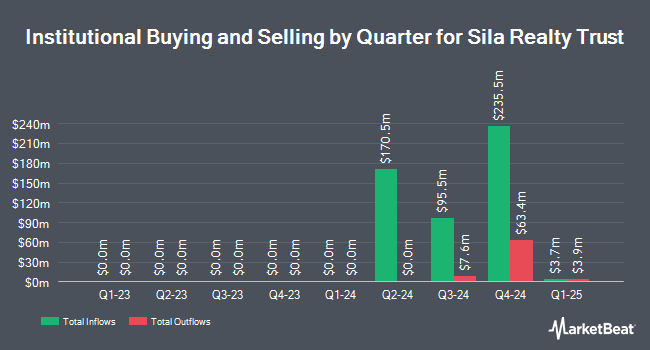

Jupiter Asset Management Ltd. purchased a new position in Sila Realty Trust, Inc. (NYSE:SILA - Free Report) during the first quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 117,299 shares of the company's stock, valued at approximately $3,133,000. Jupiter Asset Management Ltd. owned 0.21% of Sila Realty Trust at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also modified their holdings of SILA. Tritonpoint Wealth LLC boosted its holdings in shares of Sila Realty Trust by 9.6% during the first quarter. Tritonpoint Wealth LLC now owns 9,207 shares of the company's stock worth $246,000 after purchasing an additional 806 shares during the last quarter. CWM LLC boosted its holdings in shares of Sila Realty Trust by 4.6% during the first quarter. CWM LLC now owns 18,777 shares of the company's stock worth $502,000 after purchasing an additional 831 shares during the last quarter. CreativeOne Wealth LLC boosted its holdings in shares of Sila Realty Trust by 5.4% during the fourth quarter. CreativeOne Wealth LLC now owns 17,236 shares of the company's stock worth $419,000 after purchasing an additional 885 shares during the last quarter. Sunbelt Securities Inc. boosted its holdings in shares of Sila Realty Trust by 38.8% during the first quarter. Sunbelt Securities Inc. now owns 3,630 shares of the company's stock worth $97,000 after purchasing an additional 1,015 shares during the last quarter. Finally, Capital Investment Advisory Services LLC boosted its holdings in shares of Sila Realty Trust by 9.2% during the first quarter. Capital Investment Advisory Services LLC now owns 13,028 shares of the company's stock worth $348,000 after purchasing an additional 1,094 shares during the last quarter.

Sila Realty Trust Trading Up 0.5%

Shares of SILA stock traded up $0.14 during mid-day trading on Friday, hitting $25.37. 99,699 shares of the company's stock were exchanged, compared to its average volume of 437,541. Sila Realty Trust, Inc. has a fifty-two week low of $21.29 and a fifty-two week high of $27.50. The stock has a 50-day simple moving average of $24.44 and a two-hundred day simple moving average of $25.08. The company has a quick ratio of 0.99, a current ratio of 0.99 and a debt-to-equity ratio of 0.40. The stock has a market cap of $1.40 billion, a price-to-earnings ratio of 36.76 and a beta of 0.01.

Sila Realty Trust Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, September 4th. Investors of record on Thursday, August 21st will be given a $0.40 dividend. This represents a $1.60 annualized dividend and a dividend yield of 6.3%. The ex-dividend date of this dividend is Thursday, August 21st. Sila Realty Trust's dividend payout ratio (DPR) is 231.88%.

Sila Realty Trust Profile

(

Free Report)

Sila Realty Trust, Inc, headquartered in Tampa, Florida, is a net lease real estate investment trust with a strategic focus on investing in the large, growing, and resilient healthcare sector. The Company invests in high quality healthcare facilities along the continuum of care, which, we believe, generate predictable, durable, and growing income streams.

Further Reading

Before you consider Sila Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sila Realty Trust wasn't on the list.

While Sila Realty Trust currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.