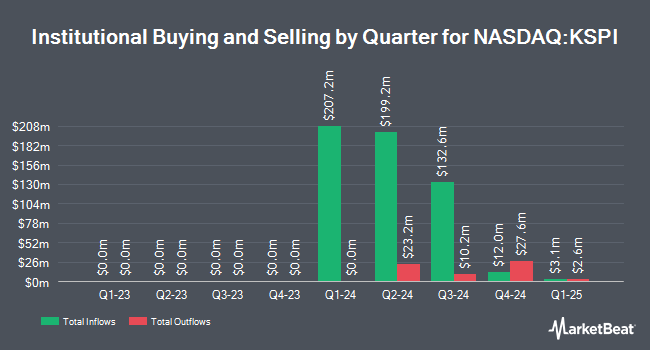

Public Employees Retirement System of Ohio increased its stake in Joint Stock Company Kaspi.kz Sponsored ADR (NASDAQ:KSPI - Free Report) by 9.8% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 147,485 shares of the company's stock after purchasing an additional 13,113 shares during the quarter. Public Employees Retirement System of Ohio owned approximately 0.07% of Joint Stock Company Kaspi.kz worth $12,520,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors have also recently bought and sold shares of the stock. Quantbot Technologies LP purchased a new position in Joint Stock Company Kaspi.kz in the 1st quarter worth about $110,000. Driehaus Capital Management LLC increased its stake in Joint Stock Company Kaspi.kz by 24.8% in the 1st quarter. Driehaus Capital Management LLC now owns 40,075 shares of the company's stock worth $3,721,000 after purchasing an additional 7,951 shares in the last quarter. Flossbach Von Storch SE increased its stake in Joint Stock Company Kaspi.kz by 66.7% in the 1st quarter. Flossbach Von Storch SE now owns 25,000 shares of the company's stock worth $2,321,000 after purchasing an additional 10,000 shares in the last quarter. Sumitomo Mitsui Trust Group Inc. increased its stake in Joint Stock Company Kaspi.kz by 8.5% in the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 313,992 shares of the company's stock worth $29,154,000 after purchasing an additional 24,616 shares in the last quarter. Finally, Nikko Asset Management Americas Inc. increased its stake in Joint Stock Company Kaspi.kz by 8.5% in the 1st quarter. Nikko Asset Management Americas Inc. now owns 313,545 shares of the company's stock worth $29,113,000 after purchasing an additional 24,616 shares in the last quarter. Hedge funds and other institutional investors own 32.20% of the company's stock.

Joint Stock Company Kaspi.kz Stock Performance

NASDAQ:KSPI opened at $84.00 on Friday. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.01 and a quick ratio of 1.01. Joint Stock Company Kaspi.kz Sponsored ADR has a fifty-two week low of $75.90 and a fifty-two week high of $116.84. The stock's 50-day moving average is $88.91 and its two-hundred day moving average is $87.33. The stock has a market cap of $16.76 billion, a PE ratio of 7.71 and a beta of 1.09.

Wall Street Analysts Forecast Growth

Separately, JPMorgan Chase & Co. reissued a "neutral" rating and issued a $96.00 price target on shares of Joint Stock Company Kaspi.kz in a research note on Wednesday, August 20th. Two investment analysts have rated the stock with a Buy rating and one has given a Hold rating to the company's stock. According to MarketBeat.com, Joint Stock Company Kaspi.kz has a consensus rating of "Moderate Buy" and an average target price of $122.00.

Check Out Our Latest Report on Joint Stock Company Kaspi.kz

Joint Stock Company Kaspi.kz Company Profile

(

Free Report)

Joint Stock Company Kaspi.kz, together with its subsidiaries, provides payments, marketplace, and fintech solutions for consumers and merchants in the Republic of Kazakhstan. It operates through three segments: Payments Platform, Marketplace Platform, and Fintech Platform. The Payments Platform segment facilities transactions between customers and merchants.

Further Reading

Want to see what other hedge funds are holding KSPI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Joint Stock Company Kaspi.kz Sponsored ADR (NASDAQ:KSPI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Joint Stock Company Kaspi.kz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Joint Stock Company Kaspi.kz wasn't on the list.

While Joint Stock Company Kaspi.kz currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.