Kestra Private Wealth Services LLC bought a new stake in shares of StoneX Group Inc. (NASDAQ:SNEX - Free Report) in the 1st quarter, according to its most recent 13F filing with the SEC. The firm bought 5,420 shares of the company's stock, valued at approximately $414,000.

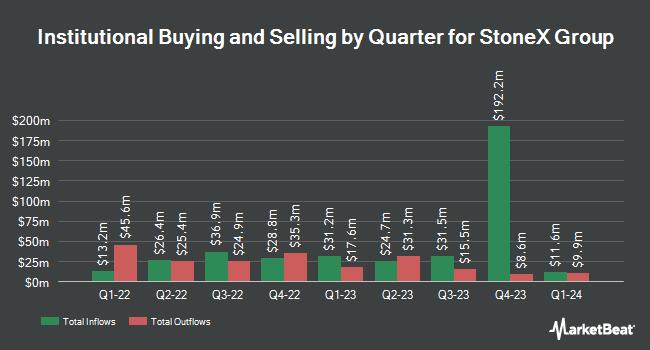

Several other hedge funds have also recently added to or reduced their stakes in SNEX. Perpetual Ltd acquired a new stake in shares of StoneX Group during the 1st quarter worth about $64,679,000. Tidal Investments LLC acquired a new stake in shares of StoneX Group during the 4th quarter worth about $16,557,000. JPMorgan Chase & Co. boosted its stake in shares of StoneX Group by 104.3% during the 4th quarter. JPMorgan Chase & Co. now owns 329,287 shares of the company's stock worth $32,260,000 after purchasing an additional 168,098 shares during the last quarter. Woodmont Investment Counsel LLC boosted its stake in shares of StoneX Group by 108.2% during the 1st quarter. Woodmont Investment Counsel LLC now owns 266,768 shares of the company's stock worth $20,376,000 after purchasing an additional 138,627 shares during the last quarter. Finally, Norges Bank acquired a new stake in shares of StoneX Group during the 4th quarter worth about $10,551,000. 75.93% of the stock is currently owned by hedge funds and other institutional investors.

StoneX Group Price Performance

StoneX Group stock opened at $94.52 on Friday. StoneX Group Inc. has a 12-month low of $47.69 and a 12-month high of $99.08. The stock has a market capitalization of $4.62 billion, a P/E ratio of 16.01 and a beta of 0.54. The firm's 50-day moving average is $89.09 and its two-hundred day moving average is $82.16. The company has a debt-to-equity ratio of 1.09, a current ratio of 1.91 and a quick ratio of 1.35.

StoneX Group (NASDAQ:SNEX - Get Free Report) last released its quarterly earnings results on Wednesday, May 14th. The company reported $1.41 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.32 by $0.09. StoneX Group had a net margin of 0.24% and a return on equity of 17.03%. The company had revenue of $956.00 million for the quarter, compared to analysts' expectations of $907.30 million. Equities analysts predict that StoneX Group Inc. will post 8.7 earnings per share for the current year.

Insider Activity at StoneX Group

In related news, President Charles M. Lyon sold 13,000 shares of the firm's stock in a transaction that occurred on Thursday, May 15th. The shares were sold at an average price of $86.92, for a total value of $1,129,960.00. Following the sale, the president directly owned 122,080 shares of the company's stock, valued at approximately $10,611,193.60. This trade represents a 9.62% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Abigail H. Perkins sold 10,470 shares of the firm's stock in a transaction that occurred on Monday, June 16th. The stock was sold at an average price of $86.22, for a total transaction of $902,723.40. Following the completion of the sale, the insider directly owned 43,913 shares in the company, valued at $3,786,178.86. This represents a 19.25% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 120,262 shares of company stock worth $10,534,329 over the last three months. Company insiders own 11.70% of the company's stock.

StoneX Group Company Profile

(

Free Report)

StoneX Group Inc operates as a global financial services network that connects companies, organizations, traders, and investors to market ecosystem worldwide. The company operates through Commercial, Institutional, Retail, and Global Payments segments. The Commercial segment provides risk management and hedging, exchange-traded and OTC products execution and clearing, voice brokerage, market intelligence, physical trading, and commodity financing and logistics services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider StoneX Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneX Group wasn't on the list.

While StoneX Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.