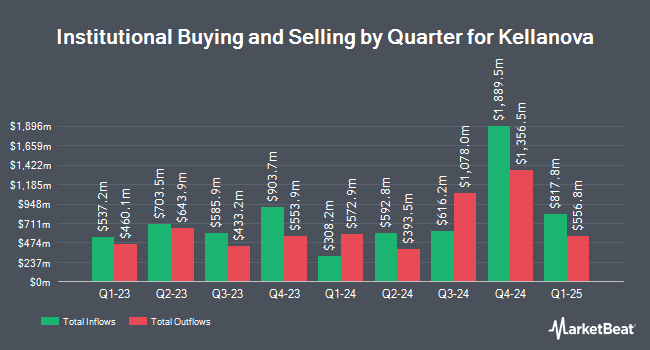

Kellogg W K Foundation Trust reduced its holdings in Kellanova (NYSE:K - Free Report) by 2.9% during the 2nd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 46,014,118 shares of the company's stock after selling 1,374,996 shares during the quarter. Kellanova comprises 94.4% of Kellogg W K Foundation Trust's portfolio, making the stock its biggest holding. Kellogg W K Foundation Trust owned approximately 13.26% of Kellanova worth $3,659,503,000 at the end of the most recent quarter.

Several other large investors have also made changes to their positions in the business. VCI Wealth Management LLC boosted its stake in Kellanova by 13.5% during the 2nd quarter. VCI Wealth Management LLC now owns 8,019 shares of the company's stock valued at $638,000 after purchasing an additional 954 shares during the period. Chevy Chase Trust Holdings LLC lifted its holdings in shares of Kellanova by 0.7% during the second quarter. Chevy Chase Trust Holdings LLC now owns 142,613 shares of the company's stock worth $11,342,000 after buying an additional 1,007 shares during the last quarter. Rosenberg Matthew Hamilton boosted its position in shares of Kellanova by 16.7% in the second quarter. Rosenberg Matthew Hamilton now owns 1,590 shares of the company's stock valued at $126,000 after acquiring an additional 228 shares during the period. TD Asset Management Inc grew its stake in shares of Kellanova by 0.6% in the second quarter. TD Asset Management Inc now owns 99,812 shares of the company's stock worth $7,938,000 after acquiring an additional 611 shares during the last quarter. Finally, Welch Group LLC increased its position in Kellanova by 5.3% during the second quarter. Welch Group LLC now owns 5,083 shares of the company's stock worth $404,000 after acquiring an additional 257 shares during the period. Institutional investors and hedge funds own 83.87% of the company's stock.

Kellanova Price Performance

Shares of Kellanova stock opened at $83.05 on Tuesday. The firm has a market cap of $28.87 billion, a P/E ratio of 21.80, a price-to-earnings-growth ratio of 5.16 and a beta of 0.24. The firm's 50-day simple moving average is $80.31 and its 200-day simple moving average is $80.80. Kellanova has a twelve month low of $76.48 and a twelve month high of $83.22. The company has a debt-to-equity ratio of 1.03, a quick ratio of 0.45 and a current ratio of 0.68.

Kellanova (NYSE:K - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The company reported $0.94 EPS for the quarter, missing analysts' consensus estimates of $0.99 by ($0.05). The business had revenue of $3.20 billion for the quarter, compared to the consensus estimate of $3.19 billion. Kellanova had a return on equity of 32.54% and a net margin of 10.56%.The firm's revenue for the quarter was up .3% on a year-over-year basis. During the same quarter in the prior year, the business earned $1.01 EPS. As a group, research analysts expect that Kellanova will post 3.93 EPS for the current fiscal year.

Kellanova Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, September 15th. Investors of record on Tuesday, September 2nd were paid a $0.58 dividend. The ex-dividend date of this dividend was Tuesday, September 2nd. This represents a $2.32 annualized dividend and a yield of 2.8%. This is a positive change from Kellanova's previous quarterly dividend of $0.57. Kellanova's payout ratio is presently 60.89%.

Insiders Place Their Bets

In other Kellanova news, major shareholder Kellogg W. K. Foundation Trust sold 114,599 shares of the stock in a transaction on Thursday, August 28th. The stock was sold at an average price of $79.55, for a total transaction of $9,116,350.45. Following the completion of the transaction, the insider directly owned 45,097,438 shares in the company, valued at $3,587,501,192.90. This represents a 0.25% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders sold 458,348 shares of company stock valued at $36,597,937 in the last quarter. Corporate insiders own 1.80% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have issued reports on K shares. Wall Street Zen lowered shares of Kellanova from a "hold" rating to a "sell" rating in a research report on Sunday, September 21st. JPMorgan Chase & Co. began coverage on shares of Kellanova in a research note on Wednesday, August 20th. They issued a "neutral" rating and a $83.50 target price for the company. Finally, Weiss Ratings upgraded Kellanova from a "hold (c+)" rating to a "buy (b-)" rating in a research note on Wednesday, October 8th. One research analyst has rated the stock with a Buy rating and four have issued a Hold rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $83.38.

Read Our Latest Stock Report on K

Kellanova Profile

(

Free Report)

Kellanova, together with its subsidiaries, manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa. Its principal products include crackers, crisps, savory snacks, toaster pastries, cereal bars, granola bars and bites, ready-to-eat cereals, frozen waffles, veggie foods, and noodles.

See Also

Want to see what other hedge funds are holding K? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Kellanova (NYSE:K - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kellanova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kellanova wasn't on the list.

While Kellanova currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.