Jefferies Financial Group Inc. decreased its stake in shares of Alarm.com Holdings, Inc. (NASDAQ:ALRM - Free Report) by 89.5% in the 1st quarter, according to its most recent 13F filing with the SEC. The firm owned 12,252 shares of the software maker's stock after selling 104,200 shares during the period. Jefferies Financial Group Inc.'s holdings in Alarm.com were worth $682,000 as of its most recent filing with the SEC.

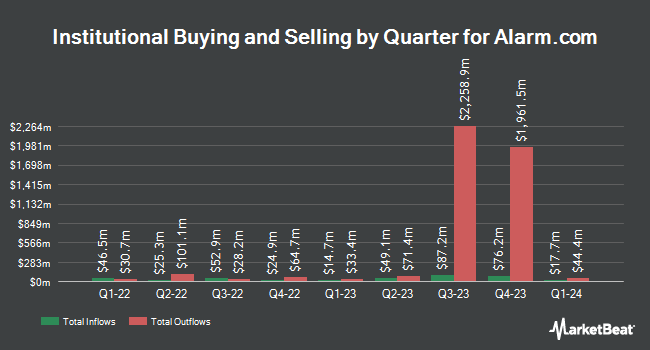

A number of other hedge funds have also bought and sold shares of ALRM. Schroder Investment Management Group increased its position in Alarm.com by 21.5% during the fourth quarter. Schroder Investment Management Group now owns 18,616 shares of the software maker's stock worth $1,137,000 after acquiring an additional 3,298 shares during the period. O Shaughnessy Asset Management LLC bought a new position in Alarm.com during the fourth quarter worth about $211,000. Franklin Resources Inc. increased its position in Alarm.com by 9.6% during the fourth quarter. Franklin Resources Inc. now owns 7,516 shares of the software maker's stock worth $457,000 after acquiring an additional 661 shares during the period. Wells Fargo & Company MN increased its position in Alarm.com by 14.1% during the fourth quarter. Wells Fargo & Company MN now owns 375,233 shares of the software maker's stock worth $22,814,000 after acquiring an additional 46,262 shares during the period. Finally, Resona Asset Management Co. Ltd. bought a new position in Alarm.com during the fourth quarter worth about $746,000. 91.74% of the stock is owned by institutional investors.

Insider Buying and Selling

In related news, CEO Stephen Trundle sold 3,644 shares of the stock in a transaction on Friday, May 23rd. The shares were sold at an average price of $56.66, for a total transaction of $206,469.04. Following the transaction, the chief executive officer directly owned 268,859 shares of the company's stock, valued at $15,233,550.94. This represents a 1.34% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Daniel Kerzner sold 2,213 shares of Alarm.com stock in a transaction on Friday, May 23rd. The shares were sold at an average price of $56.66, for a total transaction of $125,388.58. Following the completion of the sale, the insider directly owned 72,004 shares of the company's stock, valued at approximately $4,079,746.64. This trade represents a 2.98% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 34,167 shares of company stock valued at $1,994,181 in the last ninety days. Insiders own 5.80% of the company's stock.

Alarm.com Price Performance

ALRM stock traded up $0.07 during mid-day trading on Friday, hitting $54.41. The stock had a trading volume of 695,805 shares, compared to its average volume of 299,272. The company has a current ratio of 2.14, a quick ratio of 2.01 and a debt-to-equity ratio of 0.64. Alarm.com Holdings, Inc. has a 52 week low of $48.23 and a 52 week high of $70.06. The firm has a market capitalization of $2.71 billion, a P/E ratio of 22.86, a P/E/G ratio of 2.91 and a beta of 0.97. The firm has a fifty day simple moving average of $56.42 and a 200 day simple moving average of $56.95.

Alarm.com (NASDAQ:ALRM - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The software maker reported $0.60 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.52 by $0.08. The company had revenue of $254.31 million for the quarter, compared to analyst estimates of $243.96 million. Alarm.com had a net margin of 13.27% and a return on equity of 14.19%. The firm's revenue was up 8.8% on a year-over-year basis. During the same period in the previous year, the firm posted $0.58 EPS. As a group, research analysts forecast that Alarm.com Holdings, Inc. will post 1.64 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on the stock. Raymond James Financial lowered their price target on shares of Alarm.com from $85.00 to $80.00 and set a "strong-buy" rating on the stock in a research report on Friday, May 9th. The Goldman Sachs Group decreased their target price on shares of Alarm.com from $66.00 to $58.00 and set a "neutral" rating on the stock in a report on Thursday, April 17th. Finally, Barclays decreased their target price on shares of Alarm.com from $67.00 to $60.00 and set an "equal weight" rating on the stock in a report on Monday, April 14th. One analyst has rated the stock with a sell rating, two have issued a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, Alarm.com presently has an average rating of "Moderate Buy" and a consensus price target of $64.33.

Check Out Our Latest Stock Analysis on Alarm.com

Alarm.com Profile

(

Free Report)

Alarm.com Holdings, Inc provides various Internet of Things (IoT) and solutions for residential, multi-family, small business, and enterprise commercial markets in North America and internationally. The company operates through two segments, Alarm.com and Other. It offers solutions to control and monitor security systems, as well as to IoT devices, including door locks, garage doors, thermostats, and video cameras; and video monitoring and analytics solutions, such as video analytics, escalated events, video doorbells, intelligent integration, live streaming, secure cloud storage, and video alerts.

Further Reading

Before you consider Alarm.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alarm.com wasn't on the list.

While Alarm.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.