Koss Olinger Consulting LLC purchased a new stake in HCI Group, Inc. (NYSE:HCI - Free Report) in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 5,341 shares of the insurance provider's stock, valued at approximately $797,000.

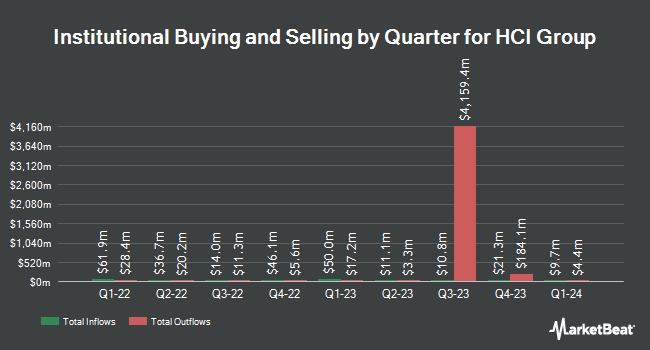

A number of other large investors have also made changes to their positions in HCI. Hood River Capital Management LLC lifted its holdings in HCI Group by 15.7% in the fourth quarter. Hood River Capital Management LLC now owns 940,000 shares of the insurance provider's stock valued at $109,538,000 after acquiring an additional 127,332 shares during the last quarter. Khrom Capital Management LLC lifted its stake in HCI Group by 20.7% during the fourth quarter. Khrom Capital Management LLC now owns 796,170 shares of the insurance provider's stock worth $92,778,000 after purchasing an additional 136,642 shares in the last quarter. Wasatch Advisors LP lifted its stake in HCI Group by 288.9% during the fourth quarter. Wasatch Advisors LP now owns 294,349 shares of the insurance provider's stock worth $34,300,000 after purchasing an additional 218,664 shares in the last quarter. Geode Capital Management LLC lifted its stake in HCI Group by 3.5% during the fourth quarter. Geode Capital Management LLC now owns 227,567 shares of the insurance provider's stock worth $26,524,000 after purchasing an additional 7,746 shares in the last quarter. Finally, Wellington Management Group LLP lifted its stake in HCI Group by 5.5% during the fourth quarter. Wellington Management Group LLP now owns 154,839 shares of the insurance provider's stock worth $18,043,000 after purchasing an additional 8,101 shares in the last quarter. 86.99% of the stock is currently owned by hedge funds and other institutional investors.

HCI Group Stock Performance

Shares of HCI traded up $0.68 during mid-day trading on Thursday, hitting $157.75. 95,955 shares of the company's stock were exchanged, compared to its average volume of 147,275. HCI Group, Inc. has a fifty-two week low of $90.01 and a fifty-two week high of $176.40. The firm has a market capitalization of $2.04 billion, a P/E ratio of 13.99 and a beta of 1.24. The business's 50 day moving average is $146.70 and its two-hundred day moving average is $143.57. The company has a current ratio of 0.71, a quick ratio of 0.56 and a debt-to-equity ratio of 0.02.

HCI Group (NYSE:HCI - Get Free Report) last announced its earnings results on Thursday, August 7th. The insurance provider reported $5.18 earnings per share for the quarter, topping the consensus estimate of $4.47 by $0.71. HCI Group had a net margin of 18.58% and a return on equity of 25.84%. The business had revenue of $221.92 million during the quarter, compared to the consensus estimate of $218.98 million. On average, equities analysts expect that HCI Group, Inc. will post 6.78 earnings per share for the current year.

HCI Group Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 19th. Investors of record on Friday, August 15th will be given a $0.40 dividend. The ex-dividend date is Friday, August 15th. This represents a $1.60 dividend on an annualized basis and a yield of 1.0%. HCI Group's dividend payout ratio (DPR) is presently 14.18%.

Analysts Set New Price Targets

A number of research firms have commented on HCI. Wall Street Zen upgraded HCI Group from a "buy" rating to a "strong-buy" rating in a research note on Saturday, August 9th. JMP Securities increased their target price on HCI Group from $210.00 to $225.00 and gave the company a "market outperform" rating in a report on Monday, May 19th. Finally, Compass Point raised HCI Group from a "neutral" rating to a "buy" rating and raised their price objective for the stock from $148.00 to $205.00 in a report on Friday, May 30th. Four research analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, HCI Group currently has an average rating of "Buy" and an average price target of $181.25.

View Our Latest Stock Analysis on HCI

HCI Group Profile

(

Free Report)

HCI Group, Inc, together with its subsidiaries, engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in Florida. It provides residential insurance products, such as homeowners, fire, flood, and wind-only insurance to homeowners, condominium owners, and tenants for properties, as well as offers reinsurance programs.

Featured Articles

Before you consider HCI Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCI Group wasn't on the list.

While HCI Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.