Freestone Capital Holdings LLC boosted its position in KLA Corporation (NASDAQ:KLAC - Free Report) by 8.3% during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 18,805 shares of the semiconductor company's stock after acquiring an additional 1,443 shares during the quarter. Freestone Capital Holdings LLC's holdings in KLA were worth $12,784,000 at the end of the most recent quarter.

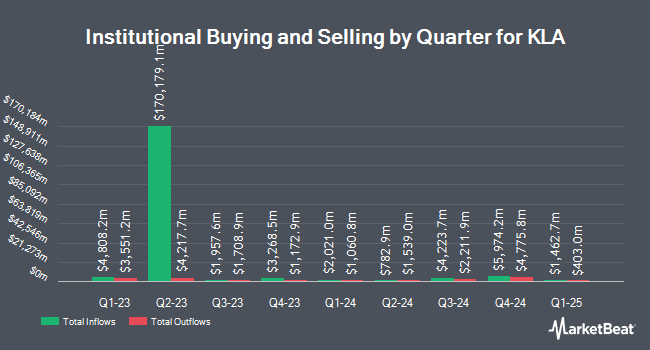

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Alpine Bank Wealth Management purchased a new stake in shares of KLA during the 1st quarter worth $35,000. Olde Wealth Management LLC purchased a new stake in KLA during the 1st quarter worth about $36,000. MJT & Associates Financial Advisory Group Inc. purchased a new stake in KLA during the 1st quarter worth about $37,000. Hazlett Burt & Watson Inc. acquired a new position in shares of KLA during the 1st quarter worth about $45,000. Finally, E Fund Management Hong Kong Co. Ltd. increased its holdings in shares of KLA by 527.3% in the 1st quarter. E Fund Management Hong Kong Co. Ltd. now owns 69 shares of the semiconductor company's stock valued at $47,000 after acquiring an additional 58 shares during the last quarter. Institutional investors and hedge funds own 86.65% of the company's stock.

Wall Street Analyst Weigh In

KLAC has been the subject of several recent analyst reports. Wells Fargo & Company restated an "equal weight" rating and set a $920.00 target price (up previously from $870.00) on shares of KLA in a research note on Tuesday, July 8th. TD Securities boosted their price objective on shares of KLA from $770.00 to $800.00 and gave the stock a "hold" rating in a research report on Thursday, May 1st. Needham & Company LLC restated a "buy" rating and issued a $830.00 target price on shares of KLA in a report on Thursday, May 1st. Cantor Fitzgerald reiterated an "overweight" rating on shares of KLA in a research note on Tuesday, June 24th. Finally, TD Cowen upped their price objective on shares of KLA from $800.00 to $900.00 and gave the company a "hold" rating in a research note on Friday, August 1st. Eight equities research analysts have rated the stock with a Buy rating and ten have given a Hold rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $890.59.

View Our Latest Analysis on KLAC

Insiders Place Their Bets

In other news, CAO Virendra A. Kirloskar sold 39 shares of the firm's stock in a transaction that occurred on Wednesday, July 2nd. The stock was sold at an average price of $891.50, for a total value of $34,768.50. Following the completion of the sale, the chief accounting officer directly owned 2,616 shares of the company's stock, valued at $2,332,164. This trade represents a 1.47% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Bren D. Higgins sold 1,019 shares of the company's stock in a transaction on Thursday, May 22nd. The stock was sold at an average price of $766.46, for a total value of $781,022.74. Following the transaction, the chief financial officer directly owned 27,779 shares in the company, valued at $21,291,492.34. This represents a 3.54% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 19,908 shares of company stock valued at $18,038,659. Corporate insiders own 0.12% of the company's stock.

KLA Stock Performance

Shares of KLA stock traded up $2.36 during trading hours on Wednesday, hitting $878.44. 978,414 shares of the company were exchanged, compared to its average volume of 1,159,217. The company has a current ratio of 2.62, a quick ratio of 1.83 and a debt-to-equity ratio of 1.25. The business has a 50-day moving average of $904.12 and a 200-day moving average of $783.62. KLA Corporation has a 1 year low of $551.33 and a 1 year high of $959.26. The stock has a market capitalization of $115.92 billion, a price-to-earnings ratio of 28.91, a P/E/G ratio of 3.01 and a beta of 1.44.

KLA (NASDAQ:KLAC - Get Free Report) last announced its quarterly earnings data on Thursday, July 31st. The semiconductor company reported $9.38 earnings per share (EPS) for the quarter, beating the consensus estimate of $8.53 by $0.85. KLA had a net margin of 33.41% and a return on equity of 112.41%. The company had revenue of $3.17 billion for the quarter, compared to analysts' expectations of $3.08 billion. During the same period in the previous year, the company posted $6.60 EPS. KLA's revenue was up 23.6% compared to the same quarter last year. KLA has set its Q1 2026 guidance at 7.760-9.300 EPS. As a group, analysts expect that KLA Corporation will post 31.59 EPS for the current fiscal year.

KLA Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, September 3rd. Shareholders of record on Monday, August 18th will be given a dividend of $1.90 per share. The ex-dividend date is Monday, August 18th. This represents a $7.60 annualized dividend and a yield of 0.9%. KLA's payout ratio is presently 25.01%.

KLA announced that its board has approved a share repurchase program on Wednesday, April 30th that authorizes the company to buyback $5.00 billion in outstanding shares. This buyback authorization authorizes the semiconductor company to reacquire up to 5.4% of its shares through open market purchases. Shares buyback programs are typically an indication that the company's management believes its shares are undervalued.

About KLA

(

Free Report)

KLA Corporation, together with its subsidiaries, engages in the design, manufacture, and marketing of process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide. It operates through three segments: Semiconductor Process Control; Specialty Semiconductor Process; and PCB and Component Inspection.

See Also

Before you consider KLA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KLA wasn't on the list.

While KLA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.