Kiker Wealth Management LLC purchased a new stake in Nomad Foods Limited (NYSE:NOMD - Free Report) in the second quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm purchased 85,239 shares of the company's stock, valued at approximately $1,448,000. Nomad Foods accounts for approximately 0.8% of Kiker Wealth Management LLC's investment portfolio, making the stock its 29th biggest position. Kiker Wealth Management LLC owned 0.06% of Nomad Foods as of its most recent filing with the Securities and Exchange Commission.

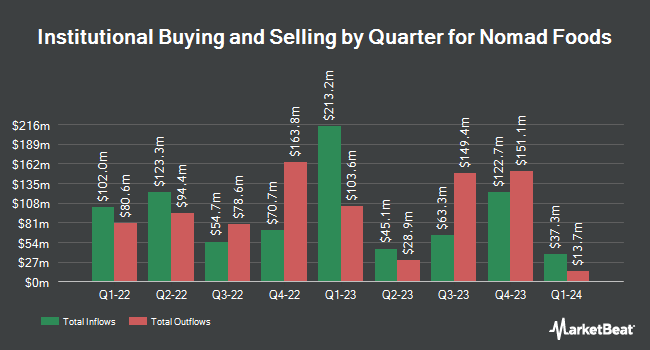

A number of other hedge funds and other institutional investors have also modified their holdings of NOMD. Boston Partners boosted its position in shares of Nomad Foods by 11.1% in the 1st quarter. Boston Partners now owns 10,209,283 shares of the company's stock valued at $200,615,000 after purchasing an additional 1,019,957 shares during the period. Ameriprise Financial Inc. boosted its position in shares of Nomad Foods by 46.2% in the 1st quarter. Ameriprise Financial Inc. now owns 1,851,199 shares of the company's stock valued at $36,376,000 after purchasing an additional 585,054 shares during the period. Hennessy Advisors Inc. acquired a new position in shares of Nomad Foods in the 2nd quarter valued at $8,617,000. Victory Capital Management Inc. boosted its position in shares of Nomad Foods by 17.3% in the 1st quarter. Victory Capital Management Inc. now owns 2,724,866 shares of the company's stock valued at $53,544,000 after purchasing an additional 402,599 shares during the period. Finally, Meritage Portfolio Management purchased a new stake in Nomad Foods in the 2nd quarter worth about $6,599,000. Institutional investors and hedge funds own 75.26% of the company's stock.

Nomad Foods Stock Down 0.2%

NOMD opened at $12.11 on Tuesday. Nomad Foods Limited has a fifty-two week low of $11.94 and a fifty-two week high of $20.81. The business has a 50-day moving average of $14.29 and a 200-day moving average of $16.78. The company has a debt-to-equity ratio of 0.81, a current ratio of 1.02 and a quick ratio of 0.63. The company has a market capitalization of $1.86 billion, a PE ratio of 8.30 and a beta of 0.70.

Nomad Foods (NYSE:NOMD - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported $0.45 earnings per share for the quarter, beating analysts' consensus estimates of $0.44 by $0.01. Nomad Foods had a return on equity of 10.26% and a net margin of 6.93%.The business had revenue of $879.27 million for the quarter, compared to the consensus estimate of $762.81 million. During the same period last year, the business earned $0.44 EPS. The firm's revenue was down .8% compared to the same quarter last year. Equities research analysts forecast that Nomad Foods Limited will post 1.82 EPS for the current fiscal year.

Nomad Foods Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, August 26th. Investors of record on Monday, August 11th were paid a $0.17 dividend. This represents a $0.68 dividend on an annualized basis and a dividend yield of 5.6%. The ex-dividend date of this dividend was Monday, August 11th. Nomad Foods's dividend payout ratio (DPR) is presently 46.58%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently issued reports on the company. Weiss Ratings reissued a "hold (c)" rating on shares of Nomad Foods in a research note on Wednesday, October 8th. Barclays reduced their price objective on Nomad Foods from $20.00 to $18.00 and set an "overweight" rating for the company in a research note on Friday, August 8th. Mizuho reduced their price objective on Nomad Foods from $23.00 to $20.00 and set an "outperform" rating for the company in a research note on Tuesday, August 12th. BTIG Research reduced their price objective on Nomad Foods from $20.00 to $18.00 and set a "buy" rating for the company in a research note on Wednesday, September 17th. Finally, Zacks Research downgraded Nomad Foods from a "hold" rating to a "strong sell" rating in a research note on Monday, September 29th. Four investment analysts have rated the stock with a Buy rating, one has issued a Hold rating and one has issued a Sell rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $19.75.

View Our Latest Research Report on NOMD

Nomad Foods Company Profile

(

Free Report)

Nomad Foods Limited, together with its subsidiaries, manufactures, markets, and distributes a range of frozen food products in the United Kingdom and internationally. The company offers frozen fish products, including fish fingers, coated fish, and natural fish; ready-to-cook vegetable products, such as peas and spinach; and frozen poultry and meat products comprising nuggets, grills, and burgers.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nomad Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nomad Foods wasn't on the list.

While Nomad Foods currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.