Deutsche Bank AG reduced its stake in Lear Corporation (NYSE:LEA - Free Report) by 25.1% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 28,117 shares of the auto parts company's stock after selling 9,423 shares during the quarter. Deutsche Bank AG owned 0.05% of Lear worth $2,480,000 as of its most recent SEC filing.

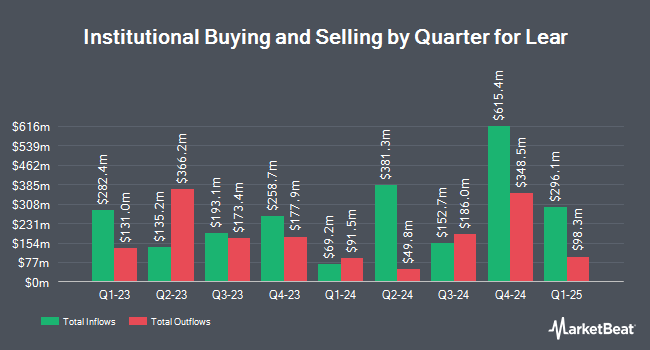

A number of other large investors have also recently added to or reduced their stakes in the company. Putney Financial Group LLC bought a new stake in shares of Lear in the fourth quarter valued at about $58,000. Fifth Third Bancorp raised its position in Lear by 131.8% in the 1st quarter. Fifth Third Bancorp now owns 765 shares of the auto parts company's stock valued at $67,000 after buying an additional 435 shares during the last quarter. CX Institutional acquired a new position in Lear during the 1st quarter worth approximately $71,000. GAMMA Investing LLC boosted its position in Lear by 57.9% during the 1st quarter. GAMMA Investing LLC now owns 938 shares of the auto parts company's stock worth $83,000 after acquiring an additional 344 shares during the last quarter. Finally, TD Waterhouse Canada Inc. grew its stake in shares of Lear by 46.6% during the 4th quarter. TD Waterhouse Canada Inc. now owns 966 shares of the auto parts company's stock worth $91,000 after acquiring an additional 307 shares in the last quarter. Institutional investors own 97.04% of the company's stock.

Insider Activity at Lear

In other Lear news, CEO Raymond E. Scott sold 5,000 shares of the firm's stock in a transaction on Tuesday, July 29th. The stock was sold at an average price of $96.77, for a total transaction of $483,850.00. Following the completion of the sale, the chief executive officer owned 38,729 shares of the company's stock, valued at $3,747,805.33. This trade represents a 11.43% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director Conrad L. Mallett, Jr. sold 1,187 shares of Lear stock in a transaction on Monday, June 16th. The stock was sold at an average price of $92.86, for a total transaction of $110,224.82. Following the transaction, the director directly owned 84 shares of the company's stock, valued at approximately $7,800.24. This trade represents a 93.39% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 11,187 shares of company stock worth $1,086,425. Company insiders own 0.91% of the company's stock.

Analysts Set New Price Targets

Several research analysts recently commented on the stock. The Goldman Sachs Group set a $88.00 target price on shares of Lear and gave the stock a "neutral" rating in a report on Tuesday, May 6th. Barclays boosted their price target on shares of Lear from $100.00 to $120.00 and gave the stock an "equal weight" rating in a research report on Wednesday, July 16th. UBS Group decreased their price objective on Lear from $116.00 to $109.00 and set a "neutral" rating for the company in a report on Monday, July 28th. Citigroup lifted their target price on Lear from $123.00 to $136.00 and gave the company a "buy" rating in a research report on Monday, June 30th. Finally, JPMorgan Chase & Co. upped their target price on Lear from $119.00 to $120.00 and gave the stock an "overweight" rating in a report on Friday, May 9th. Four equities research analysts have rated the stock with a Buy rating and nine have issued a Hold rating to the company's stock. Based on data from MarketBeat, Lear currently has a consensus rating of "Hold" and an average price target of $113.00.

Get Our Latest Stock Report on LEA

Lear Stock Performance

Shares of Lear stock traded up $5.3570 during trading on Friday, hitting $108.4470. 543,863 shares of the stock were exchanged, compared to its average volume of 627,211. The company has a current ratio of 1.34, a quick ratio of 1.07 and a debt-to-equity ratio of 0.53. The company has a fifty day moving average price of $99.83 and a 200-day moving average price of $93.52. The stock has a market capitalization of $5.77 billion, a price-to-earnings ratio of 12.65, a price-to-earnings-growth ratio of 0.63 and a beta of 1.30. Lear Corporation has a 1-year low of $73.85 and a 1-year high of $119.10.

Lear (NYSE:LEA - Get Free Report) last posted its quarterly earnings results on Friday, July 25th. The auto parts company reported $3.47 EPS for the quarter, topping analysts' consensus estimates of $3.23 by $0.24. The business had revenue of $6.03 billion during the quarter, compared to analysts' expectations of $5.89 billion. Lear had a return on equity of 13.94% and a net margin of 2.05%.Lear's quarterly revenue was up .3% on a year-over-year basis. During the same quarter last year, the company posted $3.60 earnings per share. Lear has set its FY 2025 guidance at EPS. As a group, equities analysts predict that Lear Corporation will post 12.89 EPS for the current fiscal year.

Lear Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, September 23rd. Investors of record on Wednesday, September 3rd will be paid a $0.77 dividend. This represents a $3.08 dividend on an annualized basis and a yield of 2.8%. The ex-dividend date is Wednesday, September 3rd. Lear's dividend payout ratio is 35.94%.

Lear Profile

(

Free Report)

Lear Corporation designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America. Its Seating segment offers seat systems, seat subsystems, keyseat components, seat trim covers, seat mechanisms, seat foams, and headrests, as well as surface materials, such as leather and fabric for automobiles and light trucks, compact cars, pick-up trucks, and sport utility vehicles.

Read More

Before you consider Lear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lear wasn't on the list.

While Lear currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report