Kapitalo Investimentos Ltda bought a new stake in Magnite, Inc. (NASDAQ:MGNI - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 15,975 shares of the company's stock, valued at approximately $182,000.

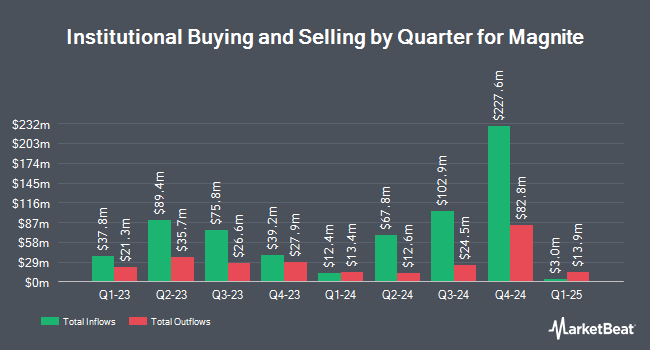

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in MGNI. MCF Advisors LLC raised its position in Magnite by 2,100.0% in the first quarter. MCF Advisors LLC now owns 2,200 shares of the company's stock valued at $25,000 after purchasing an additional 2,100 shares during the period. AllSquare Wealth Management LLC raised its position in Magnite by 76.8% in the first quarter. AllSquare Wealth Management LLC now owns 3,580 shares of the company's stock valued at $41,000 after purchasing an additional 1,555 shares during the period. GAMMA Investing LLC increased its position in shares of Magnite by 10,170.3% during the first quarter. GAMMA Investing LLC now owns 3,800 shares of the company's stock worth $43,000 after acquiring an additional 3,763 shares during the period. Larson Financial Group LLC increased its position in shares of Magnite by 67.5% during the first quarter. Larson Financial Group LLC now owns 6,108 shares of the company's stock worth $70,000 after acquiring an additional 2,461 shares during the period. Finally, Farther Finance Advisors LLC increased its position in shares of Magnite by 7,043.0% during the first quarter. Farther Finance Advisors LLC now owns 6,643 shares of the company's stock worth $76,000 after acquiring an additional 6,550 shares during the period. Hedge funds and other institutional investors own 73.40% of the company's stock.

Insider Buying and Selling

In other news, Director James Rossman sold 137,007 shares of the company's stock in a transaction dated Wednesday, June 18th. The shares were sold at an average price of $18.78, for a total value of $2,572,991.46. Following the completion of the sale, the director directly owned 93,679 shares of the company's stock, valued at approximately $1,759,291.62. This represents a 59.39% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Katie Seitz Evans sold 35,000 shares of the company's stock in a transaction dated Thursday, June 5th. The shares were sold at an average price of $17.36, for a total transaction of $607,600.00. Following the completion of the sale, the insider directly owned 442,788 shares of the company's stock, valued at $7,686,799.68. The trade was a 7.33% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 959,227 shares of company stock valued at $18,854,021 over the last ninety days. Company insiders own 4.30% of the company's stock.

Magnite Stock Performance

NASDAQ MGNI traded up $0.46 during trading hours on Wednesday, hitting $22.90. The company had a trading volume of 710,701 shares, compared to its average volume of 2,667,832. The company has a debt-to-equity ratio of 0.47, a quick ratio of 0.98 and a current ratio of 0.98. Magnite, Inc. has a 1-year low of $8.22 and a 1-year high of $25.27. The company has a market cap of $3.23 billion, a PE ratio of 114.58, a price-to-earnings-growth ratio of 1.93 and a beta of 2.96. The business has a 50 day moving average of $20.31 and a 200-day moving average of $16.45.

Magnite (NASDAQ:MGNI - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The company reported $0.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.06 by $0.06. Magnite had a net margin of 4.58% and a return on equity of 6.71%. The company had revenue of $145.85 million during the quarter, compared to the consensus estimate of $142.18 million. During the same quarter in the prior year, the firm posted $0.05 earnings per share. Magnite's revenue for the quarter was up 4.3% on a year-over-year basis. As a group, equities research analysts expect that Magnite, Inc. will post 0.33 EPS for the current year.

Wall Street Analyst Weigh In

A number of analysts have recently weighed in on MGNI shares. Needham & Company LLC upped their price objective on Magnite from $14.00 to $18.00 and gave the stock a "buy" rating in a research report on Monday, May 12th. Craig Hallum set a $24.00 price objective on Magnite and gave the stock a "buy" rating in a research report on Tuesday, May 20th. Royal Bank Of Canada cut their price objective on Magnite from $22.00 to $19.00 and set an "outperform" rating on the stock in a research report on Friday, May 2nd. Wells Fargo & Company upped their price objective on Magnite from $13.00 to $24.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 8th. Finally, Wall Street Zen raised Magnite from a "hold" rating to a "buy" rating in a research report on Sunday, July 13th. One research analyst has rated the stock with a hold rating and eleven have issued a buy rating to the stock. According to data from MarketBeat, Magnite currently has an average rating of "Moderate Buy" and a consensus price target of $21.18.

Check Out Our Latest Analysis on Magnite

About Magnite

(

Free Report)

Magnite, Inc, together with its subsidiaries, operates an independent omni-channel sell-side advertising platform in the United States and internationally. The company's platform offers applications and services for sellers of digital advertising inventory or publishers that own and operate CTV channels, applications, websites, and other digital media properties to manage and monetize their inventory; and applications and services for buyers, including advertisers, agencies, agency trading desks, and demand side platforms to buy digital advertising inventory, as well as an independent marketplace that connects buyers and sellers.

Read More

Before you consider Magnite, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magnite wasn't on the list.

While Magnite currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.