Swedbank AB cut its stake in shares of JOYY Inc. (NASDAQ:YY - Free Report) by 13.4% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 31,600 shares of the information services provider's stock after selling 4,900 shares during the quarter. Swedbank AB owned approximately 0.06% of JOYY worth $1,327,000 at the end of the most recent reporting period.

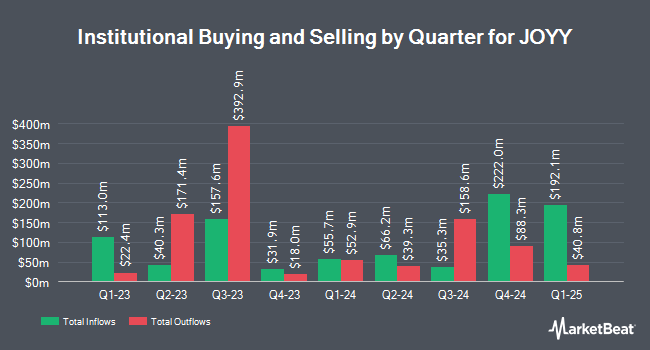

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. SVB Wealth LLC purchased a new stake in JOYY in the first quarter valued at approximately $57,000. Kathmere Capital Management LLC acquired a new stake in JOYY in the 1st quarter worth about $217,000. D Orazio & Associates Inc. acquired a new position in shares of JOYY in the 1st quarter valued at about $235,000. Asset Management One Co. Ltd. acquired a new position in shares of JOYY in the 1st quarter valued at about $253,000. Finally, Aprio Wealth Management LLC lifted its stake in shares of JOYY by 33.0% in the 1st quarter. Aprio Wealth Management LLC now owns 6,427 shares of the information services provider's stock valued at $270,000 after purchasing an additional 1,596 shares in the last quarter. 36.83% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Citigroup reiterated a "buy" rating on shares of JOYY in a report on Tuesday, September 2nd. Two investment analysts have rated the stock with a Buy rating, Based on data from MarketBeat, the stock currently has a consensus rating of "Buy".

Read Our Latest Research Report on YY

JOYY Price Performance

Shares of YY traded down $0.84 during midday trading on Friday, reaching $62.63. The stock had a trading volume of 760,792 shares, compared to its average volume of 523,246. JOYY Inc. has a 52 week low of $30.91 and a 52 week high of $55.31. The firm's 50 day moving average price is $54.51 and its 200-day moving average price is $48.35. The company has a market capitalization of $3.37 billion, a P/E ratio of 18.92 and a beta of 0.21.

JOYY Profile

(

Free Report)

JOYY Inc, together with its subsidiaries, operates social media platforms that offer users engaging and experience across various video-based social platforms. It operates through two segments, BIGO and All Other. The company operates Bigo Live, a social live streaming platform, that provides an interactive online stage for users to host and watch live streaming sessions, share their life moments, showcase their talents, and interact with people worldwide; Likee, a short-form video social platform, which enables users to discover, create, and share short videos, with video creation tools and personalized feeds; imo, an instant messenger platform, that provides audio and video communication services; Hago, a social networking platform that offers casual games integrating social features, such as audio and video multi-user chatrooms and 3D virtual interactive party games; and Shopline, a smart commerce platform, that provides solutions and services to enable merchants in creating and growing their brands online and reach customers through various sales channels, including e-commerce platforms, social commerce, and physical retail stores.

Featured Stories

Before you consider JOYY, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JOYY wasn't on the list.

While JOYY currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.