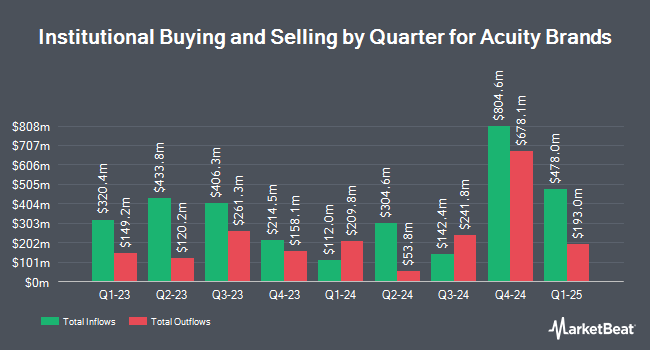

KLP Kapitalforvaltning AS raised its position in shares of Acuity, Inc. (NYSE:AYI - Free Report) by 4.0% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 26,200 shares of the electronics maker's stock after purchasing an additional 1,000 shares during the period. KLP Kapitalforvaltning AS owned 0.09% of Acuity worth $7,817,000 as of its most recent filing with the Securities and Exchange Commission.

Several other institutional investors and hedge funds have also bought and sold shares of AYI. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its holdings in Acuity by 103.0% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 312,904 shares of the electronics maker's stock valued at $82,403,000 after purchasing an additional 158,741 shares during the period. AQR Capital Management LLC grew its holdings in Acuity by 34.6% during the first quarter. AQR Capital Management LLC now owns 613,217 shares of the electronics maker's stock valued at $157,910,000 after purchasing an additional 157,790 shares during the period. T. Rowe Price Investment Management Inc. bought a new position in Acuity during the first quarter valued at $33,325,000. Alyeska Investment Group L.P. bought a new position in Acuity during the first quarter valued at $28,341,000. Finally, Nuveen LLC purchased a new stake in shares of Acuity during the first quarter worth $27,740,000. 98.21% of the stock is owned by institutional investors.

Acuity Trading Down 0.0%

Shares of AYI stock opened at $360.51 on Friday. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.33 and a current ratio of 1.95. Acuity, Inc. has a 52-week low of $216.81 and a 52-week high of $375.67. The company has a market capitalization of $11.05 billion, a PE ratio of 28.77, a price-to-earnings-growth ratio of 1.94 and a beta of 1.64. The business's fifty day moving average is $332.03 and its 200 day moving average is $290.76.

Acuity Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, November 3rd. Shareholders of record on Friday, October 17th will be given a dividend of $0.17 per share. The ex-dividend date is Friday, October 17th. This represents a $0.68 dividend on an annualized basis and a yield of 0.2%. Acuity's dividend payout ratio (DPR) is presently 5.43%.

Analyst Ratings Changes

Several equities research analysts have issued reports on AYI shares. Robert W. Baird increased their target price on Acuity from $335.00 to $360.00 and gave the stock a "neutral" rating in a research report on Thursday, September 25th. Cowen restated a "buy" rating on shares of Acuity in a research report on Thursday, October 2nd. Wells Fargo & Company increased their target price on Acuity from $380.00 to $405.00 and gave the stock an "overweight" rating in a research report on Thursday, October 2nd. Morgan Stanley increased their target price on Acuity from $365.00 to $425.00 and gave the stock an "overweight" rating in a research report on Thursday, October 2nd. Finally, Weiss Ratings restated a "buy (b-)" rating on shares of Acuity in a research report on Wednesday. One research analyst has rated the stock with a Strong Buy rating, seven have given a Buy rating and two have assigned a Hold rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $395.17.

View Our Latest Report on AYI

Acuity Company Profile

(

Free Report)

Acuity Brands, Inc provides lighting, lighting controls, building management system, location-aware applications in the United States and internationally. The company operates in two segments, Acuity Brands Lighting and Lighting Controls (ABL); and the Intelligent Spaces Group (ISG). The ABL segment provides commercial, architectural, and specialty lighting solutions, as well as lighting controls and components for various indoor and outdoor applications under the A-Light, Aculux, American Electric Lighting, Cyclone, Dark to Light, eldoLED, Eureka, Gotham, Healthcare Lighting, Holophane, Hydrel, Indy, IOTA, Juno, Lithonia Lighting, Luminaire LED, Luminis, Mark Architectural Lighting, nLight, OPTOTRONIC, Peerless, RELOCWiring Solutions, and Sensor Switch.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Acuity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acuity wasn't on the list.

While Acuity currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.