Jupiter Asset Management Ltd. purchased a new position in Brixmor Property Group Inc. (NYSE:BRX - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 1,307,043 shares of the real estate investment trust's stock, valued at approximately $34,702,000. Jupiter Asset Management Ltd. owned 0.43% of Brixmor Property Group at the end of the most recent reporting period.

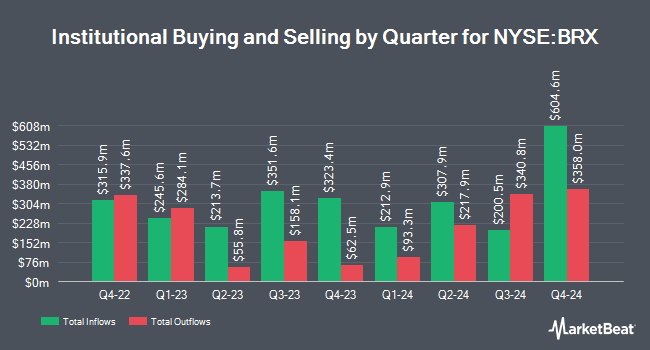

Several other hedge funds and other institutional investors have also added to or reduced their stakes in the business. Canada Pension Plan Investment Board boosted its stake in Brixmor Property Group by 6.4% in the 4th quarter. Canada Pension Plan Investment Board now owns 7,792,016 shares of the real estate investment trust's stock worth $216,930,000 after purchasing an additional 467,146 shares during the period. Deutsche Bank AG raised its holdings in shares of Brixmor Property Group by 31.3% during the 4th quarter. Deutsche Bank AG now owns 5,882,828 shares of the real estate investment trust's stock worth $163,778,000 after acquiring an additional 1,404,034 shares in the last quarter. Invesco Ltd. raised its holdings in shares of Brixmor Property Group by 61.1% during the 4th quarter. Invesco Ltd. now owns 5,748,492 shares of the real estate investment trust's stock worth $160,038,000 after acquiring an additional 2,180,541 shares in the last quarter. Geode Capital Management LLC raised its holdings in shares of Brixmor Property Group by 0.7% during the 4th quarter. Geode Capital Management LLC now owns 5,653,925 shares of the real estate investment trust's stock worth $157,450,000 after acquiring an additional 38,911 shares in the last quarter. Finally, Ameriprise Financial Inc. raised its holdings in shares of Brixmor Property Group by 7.8% during the 4th quarter. Ameriprise Financial Inc. now owns 5,453,599 shares of the real estate investment trust's stock worth $151,155,000 after acquiring an additional 393,317 shares in the last quarter. 98.43% of the stock is currently owned by institutional investors.

Brixmor Property Group Stock Performance

BRX stock traded up $0.13 during trading on Wednesday, hitting $26.52. 1,336,357 shares of the company traded hands, compared to its average volume of 2,427,666. The stock's 50-day simple moving average is $25.74 and its 200 day simple moving average is $25.89. The company has a debt-to-equity ratio of 1.73, a current ratio of 0.74 and a quick ratio of 0.74. The company has a market cap of $8.12 billion, a PE ratio of 24.11, a P/E/G ratio of 2.68 and a beta of 1.29. Brixmor Property Group Inc. has a 1 year low of $22.28 and a 1 year high of $30.67.

Brixmor Property Group (NYSE:BRX - Get Free Report) last announced its quarterly earnings results on Monday, July 28th. The real estate investment trust reported $0.56 earnings per share for the quarter, beating the consensus estimate of $0.55 by $0.01. The company had revenue of $339.40 million during the quarter, compared to analysts' expectations of $332.59 million. Brixmor Property Group had a return on equity of 11.39% and a net margin of 25.27%. Brixmor Property Group's quarterly revenue was up 7.5% on a year-over-year basis. During the same period last year, the business earned $0.54 earnings per share. On average, equities analysts expect that Brixmor Property Group Inc. will post 2.22 earnings per share for the current fiscal year.

Brixmor Property Group Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, October 15th. Shareholders of record on Thursday, October 2nd will be issued a $0.2875 dividend. This represents a $1.15 annualized dividend and a yield of 4.3%. The ex-dividend date of this dividend is Thursday, October 2nd. Brixmor Property Group's dividend payout ratio (DPR) is presently 104.55%.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on BRX. The Goldman Sachs Group decreased their price objective on Brixmor Property Group from $33.00 to $29.00 and set a "buy" rating on the stock in a report on Thursday, May 1st. Stifel Nicolaus decreased their price objective on Brixmor Property Group from $29.50 to $29.00 and set a "hold" rating on the stock in a report on Tuesday, July 29th. Mizuho raised Brixmor Property Group from a "neutral" rating to an "outperform" rating and set a $29.00 price objective on the stock in a report on Thursday, July 17th. Scotiabank cut their price objective on Brixmor Property Group from $30.00 to $29.00 and set a "sector outperform" rating on the stock in a research report on Monday, May 12th. Finally, UBS Group began coverage on Brixmor Property Group in a research report on Friday, May 30th. They set a "buy" rating and a $29.00 price target on the stock. Three equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat, Brixmor Property Group presently has an average rating of "Moderate Buy" and an average target price of $30.08.

Get Our Latest Stock Report on Brixmor Property Group

About Brixmor Property Group

(

Free Report)

Brixmor Property Group, Inc operates as a real estate investment trust, which engages in owning and operating a portfolio of grocery anchored community and neighborhood shopping centers. The company was founded in 1985 and is headquartered in New York, NY.

Featured Stories

Before you consider Brixmor Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brixmor Property Group wasn't on the list.

While Brixmor Property Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.