Korea Investment CORP boosted its position in shares of Open Text Corporation (NASDAQ:OTEX - Free Report) TSE: OTC by 107.7% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 188,444 shares of the software maker's stock after purchasing an additional 97,700 shares during the period. Korea Investment CORP owned about 0.07% of Open Text worth $4,755,000 as of its most recent SEC filing.

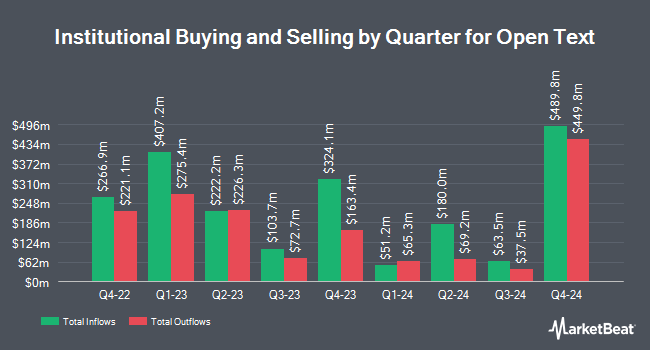

Several other hedge funds also recently added to or reduced their stakes in the company. JARISLOWSKY FRASER Ltd grew its holdings in Open Text by 11.8% during the 4th quarter. JARISLOWSKY FRASER Ltd now owns 18,547,256 shares of the software maker's stock valued at $522,879,000 after purchasing an additional 1,957,695 shares during the last quarter. Vanguard Group Inc. grew its holdings in Open Text by 6.1% during the 1st quarter. Vanguard Group Inc. now owns 11,151,279 shares of the software maker's stock valued at $281,447,000 after purchasing an additional 639,514 shares during the last quarter. Mackenzie Financial Corp grew its holdings in Open Text by 9.2% during the 1st quarter. Mackenzie Financial Corp now owns 5,876,003 shares of the software maker's stock valued at $148,299,000 after purchasing an additional 492,897 shares during the last quarter. Turtle Creek Asset Management Inc. grew its holdings in Open Text by 2.1% during the 4th quarter. Turtle Creek Asset Management Inc. now owns 5,366,703 shares of the software maker's stock valued at $151,985,000 after purchasing an additional 109,550 shares during the last quarter. Finally, Letko Brosseau & Associates Inc. grew its holdings in Open Text by 11.8% during the 1st quarter. Letko Brosseau & Associates Inc. now owns 4,860,805 shares of the software maker's stock valued at $122,664,000 after purchasing an additional 512,050 shares during the last quarter. 70.37% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several brokerages recently commented on OTEX. Scotiabank upped their price target on shares of Open Text from $30.00 to $35.00 and gave the company a "sector perform" rating in a report on Tuesday, August 12th. Jefferies Financial Group downgraded shares of Open Text from a "buy" rating to a "hold" rating and set a $33.00 target price on the stock. in a research note on Tuesday, August 12th. CIBC restated a "neutral" rating on shares of Open Text in a research note on Monday, August 11th. Barclays restated a "positive" rating on shares of Open Text in a research note on Friday, August 8th. Finally, UBS Group dropped their target price on shares of Open Text from $32.00 to $28.00 and set a "neutral" rating on the stock in a research note on Friday, May 2nd. Two analysts have rated the stock with a Buy rating, seven have issued a Hold rating and one has assigned a Sell rating to the company's stock. According to MarketBeat.com, Open Text currently has a consensus rating of "Hold" and an average target price of $32.60.

Check Out Our Latest Research Report on OTEX

Open Text Stock Up 0.3%

Shares of NASDAQ OTEX traded up $0.09 during midday trading on Thursday, reaching $33.09. 338,898 shares of the company's stock traded hands, compared to its average volume of 1,276,188. Open Text Corporation has a one year low of $22.79 and a one year high of $34.20. The stock's 50 day simple moving average is $29.78 and its 200-day simple moving average is $27.83. The company has a quick ratio of 0.80, a current ratio of 0.80 and a debt-to-equity ratio of 1.61. The company has a market cap of $8.42 billion, a price-to-earnings ratio of 20.02 and a beta of 1.12.

Open Text (NASDAQ:OTEX - Get Free Report) TSE: OTC last posted its earnings results on Thursday, August 7th. The software maker reported $0.97 EPS for the quarter, beating analysts' consensus estimates of $0.86 by $0.11. Open Text had a net margin of 8.43% and a return on equity of 22.52%. The company had revenue of $1.32 billion during the quarter, compared to analysts' expectations of $1.30 billion. During the same quarter in the prior year, the company posted $0.98 earnings per share. Open Text's revenue for the quarter was down 3.8% compared to the same quarter last year. On average, analysts predict that Open Text Corporation will post 3.45 EPS for the current fiscal year.

Open Text Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, September 19th. Investors of record on Friday, September 5th will be given a dividend of $0.275 per share. The ex-dividend date of this dividend is Friday, September 5th. This is a positive change from Open Text's previous quarterly dividend of $0.26. This represents a $1.10 dividend on an annualized basis and a yield of 3.3%. Open Text's dividend payout ratio is currently 63.64%.

Open Text Profile

(

Free Report)

Open Text Corporation provides information management software and solutions. The company offers content services, which includes content collaboration and intelligent capture to records management, collaboration, e-signatures, and archiving; and operates experience cloud platform that provides customer experience and web content management, digital asset management, customer analytics, AI and insights, e-discovery, digital fax, omnichannel communications, secure messaging, and voice of customer, as well as customer journey, testing, and segmentation.

Recommended Stories

Before you consider Open Text, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Open Text wasn't on the list.

While Open Text currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.