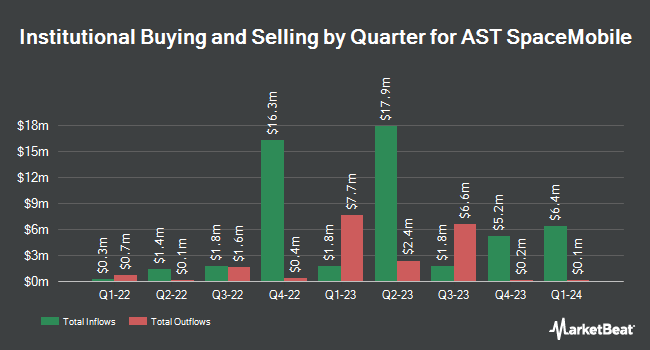

Key Colony Management LLC reduced its holdings in shares of AST SpaceMobile, Inc. (NASDAQ:ASTS - Free Report) by 31.0% in the second quarter, according to its most recent filing with the SEC. The fund owned 411,000 shares of the company's stock after selling 185,000 shares during the period. AST SpaceMobile comprises 21.7% of Key Colony Management LLC's portfolio, making the stock its 4th biggest position. Key Colony Management LLC owned about 0.13% of AST SpaceMobile worth $19,206,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also bought and sold shares of the company. Sunbelt Securities Inc. raised its position in AST SpaceMobile by 61.9% during the 1st quarter. Sunbelt Securities Inc. now owns 1,321 shares of the company's stock valued at $30,000 after purchasing an additional 505 shares in the last quarter. GAMMA Investing LLC raised its position in shares of AST SpaceMobile by 388.7% in the 1st quarter. GAMMA Investing LLC now owns 1,559 shares of the company's stock worth $35,000 after acquiring an additional 1,240 shares in the last quarter. Financial Gravity Asset Management Inc. bought a new position in shares of AST SpaceMobile in the 1st quarter worth $41,000. Close Asset Management Ltd raised its position in shares of AST SpaceMobile by 72.4% in the 1st quarter. Close Asset Management Ltd now owns 1,810 shares of the company's stock worth $41,000 after acquiring an additional 760 shares in the last quarter. Finally, Bernard Wealth Management Corp. bought a new position in shares of AST SpaceMobile in the 4th quarter worth $42,000. 60.95% of the stock is owned by institutional investors.

Insider Transactions at AST SpaceMobile

In other AST SpaceMobile news, COO Shanti B. Gupta sold 10,000 shares of the stock in a transaction that occurred on Monday, June 16th. The stock was sold at an average price of $41.84, for a total transaction of $418,400.00. Following the transaction, the chief operating officer owned 305,667 shares in the company, valued at approximately $12,789,107.28. This represents a 3.17% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO Andrew Martin Johnson sold 20,000 shares of the stock in a transaction that occurred on Tuesday, August 26th. The stock was sold at an average price of $52.48, for a total value of $1,049,600.00. Following the transaction, the chief financial officer owned 397,485 shares in the company, valued at $20,860,012.80. This represents a 4.79% decrease in their position. The disclosure for this sale can be found here. 34.15% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several research analysts have recently commented on ASTS shares. B. Riley reissued a "buy" rating and issued a $44.00 price target (up from $36.00) on shares of AST SpaceMobile in a research report on Monday, June 16th. Zacks Research upgraded AST SpaceMobile from a "strong sell" rating to a "hold" rating in a research note on Monday, August 18th. UBS Group downgraded AST SpaceMobile from a "buy" rating to a "neutral" rating and dropped their target price for the stock from $62.00 to $43.00 in a research note on Tuesday. Bank of America assumed coverage on AST SpaceMobile in a research note on Wednesday, June 25th. They set a "neutral" rating and a $55.00 target price on the stock. Finally, Scotiabank dropped their target price on AST SpaceMobile from $45.40 to $42.90 and set a "sector perform" rating on the stock in a research note on Thursday, August 7th. Three analysts have rated the stock with a Buy rating and six have issued a Hold rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $42.82.

Read Our Latest Stock Analysis on ASTS

AST SpaceMobile Stock Up 0.9%

Shares of ASTS opened at $38.72 on Friday. AST SpaceMobile, Inc. has a 52 week low of $17.50 and a 52 week high of $60.95. The company has a quick ratio of 8.23, a current ratio of 8.23 and a debt-to-equity ratio of 0.42. The company has a market capitalization of $13.88 billion, a price-to-earnings ratio of -20.49 and a beta of 2.43. The stock's 50-day moving average price is $48.67 and its 200-day moving average price is $35.92.

AST SpaceMobile (NASDAQ:ASTS - Get Free Report) last issued its earnings results on Monday, August 11th. The company reported ($0.41) EPS for the quarter, missing analysts' consensus estimates of ($0.19) by ($0.22). AST SpaceMobile had a negative return on equity of 26.81% and a negative net margin of 7,213.90%.The company had revenue of $1.16 million during the quarter, compared to analysts' expectations of $6.37 million. On average, sell-side analysts predict that AST SpaceMobile, Inc. will post -0.4 EPS for the current year.

About AST SpaceMobile

(

Free Report)

AST SpaceMobile, Inc, together with its subsidiaries, develops and provides access to a space-based cellular broadband network for smartphones in the United States. Its SpaceMobile service provides cellular broadband services to end-users who are out of terrestrial cellular coverage. The company was founded in 2017 and is headquartered in Midland, Texas.

Read More

Want to see what other hedge funds are holding ASTS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for AST SpaceMobile, Inc. (NASDAQ:ASTS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AST SpaceMobile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AST SpaceMobile wasn't on the list.

While AST SpaceMobile currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.