Jump Financial LLC lowered its position in FTAI Infrastructure Inc. (NASDAQ:FIP - Free Report) by 77.5% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 19,971 shares of the company's stock after selling 68,984 shares during the quarter. Jump Financial LLC's holdings in FTAI Infrastructure were worth $90,000 at the end of the most recent reporting period.

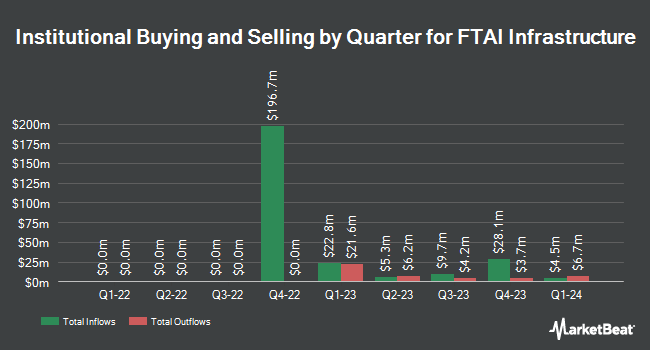

A number of other hedge funds have also recently modified their holdings of FIP. Teacher Retirement System of Texas purchased a new stake in shares of FTAI Infrastructure in the first quarter valued at about $68,000. Aigen Investment Management LP grew its holdings in shares of FTAI Infrastructure by 16.9% in the first quarter. Aigen Investment Management LP now owns 24,647 shares of the company's stock valued at $112,000 after purchasing an additional 3,568 shares during the period. Fortitude Advisory Group L.L.C. purchased a new position in FTAI Infrastructure during the first quarter worth about $113,000. Y Intercept Hong Kong Ltd purchased a new position in FTAI Infrastructure during the first quarter worth about $127,000. Finally, Stephens Inc. AR boosted its stake in FTAI Infrastructure by 10.6% during the first quarter. Stephens Inc. AR now owns 33,450 shares of the company's stock worth $152,000 after buying an additional 3,200 shares during the period. Hedge funds and other institutional investors own 87.43% of the company's stock.

Insider Buying and Selling

In other FTAI Infrastructure news, CFO Carl Russell Iv Fletcher bought 10,000 shares of the stock in a transaction dated Thursday, August 21st. The shares were acquired at an average cost of $4.48 per share, for a total transaction of $44,800.00. Following the completion of the transaction, the chief financial officer owned 30,000 shares in the company, valued at approximately $134,400. The trade was a 50.00% increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. 2.40% of the stock is owned by corporate insiders.

FTAI Infrastructure Stock Up 6.2%

NASDAQ:FIP traded up $0.26 during mid-day trading on Thursday, hitting $4.48. The stock had a trading volume of 1,867,519 shares, compared to its average volume of 2,707,149. The company has a market capitalization of $515.60 million, a PE ratio of -2.93 and a beta of 1.87. FTAI Infrastructure Inc. has a twelve month low of $3.10 and a twelve month high of $9.96. The company has a current ratio of 1.49, a quick ratio of 1.49 and a debt-to-equity ratio of 13.30. The stock has a 50-day simple moving average of $5.58 and a two-hundred day simple moving average of $5.27.

FTAI Infrastructure (NASDAQ:FIP - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported ($0.73) EPS for the quarter, missing the consensus estimate of ($0.37) by ($0.36). The company had revenue of $122.29 million during the quarter, compared to analysts' expectations of $151.77 million. FTAI Infrastructure had a negative net margin of 20.85% and a negative return on equity of 10.14%.

FTAI Infrastructure Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, September 8th. Shareholders of record on Monday, August 25th were paid a $0.03 dividend. This represents a $0.12 annualized dividend and a yield of 2.7%. The ex-dividend date was Monday, August 25th. FTAI Infrastructure's dividend payout ratio is currently -7.84%.

Analysts Set New Price Targets

Separately, Wall Street Zen lowered shares of FTAI Infrastructure from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. One analyst has rated the stock with a Buy rating, Based on data from MarketBeat, FTAI Infrastructure currently has a consensus rating of "Buy" and an average target price of $12.00.

Read Our Latest Stock Analysis on FTAI Infrastructure

About FTAI Infrastructure

(

Free Report)

FTAI Infrastructure Inc focuses on acquiring, developing, and operating assets and businesses that represent infrastructure for customers in the transportation, energy, and industrial products industries in North America. The company operates through five segments: Railroad, Jefferson Terminal, Repauno, Power and Gas, and Sustainability and Energy Transition.

Featured Stories

Before you consider FTAI Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTAI Infrastructure wasn't on the list.

While FTAI Infrastructure currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.