Vanguard Group Inc. boosted its stake in shares of Klaviyo, Inc. (NYSE:KVYO - Free Report) by 9.7% during the 1st quarter, according to its most recent filing with the SEC. The firm owned 8,467,933 shares of the company's stock after purchasing an additional 746,078 shares during the period. Vanguard Group Inc. owned approximately 3.10% of Klaviyo worth $256,240,000 at the end of the most recent quarter.

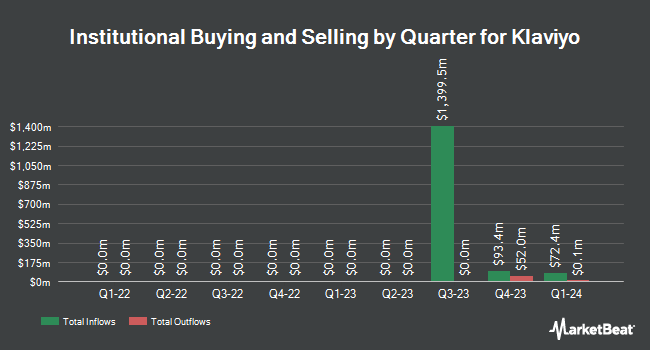

Several other institutional investors also recently bought and sold shares of the business. Encompass More Asset Management acquired a new position in Klaviyo in the 1st quarter valued at $549,000. Blair William & Co. IL boosted its position in Klaviyo by 12.1% in the 1st quarter. Blair William & Co. IL now owns 231,153 shares of the company's stock valued at $6,995,000 after buying an additional 24,929 shares during the period. Jefferies Financial Group Inc. acquired a new position in Klaviyo during the 1st quarter worth $1,858,000. Alberta Investment Management Corp purchased a new stake in shares of Klaviyo during the first quarter worth approximately $1,065,000. Finally, US Bancorp DE lifted its stake in Klaviyo by 40.6% in the first quarter. US Bancorp DE now owns 6,792 shares of the company's stock worth $206,000 after acquiring an additional 1,960 shares during the last quarter. 45.43% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Klaviyo

In other news, major shareholder Summit Partners L. P sold 4,000,000 shares of the stock in a transaction that occurred on Wednesday, June 4th. The stock was sold at an average price of $33.35, for a total value of $133,400,000.00. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, President Stephen Eric Rowland sold 7,105 shares of the business's stock in a transaction dated Monday, August 18th. The shares were sold at an average price of $31.46, for a total transaction of $223,523.30. Following the completion of the transaction, the president owned 445,726 shares in the company, valued at approximately $14,022,539.96. This trade represents a 1.57% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 4,087,383 shares of company stock worth $136,183,878. Corporate insiders own 49.92% of the company's stock.

Wall Street Analysts Forecast Growth

KVYO has been the subject of several research analyst reports. Wall Street Zen cut shares of Klaviyo from a "buy" rating to a "hold" rating in a report on Sunday, August 17th. Needham & Company LLC dropped their target price on Klaviyo from $56.00 to $45.00 and set a "buy" rating on the stock in a report on Wednesday, May 7th. Barclays lifted their price objective on Klaviyo from $35.00 to $38.00 and gave the company an "overweight" rating in a report on Wednesday, May 7th. The Goldman Sachs Group lowered their price objective on shares of Klaviyo from $51.00 to $44.00 and set a "buy" rating on the stock in a research note on Wednesday, May 7th. Finally, Scotiabank set a $35.00 price objective on Klaviyo and gave the stock a "sector perform" rating in a report on Wednesday, May 7th. Eighteen investment analysts have rated the stock with a Buy rating, three have issued a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $43.65.

Read Our Latest Research Report on KVYO

Klaviyo Stock Performance

Shares of KVYO stock traded up $0.83 during midday trading on Friday, reaching $32.81. 1,142,308 shares of the company were exchanged, compared to its average volume of 1,905,399. The company's 50 day moving average price is $32.53 and its two-hundred day moving average price is $33.87. The company has a market cap of $9.84 billion, a P/E ratio of -131.28 and a beta of 1.36. Klaviyo, Inc. has a 12 month low of $23.77 and a 12 month high of $49.55.

Klaviyo (NYSE:KVYO - Get Free Report) last announced its earnings results on Tuesday, August 5th. The company reported $0.16 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.13 by $0.03. Klaviyo had a negative net margin of 6.19% and a negative return on equity of 1.12%. The company had revenue of $293.12 million for the quarter, compared to the consensus estimate of $275.97 million. During the same period in the previous year, the business earned $0.15 EPS. The company's revenue was up 31.9% on a year-over-year basis. Klaviyo has set its Q3 2025 guidance at EPS. FY 2025 guidance at EPS. As a group, sell-side analysts predict that Klaviyo, Inc. will post 0.04 earnings per share for the current year.

Klaviyo Company Profile

(

Free Report)

Klaviyo, Inc, a technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company offers Klaviyo, a cloud-native platform for data store, segmentation engine, campaigns and flows, and messaging infrastructure.

Recommended Stories

Before you consider Klaviyo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Klaviyo wasn't on the list.

While Klaviyo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.