Jefferies Financial Group Inc. increased its holdings in JD.com, Inc. (NASDAQ:JD - Free Report) by 50.6% during the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 49,825 shares of the information services provider's stock after buying an additional 16,739 shares during the period. Jefferies Financial Group Inc.'s holdings in JD.com were worth $2,049,000 as of its most recent SEC filing.

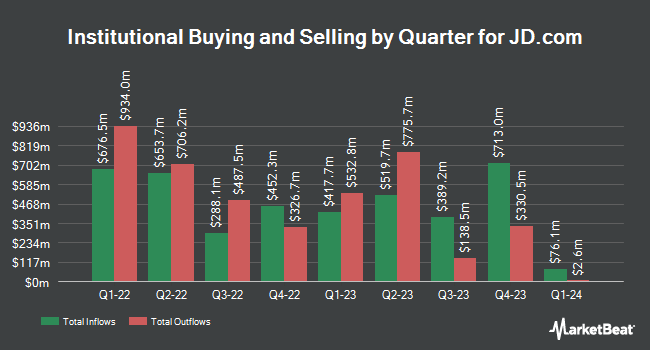

A number of other institutional investors and hedge funds also recently made changes to their positions in JD. FMR LLC raised its position in shares of JD.com by 86.2% in the fourth quarter. FMR LLC now owns 28,447,641 shares of the information services provider's stock worth $986,280,000 after buying an additional 13,170,649 shares in the last quarter. CoreView Capital Management Ltd increased its stake in JD.com by 204.8% in the fourth quarter. CoreView Capital Management Ltd now owns 6,399,711 shares of the information services provider's stock valued at $221,878,000 after acquiring an additional 4,299,872 shares during the last quarter. Voya Investment Management LLC bought a new position in JD.com in the fourth quarter valued at $109,665,000. Aspex Management HK Ltd bought a new position in JD.com in the fourth quarter valued at $93,562,000. Finally, Federated Hermes Inc. increased its stake in JD.com by 61.9% in the first quarter. Federated Hermes Inc. now owns 4,374,070 shares of the information services provider's stock valued at $179,862,000 after acquiring an additional 1,671,839 shares during the last quarter. Hedge funds and other institutional investors own 15.98% of the company's stock.

JD.com Stock Performance

Shares of JD opened at $30.91 on Monday. The company has a debt-to-equity ratio of 0.18, a current ratio of 1.26 and a quick ratio of 0.92. JD.com, Inc. has a one year low of $24.13 and a one year high of $47.82. The company has a 50-day simple moving average of $32.62 and a two-hundred day simple moving average of $36.39. The firm has a market capitalization of $43.17 billion, a PE ratio of 7.52 and a beta of 0.46.

Analysts Set New Price Targets

JD has been the topic of a number of research analyst reports. UBS Group reduced their target price on JD.com from $58.00 to $50.00 and set a "buy" rating on the stock in a research note on Thursday, July 10th. JPMorgan Chase & Co. reduced their target price on JD.com from $48.00 to $42.00 and set an "overweight" rating on the stock in a research note on Tuesday, May 27th. Citigroup reaffirmed a "buy" rating and set a $51.00 price objective (down from $56.00) on shares of JD.com in a research note on Monday, April 28th. Arete cut JD.com from a "buy" rating to a "neutral" rating and set a $45.00 price objective on the stock. in a research note on Tuesday, June 24th. Finally, Bank of America reduced their price objective on JD.com from $44.00 to $37.00 and set a "buy" rating on the stock in a research note on Monday, July 14th. Six investment analysts have rated the stock with a hold rating, nine have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, JD.com has a consensus rating of "Moderate Buy" and an average price target of $44.00.

Read Our Latest Report on JD.com

JD.com Profile

(

Free Report)

JD.com, Inc operates as a supply chain-based technology and service provider in the People's Republic of China. The company offers computers, communication, and consumer electronics products, as well as home appliances; and general merchandise products comprising food, beverage and fresh produce, baby and maternity products, furniture and household goods, cosmetics and other personal care items, pharmaceutical and healthcare products, industrial products, books, automobile accessories, apparel and footwear, bags, and jewelry.

See Also

Want to see what other hedge funds are holding JD? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for JD.com, Inc. (NASDAQ:JD - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider JD.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JD.com wasn't on the list.

While JD.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.