Kayne Anderson Rudnick Investment Management LLC cut its holdings in shares of Chemed Co. (NYSE:CHE - Free Report) by 1.8% during the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 582,134 shares of the company's stock after selling 10,820 shares during the quarter. Kayne Anderson Rudnick Investment Management LLC owned 3.87% of Chemed worth $308,415,000 at the end of the most recent quarter.

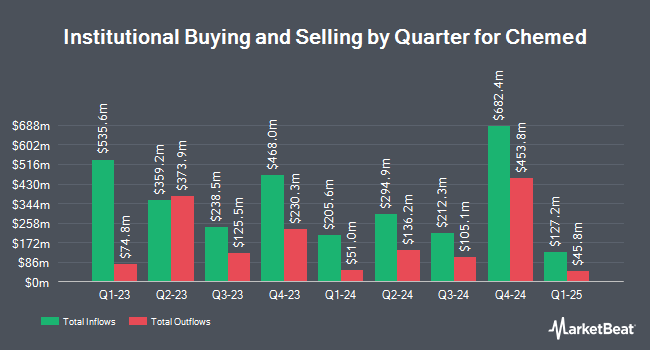

Several other hedge funds have also added to or reduced their stakes in CHE. Parr Mcknight Wealth Management Group LLC purchased a new position in shares of Chemed in the fourth quarter valued at about $917,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in Chemed by 5.0% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 48,197 shares of the company's stock worth $25,535,000 after buying an additional 2,277 shares in the last quarter. Voloridge Investment Management LLC boosted its position in Chemed by 201.3% during the 4th quarter. Voloridge Investment Management LLC now owns 11,626 shares of the company's stock valued at $6,159,000 after acquiring an additional 7,767 shares in the last quarter. Vident Advisory LLC grew its stake in Chemed by 112.4% in the fourth quarter. Vident Advisory LLC now owns 1,340 shares of the company's stock worth $710,000 after purchasing an additional 709 shares during the period. Finally, Twinbeech Capital LP bought a new position in shares of Chemed in the 4th quarter worth about $2,506,000. 95.85% of the stock is owned by institutional investors.

Chemed Trading Up 0.3%

CHE stock traded up $1.91 during midday trading on Friday, reaching $575.10. 19,915 shares of the company's stock traded hands, compared to its average volume of 102,895. Chemed Co. has a 52-week low of $512.12 and a 52-week high of $623.61. The stock has a market cap of $8.41 billion, a P/E ratio of 29.10, a PEG ratio of 2.15 and a beta of 0.59. The stock's 50-day moving average is $581.34 and its 200 day moving average is $565.81.

Chemed (NYSE:CHE - Get Free Report) last posted its earnings results on Wednesday, April 23rd. The company reported $5.63 earnings per share for the quarter, beating the consensus estimate of $5.59 by $0.04. Chemed had a net margin of 12.69% and a return on equity of 27.86%. The company had revenue of $646.94 million during the quarter, compared to analysts' expectations of $641.78 million. During the same period last year, the company posted $5.20 earnings per share. Chemed's quarterly revenue was up 9.8% on a year-over-year basis. As a group, research analysts expect that Chemed Co. will post 21.43 EPS for the current fiscal year.

Chemed Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, June 17th. Investors of record on Thursday, May 29th will be paid a $0.50 dividend. This represents a $2.00 annualized dividend and a yield of 0.35%. The ex-dividend date of this dividend is Thursday, May 29th. Chemed's dividend payout ratio is presently 9.74%.

Insider Activity at Chemed

In related news, EVP Spencer S. Lee sold 1,500 shares of the stock in a transaction on Friday, May 16th. The shares were sold at an average price of $577.99, for a total transaction of $866,985.00. Following the sale, the executive vice president now directly owns 14,627 shares of the company's stock, valued at approximately $8,454,259.73. This represents a 9.30% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CEO Kevin J. Mcnamara sold 1,000 shares of Chemed stock in a transaction dated Monday, March 31st. The shares were sold at an average price of $615.33, for a total value of $615,330.00. Following the completion of the transaction, the chief executive officer now owns 101,679 shares of the company's stock, valued at approximately $62,566,139.07. This represents a 0.97% decrease in their position. The disclosure for this sale can be found here. Insiders sold 7,500 shares of company stock worth $4,401,120 in the last 90 days. 3.29% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

CHE has been the topic of a number of recent research reports. Wall Street Zen raised Chemed from a "hold" rating to a "buy" rating in a research note on Friday, March 7th. Royal Bank of Canada increased their target price on Chemed from $667.00 to $674.00 and gave the company an "outperform" rating in a report on Monday, April 28th.

Read Our Latest Research Report on Chemed

Chemed Company Profile

(

Free Report)

Chemed Corporation provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States. The company operates in VITAS and Roto-Rooter segments. It offers plumbing, drain cleaning, excavation, water restoration, and other related services to residential and commercial customers through company-owned branches, independent contractors, and franchisees.

See Also

Before you consider Chemed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemed wasn't on the list.

While Chemed currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.