Lansforsakringar Fondforvaltning AB publ decreased its stake in Fiserv, Inc. (NYSE:FI - Free Report) by 3.3% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 186,873 shares of the business services provider's stock after selling 6,287 shares during the period. Lansforsakringar Fondforvaltning AB publ's holdings in Fiserv were worth $41,267,000 at the end of the most recent quarter.

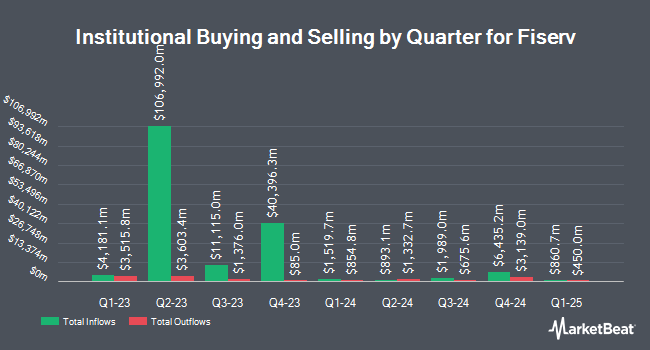

Several other hedge funds also recently modified their holdings of FI. Okabena Investment Services Inc. grew its holdings in Fiserv by 200.0% during the first quarter. Okabena Investment Services Inc. now owns 6,000 shares of the business services provider's stock worth $1,325,000 after purchasing an additional 4,000 shares during the period. Redwood Investment Management LLC bought a new position in Fiserv during the first quarter worth about $1,320,000. FORA Capital LLC bought a new position in Fiserv during the first quarter worth about $6,899,000. Caisse DE Depot ET Placement DU Quebec grew its holdings in Fiserv by 31.9% during the first quarter. Caisse DE Depot ET Placement DU Quebec now owns 301,530 shares of the business services provider's stock worth $66,587,000 after purchasing an additional 72,842 shares during the period. Finally, Northwestern Mutual Wealth Management Co. grew its holdings in Fiserv by 1.5% during the first quarter. Northwestern Mutual Wealth Management Co. now owns 282,329 shares of the business services provider's stock worth $62,347,000 after purchasing an additional 4,070 shares during the period. Institutional investors own 90.98% of the company's stock.

Fiserv Stock Performance

FI stock traded down $2.77 during mid-day trading on Tuesday, hitting $135.41. 1,843,823 shares of the company were exchanged, compared to its average volume of 4,430,292. The business has a 50 day simple moving average of $151.06 and a 200-day simple moving average of $180.49. The company has a current ratio of 1.09, a quick ratio of 1.09 and a debt-to-equity ratio of 1.09. The stock has a market capitalization of $73.61 billion, a PE ratio of 22.60, a price-to-earnings-growth ratio of 0.90 and a beta of 0.94. Fiserv, Inc. has a 1-year low of $128.22 and a 1-year high of $238.59.

Fiserv (NYSE:FI - Get Free Report) last issued its quarterly earnings data on Wednesday, July 23rd. The business services provider reported $2.47 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.43 by $0.04. Fiserv had a net margin of 16.00% and a return on equity of 19.69%. The firm had revenue of $5.20 billion during the quarter, compared to the consensus estimate of $5.20 billion. During the same period last year, the business posted $2.13 earnings per share. The business's revenue for the quarter was up 8.0% compared to the same quarter last year. Fiserv has set its FY 2025 guidance at 10.150-10.30 EPS. On average, equities analysts forecast that Fiserv, Inc. will post 10.23 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of equities analysts recently commented on FI shares. Monness Crespi & Hardt upgraded Fiserv from a "sell" rating to a "neutral" rating in a report on Monday, July 21st. Wall Street Zen upgraded Fiserv from a "hold" rating to a "buy" rating in a report on Saturday, August 23rd. UBS Group reduced their price target on Fiserv from $225.00 to $170.00 and set a "buy" rating for the company in a report on Friday, July 25th. Tigress Financial raised their price objective on shares of Fiserv from $244.00 to $250.00 and gave the stock a "buy" rating in a research report on Thursday, May 29th. Finally, Jefferies Financial Group cut their price objective on shares of Fiserv from $180.00 to $165.00 and set a "hold" rating for the company in a research report on Tuesday, May 27th. One equities research analyst has rated the stock with a Strong Buy rating, twenty-one have issued a Buy rating, two have issued a Hold rating and one has issued a Sell rating to the stock. According to MarketBeat, Fiserv has a consensus rating of "Moderate Buy" and an average price target of $207.36.

View Our Latest Stock Analysis on Fiserv

Fiserv Profile

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Recommended Stories

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.