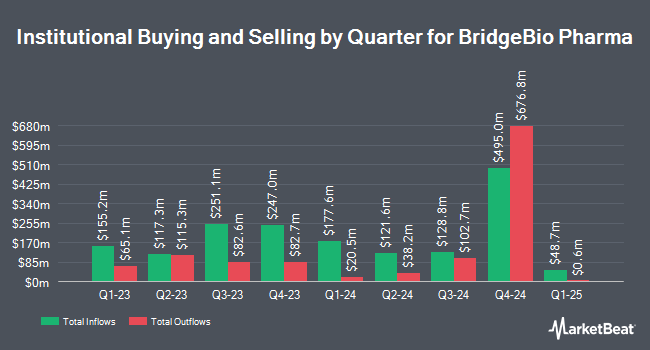

KLP Kapitalforvaltning AS boosted its position in shares of BridgeBio Pharma, Inc. (NASDAQ:BBIO - Free Report) by 20.1% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 28,035 shares of the company's stock after acquiring an additional 4,700 shares during the period. KLP Kapitalforvaltning AS's holdings in BridgeBio Pharma were worth $1,211,000 as of its most recent SEC filing.

Several other hedge funds have also bought and sold shares of BBIO. Driehaus Capital Management LLC bought a new stake in BridgeBio Pharma during the first quarter valued at approximately $51,874,000. Invesco Ltd. lifted its position in BridgeBio Pharma by 147.0% during the first quarter. Invesco Ltd. now owns 2,206,163 shares of the company's stock valued at $76,267,000 after purchasing an additional 1,313,036 shares during the last quarter. Duquesne Family Office LLC bought a new stake in BridgeBio Pharma during the first quarter valued at approximately $15,143,000. Nuveen LLC bought a new stake in BridgeBio Pharma during the first quarter valued at approximately $14,973,000. Finally, Cormorant Asset Management LP lifted its position in BridgeBio Pharma by 25.0% during the first quarter. Cormorant Asset Management LP now owns 2,000,000 shares of the company's stock valued at $69,140,000 after purchasing an additional 400,000 shares during the last quarter. 99.85% of the stock is currently owned by institutional investors.

BridgeBio Pharma Stock Up 1.0%

NASDAQ:BBIO opened at $56.50 on Wednesday. The company has a fifty day moving average of $51.40 and a 200 day moving average of $43.22. The firm has a market capitalization of $10.80 billion, a P/E ratio of -13.81 and a beta of 1.36. BridgeBio Pharma, Inc. has a 52 week low of $21.72 and a 52 week high of $57.47.

BridgeBio Pharma (NASDAQ:BBIO - Get Free Report) last released its earnings results on Tuesday, August 5th. The company reported ($0.95) earnings per share for the quarter, missing analysts' consensus estimates of ($0.83) by ($0.12). The firm had revenue of $110.57 million for the quarter, compared to analysts' expectations of $98.46 million. BridgeBio Pharma's revenue for the quarter was up 4999.9% on a year-over-year basis. During the same quarter in the previous year, the company earned ($0.39) earnings per share. As a group, analysts anticipate that BridgeBio Pharma, Inc. will post -3.67 EPS for the current year.

Analyst Ratings Changes

Several equities research analysts have issued reports on BBIO shares. Weiss Ratings reiterated a "sell (d-)" rating on shares of BridgeBio Pharma in a research report on Wednesday, October 8th. Jefferies Financial Group started coverage on shares of BridgeBio Pharma in a research report on Monday, July 14th. They set a "buy" rating and a $70.00 target price for the company. Truist Financial initiated coverage on shares of BridgeBio Pharma in a research report on Monday, July 21st. They set a "buy" rating and a $66.00 target price for the company. HC Wainwright restated a "buy" rating and issued a $70.00 price objective on shares of BridgeBio Pharma in a report on Monday, September 15th. Finally, JPMorgan Chase & Co. boosted their price objective on shares of BridgeBio Pharma from $55.00 to $70.00 and gave the stock an "overweight" rating in a report on Wednesday, September 3rd. Seventeen analysts have rated the stock with a Buy rating and one has assigned a Sell rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $63.94.

View Our Latest Research Report on BridgeBio Pharma

Insider Activity at BridgeBio Pharma

In other BridgeBio Pharma news, CFO Thomas Trimarchi sold 42,237 shares of the company's stock in a transaction dated Thursday, August 21st. The shares were sold at an average price of $49.48, for a total transaction of $2,089,886.76. Following the transaction, the chief financial officer owned 421,081 shares in the company, valued at approximately $20,835,087.88. This represents a 9.12% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Neil Kumar sold 40,000 shares of the company's stock in a transaction dated Wednesday, October 8th. The shares were sold at an average price of $54.78, for a total transaction of $2,191,200.00. Following the transaction, the chief executive officer owned 855,686 shares in the company, valued at $46,874,479.08. This represents a 4.47% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 597,913 shares of company stock worth $29,034,227 in the last ninety days. 18.20% of the stock is currently owned by company insiders.

BridgeBio Pharma Profile

(

Free Report)

BridgeBio Pharma, Inc, a commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers. Its products in development programs include AG10, a next-generation oral small molecule near-complete TTR stabilizer that is in Phase 3 clinical trial for the treatment of TTR amyloidosis, or transthyretin amyloid cardiomyopathy (ATTR-CM); low-dose infigratinib, an oral FGFR1-3 selective tyrosine kinase inhibitor, which is in Phase 3 double-blinded, placebo-controlled pivotal study for the treatment option for children with achondroplasia; and BBP-631, an AAV5 gene transfer product candidate that is in Phase 1/2 clinical trial for the treatment of congenital adrenal hyperplasia, or CAH, driven by 21-hydroxylase deficiency, or 21OHD.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BridgeBio Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BridgeBio Pharma wasn't on the list.

While BridgeBio Pharma currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report