Jefferies Financial Group Inc. acquired a new stake in shares of Cognizant Technology Solutions Corporation (NASDAQ:CTSH - Free Report) during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 37,598 shares of the information technology service provider's stock, valued at approximately $2,876,000.

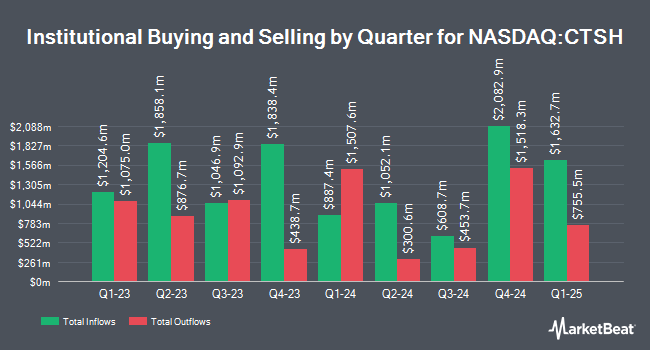

A number of other institutional investors also recently added to or reduced their stakes in CTSH. Brighton Jones LLC bought a new stake in Cognizant Technology Solutions during the fourth quarter valued at about $214,000. Huntington National Bank boosted its holdings in Cognizant Technology Solutions by 12.6% in the fourth quarter. Huntington National Bank now owns 7,329 shares of the information technology service provider's stock worth $564,000 after acquiring an additional 823 shares in the last quarter. World Investment Advisors boosted its holdings in Cognizant Technology Solutions by 17.3% in the fourth quarter. World Investment Advisors now owns 6,607 shares of the information technology service provider's stock worth $508,000 after acquiring an additional 973 shares in the last quarter. Integrated Quantitative Investments LLC acquired a new stake in Cognizant Technology Solutions in the fourth quarter worth about $408,000. Finally, Resona Asset Management Co. Ltd. acquired a new stake in Cognizant Technology Solutions in the fourth quarter worth about $13,747,000. Institutional investors own 92.44% of the company's stock.

Analysts Set New Price Targets

CTSH has been the subject of several recent analyst reports. Wall Street Zen downgraded Cognizant Technology Solutions from a "buy" rating to a "hold" rating in a report on Saturday. Guggenheim raised Cognizant Technology Solutions from a "neutral" rating to a "buy" rating and set a $90.00 price target for the company in a report on Friday, July 18th. Needham & Company LLC reissued a "hold" rating on shares of Cognizant Technology Solutions in a report on Thursday, May 1st. Robert W. Baird raised their price target on Cognizant Technology Solutions from $78.00 to $82.00 and gave the stock a "neutral" rating in a report on Thursday, May 1st. Finally, Susquehanna raised Cognizant Technology Solutions from a "neutral" rating to a "positive" rating and lifted their target price for the stock from $77.00 to $90.00 in a report on Thursday, May 1st. Fourteen analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $85.88.

Read Our Latest Analysis on CTSH

Cognizant Technology Solutions Price Performance

Shares of CTSH traded down $1.09 during trading hours on Tuesday, hitting $70.17. 886,439 shares of the stock were exchanged, compared to its average volume of 3,800,351. The stock's 50-day moving average price is $77.78 and its two-hundred day moving average price is $78.57. The company has a market cap of $34.59 billion, a price-to-earnings ratio of 14.26, a price-to-earnings-growth ratio of 1.47 and a beta of 0.90. The company has a debt-to-equity ratio of 0.04, a quick ratio of 2.41 and a current ratio of 2.41. Cognizant Technology Solutions Corporation has a 12-month low of $65.52 and a 12-month high of $90.82.

Cognizant Technology Solutions (NASDAQ:CTSH - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The information technology service provider reported $1.31 earnings per share for the quarter, topping analysts' consensus estimates of $1.26 by $0.05. Cognizant Technology Solutions had a return on equity of 16.77% and a net margin of 11.89%. The company had revenue of $5.25 billion for the quarter, compared to analyst estimates of $5.17 billion. During the same quarter in the previous year, the company posted $1.17 earnings per share. The firm's revenue for the quarter was up 8.1% compared to the same quarter last year. Research analysts expect that Cognizant Technology Solutions Corporation will post 4.98 earnings per share for the current year.

Cognizant Technology Solutions Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, August 26th. Stockholders of record on Monday, August 18th will be paid a $0.31 dividend. This represents a $1.24 annualized dividend and a dividend yield of 1.8%. The ex-dividend date of this dividend is Monday, August 18th. Cognizant Technology Solutions's dividend payout ratio is 25.20%.

About Cognizant Technology Solutions

(

Free Report)

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services, Health Sciences, Products and Resources, and Communications, Media and Technology.

See Also

Before you consider Cognizant Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognizant Technology Solutions wasn't on the list.

While Cognizant Technology Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.