Jupiter Asset Management Ltd. trimmed its stake in shares of Docusign Inc. (NASDAQ:DOCU - Free Report) by 10.2% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 699,240 shares of the company's stock after selling 79,501 shares during the period. Jupiter Asset Management Ltd. owned about 0.35% of Docusign worth $56,918,000 as of its most recent SEC filing.

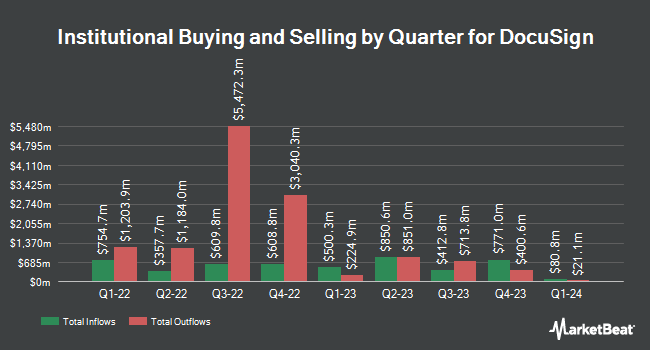

A number of other hedge funds and other institutional investors have also made changes to their positions in DOCU. Orion Portfolio Solutions LLC acquired a new stake in Docusign in the 4th quarter valued at $1,073,000. O Shaughnessy Asset Management LLC grew its position in shares of Docusign by 111.7% in the 4th quarter. O Shaughnessy Asset Management LLC now owns 21,712 shares of the company's stock valued at $1,953,000 after acquiring an additional 11,455 shares during the period. Wellington Management Group LLP grew its position in shares of Docusign by 1,054.0% in the 4th quarter. Wellington Management Group LLP now owns 386,680 shares of the company's stock valued at $34,778,000 after acquiring an additional 353,172 shares during the period. Alliancebernstein L.P. grew its position in shares of Docusign by 70.4% in the 4th quarter. Alliancebernstein L.P. now owns 378,780 shares of the company's stock valued at $34,067,000 after acquiring an additional 156,518 shares during the period. Finally, B. Metzler seel. Sohn & Co. AG boosted its holdings in shares of Docusign by 72.7% during the 4th quarter. B. Metzler seel. Sohn & Co. AG now owns 8,677 shares of the company's stock worth $780,000 after buying an additional 3,652 shares during the period. 77.64% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Docusign

In other Docusign news, CEO Allan C. Thygesen sold 40,000 shares of the company's stock in a transaction that occurred on Tuesday, July 1st. The stock was sold at an average price of $77.51, for a total value of $3,100,400.00. Following the sale, the chief executive officer owned 143,983 shares in the company, valued at approximately $11,160,122.33. This represents a 21.74% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, CFO Blake Jeffrey Grayson sold 15,143 shares of the company's stock in a transaction that occurred on Wednesday, June 18th. The stock was sold at an average price of $74.80, for a total value of $1,132,696.40. Following the completion of the sale, the chief financial officer owned 110,723 shares in the company, valued at approximately $8,282,080.40. This represents a 12.03% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 78,552 shares of company stock worth $5,983,631 in the last 90 days. Corporate insiders own 1.66% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on DOCU. UBS Group reduced their target price on shares of Docusign from $85.00 to $80.00 and set a "neutral" rating for the company in a report on Friday, June 6th. Wedbush cut their price objective on shares of Docusign from $100.00 to $85.00 and set a "neutral" rating for the company in a report on Thursday, June 12th. Bank of America cut their price objective on shares of Docusign from $88.00 to $85.00 and set a "neutral" rating for the company in a report on Friday, June 6th. Robert W. Baird dropped their target price on shares of Docusign from $93.00 to $85.00 and set a "neutral" rating for the company in a research report on Friday, June 6th. Finally, William Blair restated an "outperform" rating on shares of Docusign in a research report on Monday, April 21st. Thirteen analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $89.77.

Read Our Latest Analysis on DOCU

Docusign Trading Up 2.1%

Shares of DOCU traded up $1.54 during trading hours on Monday, reaching $75.38. 1,362,302 shares of the company traded hands, compared to its average volume of 2,181,801. The firm has a market cap of $15.23 billion, a price-to-earnings ratio of 14.25, a PEG ratio of 27.56 and a beta of 1.01. Docusign Inc. has a 12-month low of $48.80 and a 12-month high of $107.86. The stock's fifty day moving average price is $79.18 and its 200 day moving average price is $82.54.

Docusign (NASDAQ:DOCU - Get Free Report) last released its quarterly earnings data on Thursday, June 5th. The company reported $0.90 earnings per share for the quarter, beating the consensus estimate of $0.81 by $0.09. The firm had revenue of $763.65 million during the quarter, compared to the consensus estimate of $748.79 million. Docusign had a return on equity of 14.27% and a net margin of 36.50%. The firm's quarterly revenue was up 7.6% on a year-over-year basis. During the same period in the previous year, the company posted $0.82 earnings per share. On average, research analysts forecast that Docusign Inc. will post 1.17 earnings per share for the current year.

Docusign announced that its Board of Directors has initiated a share repurchase program on Thursday, June 5th that authorizes the company to repurchase $1.00 billion in shares. This repurchase authorization authorizes the company to repurchase up to 6.6% of its shares through open market purchases. Shares repurchase programs are generally a sign that the company's leadership believes its shares are undervalued.

Docusign Profile

(

Free Report)

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

Featured Articles

Before you consider Docusign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Docusign wasn't on the list.

While Docusign currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.