Johnson & Johnson decreased its stake in shares of Lyell Immunopharma, Inc. (NASDAQ:LYEL - Free Report) by 95.0% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 41,165 shares of the company's stock after selling 782,152 shares during the quarter. Lyell Immunopharma comprises 0.1% of Johnson & Johnson's holdings, making the stock its 17th biggest position. Johnson & Johnson owned approximately 0.28% of Lyell Immunopharma worth $368,000 as of its most recent filing with the Securities and Exchange Commission.

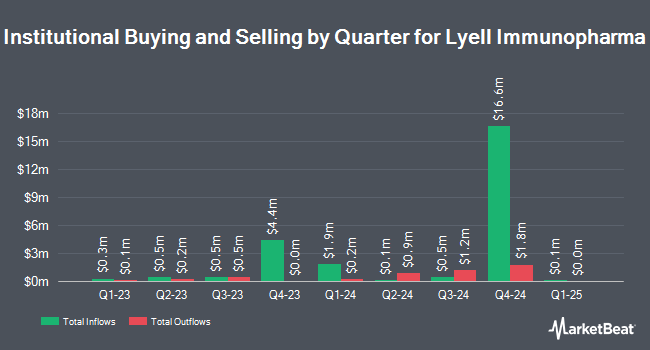

Several other large investors have also added to or reduced their stakes in LYEL. AQR Capital Management LLC raised its stake in shares of Lyell Immunopharma by 773.5% during the 1st quarter. AQR Capital Management LLC now owns 174,279 shares of the company's stock valued at $94,000 after buying an additional 154,327 shares during the last quarter. Exchange Traded Concepts LLC grew its holdings in shares of Lyell Immunopharma by 82.4% during the first quarter. Exchange Traded Concepts LLC now owns 246,349 shares of the company's stock worth $133,000 after buying an additional 111,299 shares in the last quarter. Two Sigma Advisers LP boosted its position in shares of Lyell Immunopharma by 143.8% during the 4th quarter. Two Sigma Advisers LP now owns 306,400 shares of the company's stock valued at $196,000 after acquiring an additional 180,700 shares during the last quarter. Nuveen LLC acquired a new position in Lyell Immunopharma in the first quarter valued at about $345,000. Finally, Acadian Asset Management LLC increased its stake in Lyell Immunopharma by 204.2% during the 1st quarter. Acadian Asset Management LLC now owns 660,899 shares of the company's stock worth $354,000 after buying an additional 443,614 shares during the period. Hedge funds and other institutional investors own 66.05% of the company's stock.

Lyell Immunopharma Stock Up 12.3%

Shares of NASDAQ:LYEL opened at $17.75 on Monday. Lyell Immunopharma, Inc. has a 12-month low of $7.65 and a 12-month high of $30.00. The business has a 50 day moving average of $12.30 and a 200-day moving average of $10.41. The stock has a market cap of $341.00 million, a PE ratio of -0.73 and a beta of -0.07.

Lyell Immunopharma (NASDAQ:LYEL - Get Free Report) last issued its quarterly earnings data on Tuesday, August 12th. The company reported ($2.89) earnings per share for the quarter, topping analysts' consensus estimates of ($3.80) by $0.91. The business had revenue of $0.01 million for the quarter, compared to analyst estimates of $0.00 million. Lyell Immunopharma had a negative return on equity of 85.58% and a negative net margin of 552,328.31%. Equities research analysts expect that Lyell Immunopharma, Inc. will post -0.78 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on LYEL. HC Wainwright reissued a "neutral" rating and issued a $10.00 price objective on shares of Lyell Immunopharma in a report on Tuesday, June 24th. Weiss Ratings reiterated a "sell (d-)" rating on shares of Lyell Immunopharma in a research note on Saturday, September 27th. Finally, Wall Street Zen raised shares of Lyell Immunopharma from a "sell" rating to a "hold" rating in a research note on Monday, September 1st. One equities research analyst has rated the stock with a Hold rating and two have assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, Lyell Immunopharma presently has an average rating of "Sell" and a consensus price target of $15.00.

View Our Latest Stock Report on LYEL

Lyell Immunopharma Company Profile

(

Free Report)

Lyell Immunopharma, Inc, a clinical-stage cell therapy company, develops T cell reprogramming technologies for patients with solid tumors. The company develops therapies using an ex vivo genetic reprogramming technologies, such as c Jun overexpression and NR4A3 gene knockout, to endow resistance to T cell exhaustion; and an ex vivo epigenetic reprogramming technologies, including Epi R to generate population of T cells with durable stemness, and Stim R, a proprietary synthetic cell mimetic.

Featured Articles

Want to see what other hedge funds are holding LYEL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Lyell Immunopharma, Inc. (NASDAQ:LYEL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lyell Immunopharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyell Immunopharma wasn't on the list.

While Lyell Immunopharma currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.