L & S Advisors Inc cut its position in Parker-Hannifin Corporation (NYSE:PH - Free Report) by 25.2% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 11,650 shares of the industrial products company's stock after selling 3,919 shares during the quarter. Parker-Hannifin makes up about 0.9% of L & S Advisors Inc's holdings, making the stock its 29th biggest position. L & S Advisors Inc's holdings in Parker-Hannifin were worth $7,081,000 at the end of the most recent reporting period.

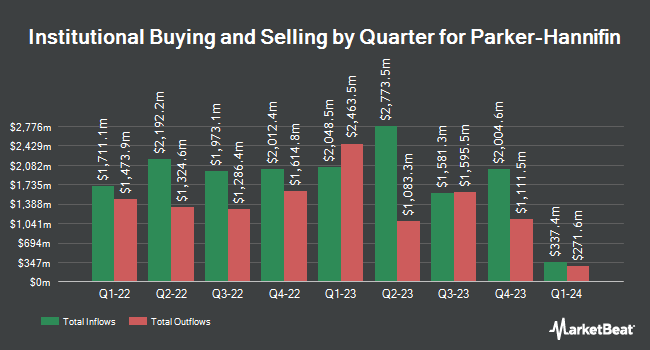

A number of other institutional investors and hedge funds have also recently bought and sold shares of the company. Invesco Ltd. grew its holdings in shares of Parker-Hannifin by 8.6% in the 4th quarter. Invesco Ltd. now owns 2,502,728 shares of the industrial products company's stock worth $1,591,810,000 after purchasing an additional 198,292 shares during the last quarter. Royal Bank of Canada raised its position in shares of Parker-Hannifin by 99.8% in the 4th quarter. Royal Bank of Canada now owns 2,277,001 shares of the industrial products company's stock valued at $1,448,241,000 after acquiring an additional 1,137,564 shares during the period. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main increased its position in shares of Parker-Hannifin by 9.3% in the 4th quarter. DZ BANK AG Deutsche Zentral Genossenschafts Bank Frankfurt am Main now owns 2,016,091 shares of the industrial products company's stock valued at $1,282,294,000 after buying an additional 172,064 shares in the last quarter. GAMMA Investing LLC lifted its holdings in shares of Parker-Hannifin by 66,111.8% during the 1st quarter. GAMMA Investing LLC now owns 1,735,412 shares of the industrial products company's stock valued at $1,054,870,000 after purchasing an additional 1,732,791 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD boosted its holdings in shares of Parker-Hannifin by 17.4% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 1,600,842 shares of the industrial products company's stock valued at $1,018,185,000 after buying an additional 237,634 shares during the last quarter. Institutional investors and hedge funds own 82.44% of the company's stock.

Parker-Hannifin Stock Performance

NYSE:PH traded up $26.46 during mid-day trading on Thursday, hitting $723.59. 457,431 shares of the company traded hands, compared to its average volume of 752,440. The company has a quick ratio of 0.70, a current ratio of 1.21 and a debt-to-equity ratio of 0.55. The stock's fifty day moving average price is $695.14 and its 200-day moving average price is $655.75. The firm has a market cap of $92.46 billion, a price-to-earnings ratio of 27.86, a price-to-earnings-growth ratio of 3.05 and a beta of 1.37. Parker-Hannifin Corporation has a one year low of $488.45 and a one year high of $745.34.

Parker-Hannifin (NYSE:PH - Get Free Report) last issued its earnings results on Thursday, August 7th. The industrial products company reported $7.69 earnings per share for the quarter, topping the consensus estimate of $7.08 by $0.61. Parker-Hannifin had a net margin of 17.14% and a return on equity of 26.80%. Parker-Hannifin's revenue was up 1.1% on a year-over-year basis. During the same period in the prior year, the company posted $6.77 earnings per share. Research analysts anticipate that Parker-Hannifin Corporation will post 26.71 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of brokerages recently commented on PH. Barclays upped their price target on shares of Parker-Hannifin from $700.00 to $750.00 and gave the company an "overweight" rating in a research note on Wednesday, July 9th. Argus set a $680.00 price target on shares of Parker-Hannifin in a research report on Tuesday, May 6th. Wells Fargo & Company raised their price objective on Parker-Hannifin from $670.00 to $770.00 and gave the stock an "overweight" rating in a research note on Tuesday, July 1st. Stifel Nicolaus upped their target price on Parker-Hannifin from $709.00 to $717.00 and gave the company a "hold" rating in a research report on Monday, July 21st. Finally, Morgan Stanley raised their price target on Parker-Hannifin from $700.00 to $725.00 and gave the stock an "equal weight" rating in a research report on Wednesday, July 9th. Five research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $739.59.

Read Our Latest Stock Analysis on Parker-Hannifin

About Parker-Hannifin

(

Free Report)

Parker-Hannifin Corporation manufactures and sells motion and control technologies and systems for various mobile, industrial, and aerospace markets worldwide. The company operates through two segments: Diversified Industrial and Aerospace Systems. The Diversified Industrial segment offers sealing, shielding, thermal products and systems, adhesives, coatings, and noise vibration and harshness solutions; filters, systems, and diagnostics solutions to ensure purity and remove contaminants from fuel, air, oil, water, and other liquids and gases; connectors used in fluid and gas handling; and hydraulic, pneumatic, and electromechanical components and systems for builders and users of mobile and industrial machinery and equipment.

Featured Stories

Before you consider Parker-Hannifin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parker-Hannifin wasn't on the list.

While Parker-Hannifin currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.