John G Ullman & Associates Inc. reduced its position in Western Digital Corporation (NASDAQ:WDC - Free Report) by 8.0% in the 2nd quarter, according to its most recent filing with the SEC. The firm owned 92,543 shares of the data storage provider's stock after selling 8,068 shares during the period. John G Ullman & Associates Inc.'s holdings in Western Digital were worth $5,922,000 at the end of the most recent reporting period.

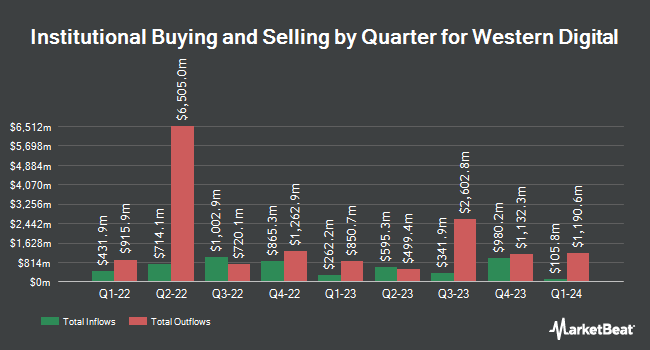

Several other hedge funds and other institutional investors have also recently bought and sold shares of the company. Vanguard Group Inc. grew its stake in Western Digital by 1.1% in the 1st quarter. Vanguard Group Inc. now owns 42,938,495 shares of the data storage provider's stock worth $1,736,003,000 after acquiring an additional 478,728 shares during the period. Alyeska Investment Group L.P. grew its stake in Western Digital by 130.0% in the 1st quarter. Alyeska Investment Group L.P. now owns 5,029,359 shares of the data storage provider's stock worth $203,337,000 after acquiring an additional 2,842,822 shares during the period. Northern Trust Corp grew its stake in Western Digital by 1.5% in the 1st quarter. Northern Trust Corp now owns 3,449,811 shares of the data storage provider's stock worth $139,476,000 after acquiring an additional 52,140 shares during the period. Deutsche Bank AG grew its stake in Western Digital by 107.1% in the 1st quarter. Deutsche Bank AG now owns 3,369,331 shares of the data storage provider's stock worth $136,222,000 after acquiring an additional 1,742,481 shares during the period. Finally, Dimensional Fund Advisors LP grew its stake in Western Digital by 8.0% in the 1st quarter. Dimensional Fund Advisors LP now owns 2,933,278 shares of the data storage provider's stock worth $118,574,000 after acquiring an additional 216,387 shares during the period. 92.51% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Western Digital

In related news, SVP Gene M. Zamiska sold 3,160 shares of Western Digital stock in a transaction on Thursday, August 21st. The shares were sold at an average price of $75.68, for a total transaction of $239,148.80. Following the transaction, the senior vice president owned 31,560 shares in the company, valued at approximately $2,388,460.80. The trade was a 9.10% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, insider Vidyadhara K. Gubbi sold 11,343 shares of the business's stock in a transaction on Thursday, September 4th. The stock was sold at an average price of $90.29, for a total transaction of $1,024,159.47. Following the completion of the transaction, the insider owned 151,596 shares in the company, valued at $13,687,602.84. This represents a 6.96% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 49,730 shares of company stock worth $3,921,594. Insiders own 0.18% of the company's stock.

Western Digital Stock Performance

NASDAQ:WDC opened at $126.20 on Friday. The company has a current ratio of 1.08, a quick ratio of 0.84 and a debt-to-equity ratio of 0.47. The firm has a market capitalization of $43.26 billion, a price-to-earnings ratio of 24.50, a PEG ratio of 1.06 and a beta of 1.77. The firm's fifty day simple moving average is $99.35 and its 200 day simple moving average is $69.85. Western Digital Corporation has a twelve month low of $28.83 and a twelve month high of $137.40.

Western Digital (NASDAQ:WDC - Get Free Report) last posted its earnings results on Monday, April 7th. The data storage provider reported $1.78 earnings per share for the quarter. The business had revenue of $4.10 billion for the quarter. Western Digital had a net margin of 14.13% and a return on equity of 24.93%. As a group, equities research analysts expect that Western Digital Corporation will post 4.89 earnings per share for the current fiscal year.

Western Digital Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, September 18th. Investors of record on Thursday, September 4th were issued a dividend of $0.10 per share. The ex-dividend date was Thursday, September 4th. This represents a $0.40 annualized dividend and a dividend yield of 0.3%. Western Digital's payout ratio is presently 7.77%.

Wall Street Analyst Weigh In

WDC has been the subject of several research reports. Wedbush boosted their price objective on shares of Western Digital from $90.00 to $135.00 and gave the company an "outperform" rating in a research note on Thursday. Zacks Research raised shares of Western Digital from a "hold" rating to a "strong-buy" rating in a research note on Monday, October 13th. Benchmark boosted their price objective on shares of Western Digital from $85.00 to $115.00 and gave the company a "buy" rating in a research note on Monday, September 15th. The Goldman Sachs Group boosted their price objective on shares of Western Digital from $78.00 to $130.00 and gave the company a "neutral" rating in a research note on Wednesday, October 8th. Finally, Loop Capital boosted their price objective on shares of Western Digital from $92.00 to $150.00 and gave the company a "buy" rating in a research note on Thursday. One analyst has rated the stock with a Strong Buy rating, seventeen have given a Buy rating and five have issued a Hold rating to the stock. Based on data from MarketBeat, Western Digital presently has a consensus rating of "Moderate Buy" and an average price target of $105.65.

Check Out Our Latest Research Report on WDC

Western Digital Profile

(

Free Report)

Western Digital Corporation develops, manufactures, and sells data storage devices and solutions in the United States, China, Hong Kong, Europe, the Middle East, Africa, rest of Asia, and internationally. It offers client devices, including hard disk drives (HDDs) and solid state drives (SSDs) for desktop and notebook personal computers (PCs), gaming consoles, and set top boxes; and flash-based embedded storage products for mobile phones, tablets, notebook PCs, and other portable and wearable devices, as well as automotive, Internet of Things, industrial, and connected home applications.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Western Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Digital wasn't on the list.

While Western Digital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report