be issued a $1.856 dividend. This is an increase from ASML's previous quarterly dividend of $1.64. The ex-dividend date is Tuesday, July 29th. This represents a $7.42 annualized dividend and a yield of 1.1%. ASML's payout ratio is presently 26.21%.

ASML Company Profile

(

Free Report)

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers. It offers advanced semiconductor equipment systems, including lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various range of semiconductor nodes and technologies.

Featured Articles

Before you consider ASML, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASML wasn't on the list.

While ASML currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.