John G Ullman & Associates Inc. boosted its position in Sysco Corporation (NYSE:SYY - Free Report) by 14.6% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 75,410 shares of the company's stock after purchasing an additional 9,594 shares during the period. John G Ullman & Associates Inc.'s holdings in Sysco were worth $5,659,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

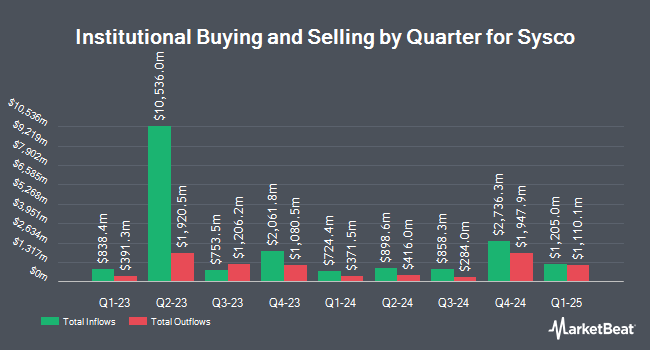

Other institutional investors have also added to or reduced their stakes in the company. Rialto Wealth Management LLC increased its holdings in Sysco by 188.7% during the first quarter. Rialto Wealth Management LLC now owns 332 shares of the company's stock valued at $25,000 after buying an additional 217 shares during the period. Parvin Asset Management LLC purchased a new position in Sysco in the fourth quarter worth $29,000. Golden State Wealth Management LLC grew its holdings in Sysco by 48.4% in the first quarter. Golden State Wealth Management LLC now owns 429 shares of the company's stock worth $32,000 after purchasing an additional 140 shares during the last quarter. Capital A Wealth Management LLC purchased a new position in Sysco in the fourth quarter worth $34,000. Finally, Ameriflex Group Inc. acquired a new stake in shares of Sysco during the fourth quarter worth $35,000. Institutional investors own 83.41% of the company's stock.

Insiders Place Their Bets

In other news, EVP Greg D. Bertrand sold 40,000 shares of the firm's stock in a transaction on Tuesday, July 22nd. The shares were sold at an average price of $80.00, for a total value of $3,200,000.00. Following the sale, the executive vice president directly owned 56,304 shares in the company, valued at approximately $4,504,320. This trade represents a 41.54% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Ronald L. Phillips sold 37,606 shares of the firm's stock in a transaction on Wednesday, July 23rd. The shares were sold at an average price of $81.00, for a total transaction of $3,046,086.00. Following the completion of the sale, the executive vice president owned 30,235 shares in the company, valued at $2,449,035. The trade was a 55.43% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 77,962 shares of company stock worth $6,271,305 in the last ninety days. 0.54% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the stock. Citigroup initiated coverage on shares of Sysco in a research report on Thursday, May 22nd. They set a "neutral" rating and a $78.00 target price for the company. UBS Group reduced their price target on shares of Sysco from $86.00 to $83.00 and set a "buy" rating for the company in a research report on Wednesday, April 30th. BMO Capital Markets reduced their price target on shares of Sysco from $82.00 to $77.00 and set an "outperform" rating for the company in a research report on Wednesday, April 30th. Wall Street Zen downgraded shares of Sysco from a "buy" rating to a "hold" rating in a research report on Sunday, July 13th. Finally, Morgan Stanley upped their price target on shares of Sysco from $72.00 to $77.00 and gave the stock an "equal weight" rating in a research report on Monday, July 14th. Five research analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $83.23.

Read Our Latest Stock Analysis on SYY

Sysco Trading Up 0.6%

Shares of Sysco stock traded up $0.48 during mid-day trading on Monday, hitting $80.78. The stock had a trading volume of 1,349,854 shares, compared to its average volume of 3,292,000. The company has a quick ratio of 0.76, a current ratio of 1.26 and a debt-to-equity ratio of 6.37. The firm has a market cap of $39.16 billion, a P/E ratio of 20.93, a price-to-earnings-growth ratio of 2.37 and a beta of 0.81. The firm has a 50-day moving average of $75.40 and a two-hundred day moving average of $73.46. Sysco Corporation has a 12-month low of $67.12 and a 12-month high of $82.23.

Sysco (NYSE:SYY - Get Free Report) last posted its quarterly earnings data on Tuesday, April 29th. The company reported $0.96 earnings per share for the quarter, missing analysts' consensus estimates of $1.02 by ($0.06). The company had revenue of $19.60 billion for the quarter, compared to analysts' expectations of $20.11 billion. Sysco had a return on equity of 107.96% and a net margin of 2.36%. The business's revenue for the quarter was up 1.1% on a year-over-year basis. During the same period in the previous year, the business posted $0.96 EPS. Sell-side analysts forecast that Sysco Corporation will post 4.58 earnings per share for the current year.

About Sysco

(

Free Report)

Sysco Corporation, through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally. It operates through U.S. Foodservice Operations, International Foodservice Operations, SYGMA, and Other segments.

Featured Articles

Before you consider Sysco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sysco wasn't on the list.

While Sysco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.