L & S Advisors Inc acquired a new stake in Rolls-Royce Holdings PLC (OTCMKTS:RYCEY - Free Report) in the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor acquired 247,367 shares of the aerospace company's stock, valued at approximately $2,427,000.

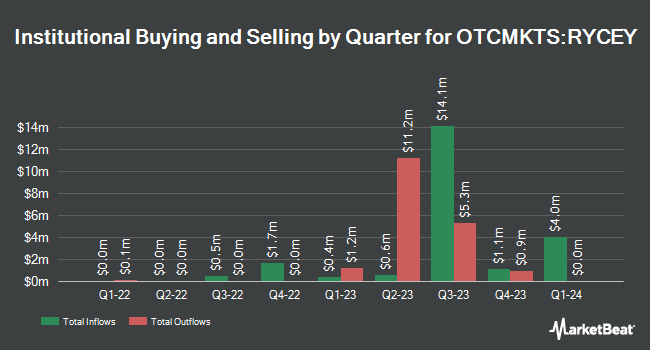

Several other institutional investors also recently modified their holdings of RYCEY. First Horizon Advisors Inc. raised its stake in shares of Rolls-Royce Holdings PLC by 31.8% during the 1st quarter. First Horizon Advisors Inc. now owns 8,526 shares of the aerospace company's stock valued at $84,000 after purchasing an additional 2,055 shares during the period. Financial Avengers Inc. lifted its holdings in Rolls-Royce Holdings PLC by 32.6% in the fourth quarter. Financial Avengers Inc. now owns 28,500 shares of the aerospace company's stock worth $203,000 after buying an additional 7,000 shares during the period. Finally, GAMMA Investing LLC grew its holdings in Rolls-Royce Holdings PLC by 14.7% in the first quarter. GAMMA Investing LLC now owns 29,344 shares of the aerospace company's stock worth $288,000 after purchasing an additional 3,771 shares during the period. 0.07% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Kepler Capital Markets lowered Rolls-Royce Holdings PLC from a "strong-buy" rating to a "hold" rating in a report on Thursday, June 26th.

Read Our Latest Stock Analysis on RYCEY

Rolls-Royce Holdings PLC Stock Down 0.4%

Shares of RYCEY traded down $0.06 during mid-day trading on Thursday, hitting $14.64. 690,054 shares of the company's stock were exchanged, compared to its average volume of 3,701,249. The stock's 50-day moving average is $12.98 and its 200-day moving average is $10.66. Rolls-Royce Holdings PLC has a fifty-two week low of $5.97 and a fifty-two week high of $14.73.

Rolls-Royce Holdings PLC Cuts Dividend

The company also recently disclosed a dividend, which will be paid on Thursday, September 25th. Investors of record on Tuesday, August 12th will be paid a $0.0596 dividend. This represents a yield of 97.0%. The ex-dividend date of this dividend is Monday, August 11th.

Rolls-Royce Holdings PLC Profile

(

Free Report)

Rolls-Royce Holdings plc develops and delivers complex power and propulsion solutions for air, sea, and land in the United Kingdom and internationally. The company operates through four segments: Civil Aerospace, Defence, Power Systems, and New Markets. The Civil Aerospace segment develops, manufactures, markets, and sells aero engines for large commercial aircraft, regional jet, and business aviation markets, as well as provides aftermarket services.

Featured Articles

Before you consider Rolls-Royce Holdings PLC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rolls-Royce Holdings PLC wasn't on the list.

While Rolls-Royce Holdings PLC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.