Josh Arnold Investment Consultant LLC acquired a new stake in Talkspace, Inc. (NASDAQ:TALK - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 250,000 shares of the company's stock, valued at approximately $640,000. Talkspace makes up approximately 0.5% of Josh Arnold Investment Consultant LLC's portfolio, making the stock its 14th biggest position. Josh Arnold Investment Consultant LLC owned 0.15% of Talkspace as of its most recent SEC filing.

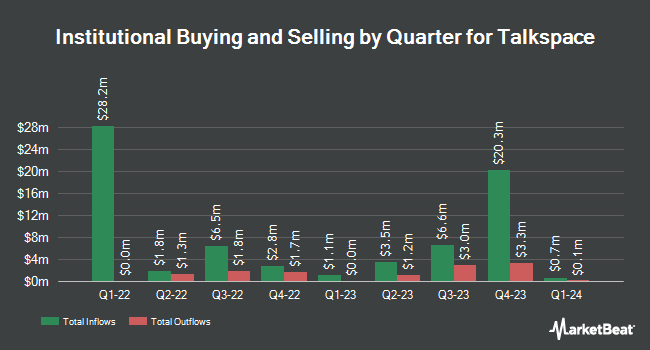

Several other institutional investors and hedge funds have also recently made changes to their positions in TALK. Financial Management Professionals Inc. bought a new stake in shares of Talkspace in the first quarter valued at about $29,000. EntryPoint Capital LLC purchased a new position in Talkspace in the first quarter valued at about $45,000. Ameriprise Financial Inc. purchased a new position in Talkspace in the fourth quarter valued at about $53,000. CWM LLC grew its stake in Talkspace by 1,230.7% in the first quarter. CWM LLC now owns 21,265 shares of the company's stock valued at $54,000 after purchasing an additional 19,667 shares during the last quarter. Finally, Blair William & Co. IL purchased a new position in Talkspace in the first quarter valued at about $54,000. 57.37% of the stock is currently owned by institutional investors.

Talkspace Stock Performance

TALK traded down $0.03 on Wednesday, hitting $2.56. The company had a trading volume of 691,671 shares, compared to its average volume of 1,819,242. The stock has a fifty day moving average price of $2.58 and a 200-day moving average price of $2.78. Talkspace, Inc. has a 12-month low of $1.76 and a 12-month high of $4.36. The stock has a market capitalization of $427.88 million, a price-to-earnings ratio of 127.81 and a beta of 1.09.

Talkspace (NASDAQ:TALK - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The company reported $0.00 earnings per share for the quarter, missing analysts' consensus estimates of $0.01 by ($0.01). Talkspace had a return on equity of 2.48% and a net margin of 1.41%.The business had revenue of $54.31 million for the quarter, compared to analysts' expectations of $54.08 million. Talkspace has set its FY 2025 guidance at EPS. Analysts forecast that Talkspace, Inc. will post 0.08 EPS for the current fiscal year.

About Talkspace

(

Free Report)

Talkspace, Inc operates as a virtual behavioral healthcare company in the United States. The company offers psychotherapy and psychiatry services through its platform to individuals, enterprises, and health plans and employee assistance programs. It provides text, audio, and video-based psychotherapy from licensed therapists.

See Also

Before you consider Talkspace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talkspace wasn't on the list.

While Talkspace currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.