Jefferies Financial Group Inc. increased its stake in Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN - Free Report) by 230.5% in the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 81,313 shares of the specialty pharmaceutical company's stock after acquiring an additional 56,713 shares during the period. Jefferies Financial Group Inc. owned about 0.15% of Supernus Pharmaceuticals worth $2,663,000 as of its most recent SEC filing.

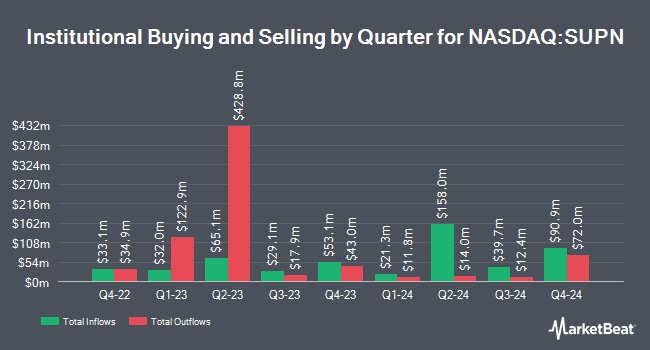

Several other institutional investors have also added to or reduced their stakes in SUPN. LPL Financial LLC boosted its position in Supernus Pharmaceuticals by 18.9% during the fourth quarter. LPL Financial LLC now owns 12,741 shares of the specialty pharmaceutical company's stock valued at $461,000 after buying an additional 2,029 shares during the period. Vanguard Group Inc. boosted its position in Supernus Pharmaceuticals by 0.4% during the fourth quarter. Vanguard Group Inc. now owns 6,150,759 shares of the specialty pharmaceutical company's stock valued at $222,411,000 after buying an additional 22,852 shares during the period. JPMorgan Chase & Co. boosted its position in Supernus Pharmaceuticals by 17.5% during the fourth quarter. JPMorgan Chase & Co. now owns 297,810 shares of the specialty pharmaceutical company's stock valued at $10,769,000 after buying an additional 44,414 shares during the period. Norges Bank purchased a new stake in Supernus Pharmaceuticals during the fourth quarter valued at about $4,540,000. Finally, Arrowstreet Capital Limited Partnership boosted its position in Supernus Pharmaceuticals by 79.4% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 174,916 shares of the specialty pharmaceutical company's stock valued at $6,325,000 after buying an additional 77,393 shares during the period.

Supernus Pharmaceuticals Stock Down 0.0%

Shares of Supernus Pharmaceuticals stock traded down $0.01 during trading on Tuesday, reaching $37.05. 51,909 shares of the stock were exchanged, compared to its average volume of 587,685. The stock's fifty day moving average is $32.74 and its 200 day moving average is $33.33. The firm has a market cap of $2.07 billion, a price-to-earnings ratio of 33.46 and a beta of 0.74. Supernus Pharmaceuticals, Inc. has a 1 year low of $27.58 and a 1 year high of $40.28.

Wall Street Analyst Weigh In

Several analysts have issued reports on the stock. Cantor Fitzgerald upgraded shares of Supernus Pharmaceuticals from a "neutral" rating to an "overweight" rating and set a $42.00 price target for the company in a research report on Wednesday, July 30th. Wall Street Zen upgraded shares of Supernus Pharmaceuticals from a "hold" rating to a "buy" rating in a report on Saturday.

Read Our Latest Stock Report on SUPN

Supernus Pharmaceuticals Company Profile

(

Free Report)

Supernus Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States. The company's commercial products are Trokendi XR, an extended release topiramate product indicated for the treatment of epilepsy, as well as for the prophylaxis of migraine headache; and Oxtellar XR, an extended release oxcarbazepine for the monotherapy treatment of partial onset seizures in adults and children between 6 to 17 years of age.

See Also

Before you consider Supernus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Supernus Pharmaceuticals wasn't on the list.

While Supernus Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.