Junto Capital Management LP trimmed its position in shares of The Kroger Co. (NYSE:KR - Free Report) by 14.8% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,680,995 shares of the company's stock after selling 639,635 shares during the period. Kroger makes up 5.2% of Junto Capital Management LP's portfolio, making the stock its 3rd biggest position. Junto Capital Management LP owned 0.56% of Kroger worth $249,167,000 at the end of the most recent quarter.

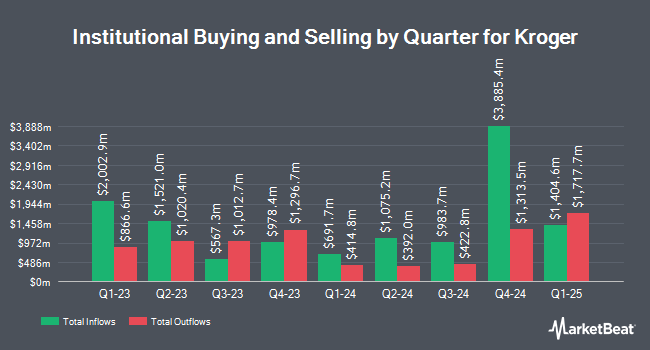

A number of other large investors have also added to or reduced their stakes in KR. Steadfast Capital Management LP acquired a new stake in Kroger during the 4th quarter valued at $277,989,000. Wellington Management Group LLP grew its holdings in Kroger by 85.3% during the 1st quarter. Wellington Management Group LLP now owns 6,397,771 shares of the company's stock valued at $433,065,000 after purchasing an additional 2,945,848 shares in the last quarter. Nuveen LLC acquired a new stake in Kroger during the 1st quarter valued at $178,385,000. Alyeska Investment Group L.P. acquired a new stake in Kroger during the 4th quarter valued at $123,829,000. Finally, GAMMA Investing LLC grew its holdings in Kroger by 7,363.9% during the 1st quarter. GAMMA Investing LLC now owns 1,706,397 shares of the company's stock valued at $115,506,000 after purchasing an additional 1,683,535 shares in the last quarter. 80.93% of the stock is owned by institutional investors and hedge funds.

Kroger Stock Performance

Shares of NYSE KR traded down $0.50 during mid-day trading on Wednesday, reaching $68.14. 6,846,842 shares of the company were exchanged, compared to its average volume of 7,058,676. The company's 50-day simple moving average is $70.89 and its 200-day simple moving average is $68.73. The company has a quick ratio of 0.53, a current ratio of 0.95 and a debt-to-equity ratio of 1.92. The stock has a market capitalization of $45.03 billion, a P/E ratio of 18.57, a P/E/G ratio of 2.16 and a beta of 0.59. The Kroger Co. has a twelve month low of $50.69 and a twelve month high of $74.90.

Kroger (NYSE:KR - Get Free Report) last posted its earnings results on Friday, June 20th. The company reported $1.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.45 by $0.04. Kroger had a net margin of 1.89% and a return on equity of 34.71%. The company had revenue of $45.12 billion during the quarter, compared to analysts' expectations of $45.35 billion. During the same quarter last year, the company posted $1.43 EPS. Kroger's quarterly revenue was down .3% compared to the same quarter last year. Kroger has set its FY 2025 guidance at 4.600-4.800 EPS. As a group, research analysts predict that The Kroger Co. will post 4.44 earnings per share for the current year.

Kroger Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, September 1st. Shareholders of record on Friday, August 15th were paid a $0.35 dividend. This is a positive change from Kroger's previous quarterly dividend of $0.32. The ex-dividend date was Friday, August 15th. This represents a $1.40 annualized dividend and a yield of 2.1%. Kroger's dividend payout ratio is presently 38.15%.

Insiders Place Their Bets

In related news, Director Clyde R. Moore sold 3,810 shares of Kroger stock in a transaction that occurred on Wednesday, July 16th. The shares were sold at an average price of $71.61, for a total transaction of $272,834.10. Following the sale, the director directly owned 85,850 shares of the company's stock, valued at approximately $6,147,718.50. The trade was a 4.25% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, EVP Timothy A. Massa sold 8,415 shares of the business's stock in a transaction that occurred on Monday, June 23rd. The stock was sold at an average price of $74.00, for a total transaction of $622,710.00. Following the sale, the executive vice president directly owned 118,761 shares in the company, valued at $8,788,314. The trade was a 6.62% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 198,948 shares of company stock worth $14,422,926. 0.44% of the stock is currently owned by insiders.

Analysts Set New Price Targets

Several research analysts have weighed in on the stock. UBS Group reissued a "neutral" rating and set a $74.00 price objective (up from $66.00) on shares of Kroger in a report on Monday, June 23rd. Guggenheim boosted their target price on shares of Kroger from $73.00 to $78.00 and gave the stock a "buy" rating in a report on Monday, June 23rd. Melius raised shares of Kroger from a "sell" rating to a "hold" rating and set a $70.00 target price on the stock in a research report on Tuesday, May 20th. Jefferies Financial Group set a $83.00 target price on shares of Kroger and gave the stock a "buy" rating in a research report on Monday, June 23rd. Finally, Roth Capital boosted their price objective on shares of Kroger from $58.00 to $66.00 and gave the stock a "neutral" rating in a research note on Wednesday, August 20th. Seven investment analysts have rated the stock with a Buy rating and twelve have issued a Hold rating to the company's stock. According to data from MarketBeat.com, Kroger has an average rating of "Hold" and an average price target of $70.58.

Read Our Latest Stock Analysis on KR

Kroger Company Profile

(

Free Report)

The Kroger Co operates as a food and drug retailer in the United States. The company operates combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. Its combination food and drug stores offer natural food and organic sections, pharmacies, general merchandise, pet centers, fresh seafood, and organic produce; and multi-department stores provide apparel, home fashion and furnishings, outdoor living, electronics, automotive products, and toys.

See Also

Before you consider Kroger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kroger wasn't on the list.

While Kroger currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report