Knights of Columbus Asset Advisors LLC raised its position in shares of Quest Diagnostics Incorporated (NYSE:DGX - Free Report) by 4.4% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 46,394 shares of the medical research company's stock after purchasing an additional 1,945 shares during the quarter. Knights of Columbus Asset Advisors LLC's holdings in Quest Diagnostics were worth $7,850,000 as of its most recent SEC filing.

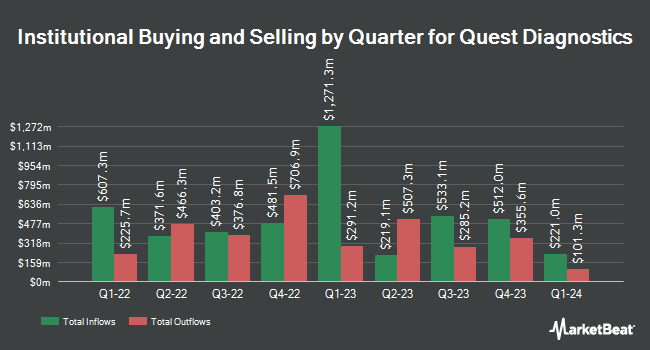

Other large investors have also added to or reduced their stakes in the company. Price T Rowe Associates Inc. MD lifted its holdings in shares of Quest Diagnostics by 42.5% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 5,490,278 shares of the medical research company's stock worth $828,265,000 after buying an additional 1,637,525 shares in the last quarter. Geode Capital Management LLC lifted its holdings in shares of Quest Diagnostics by 2.8% in the fourth quarter. Geode Capital Management LLC now owns 2,690,021 shares of the medical research company's stock worth $404,764,000 after buying an additional 73,368 shares in the last quarter. JPMorgan Chase & Co. lifted its holdings in shares of Quest Diagnostics by 60.4% in the fourth quarter. JPMorgan Chase & Co. now owns 2,433,913 shares of the medical research company's stock worth $367,180,000 after buying an additional 916,898 shares in the last quarter. Grantham Mayo Van Otterloo & Co. LLC lifted its holdings in shares of Quest Diagnostics by 1.2% in the fourth quarter. Grantham Mayo Van Otterloo & Co. LLC now owns 2,268,990 shares of the medical research company's stock worth $342,300,000 after buying an additional 26,214 shares in the last quarter. Finally, Norges Bank purchased a new position in shares of Quest Diagnostics in the fourth quarter worth $191,823,000. Hedge funds and other institutional investors own 88.06% of the company's stock.

Quest Diagnostics Price Performance

DGX stock traded down $0.71 during trading on Monday, hitting $167.84. The stock had a trading volume of 1,086,582 shares, compared to its average volume of 1,203,872. The company's 50 day moving average price is $174.51 and its two-hundred day moving average price is $169.83. Quest Diagnostics Incorporated has a 1-year low of $140.71 and a 1-year high of $182.38. The stock has a market cap of $18.77 billion, a price-to-earnings ratio of 20.10, a price-to-earnings-growth ratio of 2.24 and a beta of 0.49. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.99 and a current ratio of 1.09.

Quest Diagnostics (NYSE:DGX - Get Free Report) last issued its quarterly earnings results on Tuesday, July 22nd. The medical research company reported $2.62 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.57 by $0.05. The firm had revenue of $2.76 billion for the quarter, compared to analyst estimates of $2.73 billion. Quest Diagnostics had a return on equity of 15.24% and a net margin of 9.01%. The firm's quarterly revenue was up 15.2% on a year-over-year basis. During the same period last year, the company earned $2.35 EPS. On average, sell-side analysts forecast that Quest Diagnostics Incorporated will post 9.7 EPS for the current fiscal year.

Quest Diagnostics Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Monday, July 21st. Shareholders of record on Monday, July 7th were issued a dividend of $0.80 per share. The ex-dividend date was Monday, July 7th. This represents a $3.20 annualized dividend and a yield of 1.91%. Quest Diagnostics's dividend payout ratio is presently 38.32%.

Insider Transactions at Quest Diagnostics

In other news, SVP Mark E. Delaney sold 874 shares of the business's stock in a transaction that occurred on Monday, May 12th. The stock was sold at an average price of $175.72, for a total value of $153,579.28. Following the completion of the sale, the senior vice president directly owned 8,372 shares in the company, valued at approximately $1,471,127.84. The trade was a 9.45% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 8.16% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on the stock. Piper Sandler boosted their target price on shares of Quest Diagnostics from $180.00 to $200.00 and gave the stock a "neutral" rating in a report on Monday, April 28th. William Blair restated an "outperform" rating on shares of Quest Diagnostics in a research report on Wednesday, July 23rd. JPMorgan Chase & Co. boosted their price target on shares of Quest Diagnostics from $180.00 to $190.00 and gave the stock a "neutral" rating in a research report on Tuesday, May 6th. Wall Street Zen cut shares of Quest Diagnostics from a "buy" rating to a "hold" rating in a research report on Saturday, June 7th. Finally, Mizuho boosted their price target on shares of Quest Diagnostics from $178.00 to $189.00 and gave the stock an "outperform" rating in a research report on Wednesday, April 9th. Nine research analysts have rated the stock with a hold rating, eight have issued a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $186.00.

Get Our Latest Stock Report on Quest Diagnostics

Quest Diagnostics Profile

(

Free Report)

Quest Diagnostics Incorporated provides diagnostic testing and services in the United States and internationally. The company develops and delivers diagnostic information services, such as routine, non-routine and advanced clinical testing, anatomic pathology testing, and other diagnostic information services.

Recommended Stories

Before you consider Quest Diagnostics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quest Diagnostics wasn't on the list.

While Quest Diagnostics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.