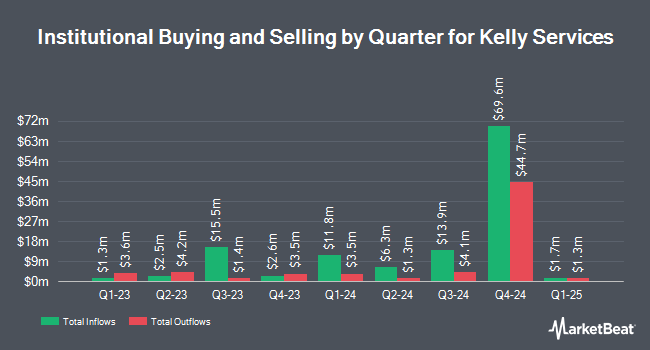

Quantbot Technologies LP decreased its stake in shares of Kelly Services, Inc. (NASDAQ:KELYA - Free Report) by 59.3% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 25,314 shares of the business services provider's stock after selling 36,917 shares during the quarter. Quantbot Technologies LP owned about 0.07% of Kelly Services worth $333,000 at the end of the most recent quarter.

A number of other large investors have also added to or reduced their stakes in the stock. Boston Partners raised its stake in Kelly Services by 9.2% during the first quarter. Boston Partners now owns 2,062,292 shares of the business services provider's stock valued at $26,622,000 after buying an additional 172,903 shares during the last quarter. Russell Investments Group Ltd. raised its stake in Kelly Services by 59.1% during the first quarter. Russell Investments Group Ltd. now owns 31,993 shares of the business services provider's stock valued at $421,000 after buying an additional 11,879 shares during the last quarter. Nuveen LLC purchased a new position in Kelly Services during the first quarter valued at $8,739,000. Aigen Investment Management LP raised its stake in Kelly Services by 40.8% during the first quarter. Aigen Investment Management LP now owns 29,109 shares of the business services provider's stock valued at $383,000 after buying an additional 8,436 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its stake in Kelly Services by 26.5% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 650,134 shares of the business services provider's stock valued at $8,562,000 after purchasing an additional 136,392 shares during the last quarter. Hedge funds and other institutional investors own 76.34% of the company's stock.

Wall Street Analyst Weigh In

KELYA has been the topic of several recent analyst reports. Barrington Research reiterated an "outperform" rating and set a $25.00 target price on shares of Kelly Services in a research note on Tuesday, May 20th. Wall Street Zen upgraded Kelly Services from a "buy" rating to a "strong-buy" rating in a research note on Friday, August 22nd. One research analyst has rated the stock with a Buy rating, Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average price target of $25.00.

View Our Latest Stock Analysis on Kelly Services

Insiders Place Their Bets

In other Kelly Services news, SVP Daniel H. Malan sold 7,650 shares of the business's stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $14.40, for a total transaction of $110,160.00. Following the completion of the sale, the senior vice president directly owned 87,631 shares in the company, valued at approximately $1,261,886.40. The trade was a 8.03% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 3.90% of the company's stock.

Kelly Services Stock Performance

KELYA traded up $0.13 during mid-day trading on Monday, reaching $14.23. 174,217 shares of the company traded hands, compared to its average volume of 333,999. The stock has a market capitalization of $501.61 million, a P/E ratio of -71.15, a P/E/G ratio of 0.51 and a beta of 0.89. The company has a quick ratio of 1.52, a current ratio of 1.52 and a debt-to-equity ratio of 0.06. The company's fifty day moving average price is $13.05 and its 200-day moving average price is $12.58. Kelly Services, Inc. has a 52-week low of $10.80 and a 52-week high of $22.44.

Kelly Services (NASDAQ:KELYA - Get Free Report) last announced its earnings results on Thursday, August 7th. The business services provider reported $0.54 earnings per share for the quarter, meeting analysts' consensus estimates of $0.54. The business had revenue of $1.10 billion during the quarter, compared to analyst estimates of $1.12 billion. Kelly Services had a negative net margin of 0.14% and a positive return on equity of 5.65%. Kelly Services has set its Q3 2025 guidance at EPS. On average, sell-side analysts expect that Kelly Services, Inc. will post 2.45 EPS for the current year.

Kelly Services Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, September 3rd. Shareholders of record on Wednesday, August 20th will be paid a dividend of $0.075 per share. The ex-dividend date is Wednesday, August 20th. This represents a $0.30 dividend on an annualized basis and a yield of 2.1%. Kelly Services's payout ratio is currently -150.00%.

Kelly Services Company Profile

(

Free Report)

Kelly Services, Inc, together with its subsidiaries, provides workforce solutions to various industries. The company operates through five segments: Professional & Industrial; Science, Engineering & Technology; Education; Outsourcing & Consulting; and International. The Professional & Industrial segment delivers staffing, outcome-based, and permanent placement services providing administrative, accounting, and finance; light industrial; contact center staffing; and other workforce solutions.

Read More

Before you consider Kelly Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kelly Services wasn't on the list.

While Kelly Services currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.