King Luther Capital Management Corp cut its holdings in Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 31.7% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 582,241 shares of the technology infrastructure company's stock after selling 270,816 shares during the period. King Luther Capital Management Corp owned approximately 0.40% of Akamai Technologies worth $46,870,000 at the end of the most recent reporting period.

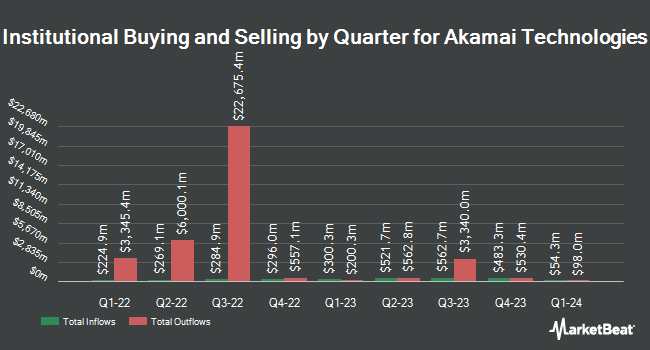

Several other hedge funds have also added to or reduced their stakes in the business. Brighton Jones LLC boosted its holdings in Akamai Technologies by 101.4% during the 4th quarter. Brighton Jones LLC now owns 4,016 shares of the technology infrastructure company's stock valued at $384,000 after acquiring an additional 2,022 shares during the period. Distillate Capital Partners LLC purchased a new stake in Akamai Technologies during the 4th quarter valued at about $15,347,000. Townsquare Capital LLC purchased a new stake in Akamai Technologies during the 4th quarter valued at about $221,000. Canada Post Corp Registered Pension Plan purchased a new stake in Akamai Technologies during the 4th quarter valued at about $259,000. Finally, Ontario Teachers Pension Plan Board boosted its holdings in Akamai Technologies by 24.6% during the 4th quarter. Ontario Teachers Pension Plan Board now owns 7,883 shares of the technology infrastructure company's stock valued at $754,000 after acquiring an additional 1,557 shares during the period. 94.28% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on the company. KeyCorp assumed coverage on Akamai Technologies in a report on Friday, June 6th. They set an "underweight" rating and a $63.00 target price for the company. Scotiabank dropped their price objective on Akamai Technologies from $105.00 to $95.00 and set a "sector outperform" rating for the company in a report on Friday. UBS Group increased their price objective on Akamai Technologies from $85.00 to $90.00 and gave the stock a "neutral" rating in a report on Friday, May 9th. Wall Street Zen upgraded Akamai Technologies from a "hold" rating to a "buy" rating in a report on Saturday. Finally, Piper Sandler dropped their price objective on Akamai Technologies from $88.00 to $83.00 and set a "neutral" rating for the company in a report on Friday. Three analysts have rated the stock with a sell rating, eight have assigned a hold rating, eight have issued a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $96.44.

View Our Latest Research Report on Akamai Technologies

Insider Buying and Selling

In other Akamai Technologies news, EVP Paul C. Joseph sold 5,000 shares of Akamai Technologies stock in a transaction on Tuesday, July 15th. The stock was sold at an average price of $77.74, for a total value of $388,700.00. Following the completion of the sale, the executive vice president owned 32,349 shares of the company's stock, valued at approximately $2,514,811.26. This trade represents a 13.39% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Kim Salem-Jackson sold 13,157 shares of Akamai Technologies stock in a transaction on Tuesday, May 27th. The stock was sold at an average price of $76.33, for a total value of $1,004,273.81. Following the completion of the sale, the executive vice president directly owned 43,575 shares of the company's stock, valued at approximately $3,326,079.75. The trade was a 23.19% decrease in their position. The disclosure for this sale can be found here. 2.00% of the stock is owned by company insiders.

Akamai Technologies Stock Up 1.9%

AKAM traded up $1.36 during midday trading on Tuesday, reaching $71.97. The company's stock had a trading volume of 2,875,903 shares, compared to its average volume of 1,960,610. Akamai Technologies, Inc. has a 1 year low of $67.51 and a 1 year high of $106.80. The stock's 50-day moving average is $77.91 and its 200-day moving average is $81.13. The firm has a market capitalization of $10.32 billion, a price-to-earnings ratio of 25.52, a PEG ratio of 2.73 and a beta of 0.76. The company has a current ratio of 2.31, a quick ratio of 1.18 and a debt-to-equity ratio of 0.92.

Akamai Technologies (NASDAQ:AKAM - Get Free Report) last announced its earnings results on Thursday, August 7th. The technology infrastructure company reported $1.73 earnings per share for the quarter, beating analysts' consensus estimates of $1.55 by $0.18. Akamai Technologies had a net margin of 10.40% and a return on equity of 14.26%. The business had revenue of $1.04 billion during the quarter, compared to the consensus estimate of $1.02 billion. During the same quarter last year, the firm earned $1.58 earnings per share. The business's revenue for the quarter was up 6.5% on a year-over-year basis. As a group, research analysts expect that Akamai Technologies, Inc. will post 4.6 EPS for the current year.

Akamai Technologies Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Further Reading

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.