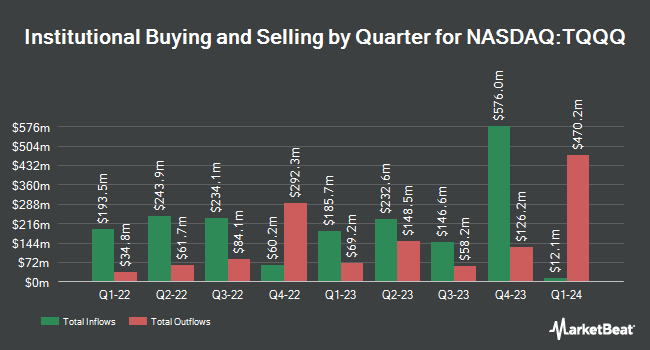

Kingstone Capital Partners Texas LLC acquired a new stake in shares of ProShares UltraPro QQQ (NASDAQ:TQQQ - Free Report) during the 2nd quarter, according to its most recent filing with the SEC. The institutional investor acquired 4,770,498 shares of the exchange traded fund's stock, valued at approximately $395,951,000. Kingstone Capital Partners Texas LLC owned about 1.48% of ProShares UltraPro QQQ at the end of the most recent quarter.

Several other institutional investors have also recently modified their holdings of TQQQ. Jump Financial LLC bought a new position in shares of ProShares UltraPro QQQ during the 1st quarter valued at about $53,458,000. Goldman Sachs Group Inc. increased its position in shares of ProShares UltraPro QQQ by 4,237.0% during the 1st quarter. Goldman Sachs Group Inc. now owns 520,444 shares of the exchange traded fund's stock valued at $29,821,000 after purchasing an additional 508,444 shares during the last quarter. Oriental Harbor Investment Fund increased its position in shares of ProShares UltraPro QQQ by 47.3% during the 1st quarter. Oriental Harbor Investment Fund now owns 1,515,410 shares of the exchange traded fund's stock valued at $86,488,000 after purchasing an additional 486,506 shares during the last quarter. TB Alternative Assets Ltd. bought a new position in shares of ProShares UltraPro QQQ during the 1st quarter valued at about $26,495,000. Finally, WT Asset Management Ltd bought a new position in shares of ProShares UltraPro QQQ during the 1st quarter valued at about $21,201,000.

ProShares UltraPro QQQ Stock Down 0.6%

Shares of ProShares UltraPro QQQ stock traded down $0.62 during trading on Tuesday, hitting $104.10. 22,974,204 shares of the stock traded hands, compared to its average volume of 78,853,711. The stock has a market cap of $32.08 billion, a price-to-earnings ratio of 38.25 and a beta of 3.45. The firm's fifty day moving average is $91.28 and its 200-day moving average is $74.00. ProShares UltraPro QQQ has a 52 week low of $35.00 and a 52 week high of $105.08.

ProShares UltraPro QQQ Profile

(

Free Report)

Proshares UltraPro QQQ ETF (the Fund) seeks daily investment results, before fees and expenses that correspond to triple (300%) the daily performance of the NASDAQ-100 Index (the Index). The Fund invests in equity securities, derivatives, such as futures contracts, swap agreements, and money market instruments.

Featured Stories

Before you consider ProShares UltraPro QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProShares UltraPro QQQ wasn't on the list.

While ProShares UltraPro QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.