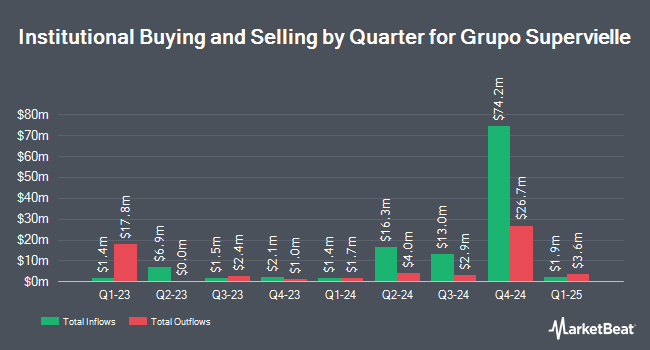

Kiker Wealth Management LLC bought a new stake in Grupo Supervielle S.A. (NYSE:SUPV - Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 127,005 shares of the company's stock, valued at approximately $1,345,000. Kiker Wealth Management LLC owned 0.14% of Grupo Supervielle as of its most recent SEC filing.

Several other institutional investors and hedge funds have also made changes to their positions in the business. GAMMA Investing LLC boosted its position in shares of Grupo Supervielle by 10.2% in the 1st quarter. GAMMA Investing LLC now owns 7,958 shares of the company's stock valued at $104,000 after purchasing an additional 737 shares during the period. Cetera Investment Advisers purchased a new position in shares of Grupo Supervielle during the 1st quarter worth approximately $268,000. Itau Unibanco Holding S.A. acquired a new stake in Grupo Supervielle during the first quarter worth approximately $357,000. XTX Topco Ltd boosted its position in Grupo Supervielle by 83.5% during the first quarter. XTX Topco Ltd now owns 31,304 shares of the company's stock worth $409,000 after acquiring an additional 14,243 shares during the last quarter. Finally, Insigneo Advisory Services LLC boosted its holdings in shares of Grupo Supervielle by 11.1% in the 1st quarter. Insigneo Advisory Services LLC now owns 36,209 shares of the company's stock valued at $473,000 after purchasing an additional 3,604 shares during the last quarter.

Grupo Supervielle Price Performance

Shares of NYSE:SUPV opened at $6.51 on Tuesday. The company has a quick ratio of 0.96, a current ratio of 0.96 and a debt-to-equity ratio of 0.38. Grupo Supervielle S.A. has a fifty-two week low of $4.54 and a fifty-two week high of $19.75. The firm has a 50-day simple moving average of $7.36 and a 200 day simple moving average of $10.78. The company has a market cap of $576.60 million, a PE ratio of 9.87, a P/E/G ratio of 11.58 and a beta of 1.56.

Grupo Supervielle (NYSE:SUPV - Get Free Report) last announced its quarterly earnings data on Wednesday, August 13th. The company reported $0.14 earnings per share for the quarter, missing analysts' consensus estimates of $0.22 by ($0.08). The business had revenue of $210.52 million for the quarter, compared to the consensus estimate of $283.67 billion. Grupo Supervielle had a net margin of 4.08% and a return on equity of 6.82%. On average, sell-side analysts anticipate that Grupo Supervielle S.A. will post 1.5 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on SUPV shares. Weiss Ratings reissued a "hold (c)" rating on shares of Grupo Supervielle in a research note on Wednesday, October 8th. Citigroup downgraded shares of Grupo Supervielle from a "buy" rating to a "neutral" rating in a research note on Wednesday, September 10th. One equities research analyst has rated the stock with a Buy rating and three have issued a Hold rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $17.00.

View Our Latest Stock Report on SUPV

About Grupo Supervielle

(

Free Report)

Grupo Supervielle SA, a financial services holding company, provides various banking products and services in Argentina. The company operates through Personal & Business Banking, Corporate Banking, Bank Treasury, Consumer Finance, Insurance, and Asset Management and Other Services segments. It offers savings accounts, time and demand deposits, and checking accounts; various loan products, including personal, consumer, mortgage, unsecured, and car loans; overdrafts; loans with special facilities for project and working capital financing; and leasing, bank guarantees for tenants, salary advances, domestic and international factoring, international guarantees and letters of credit, payroll payment plans, credit and debit cards, and senior citizens benefit payment services, as well as financial services and investments, such as mutual funds and guarantees.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Grupo Supervielle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grupo Supervielle wasn't on the list.

While Grupo Supervielle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.