Lecap Asset Management Ltd. acquired a new stake in MongoDB, Inc. (NASDAQ:MDB - Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 9,376 shares of the company's stock, valued at approximately $1,969,000. MongoDB comprises approximately 0.7% of Lecap Asset Management Ltd.'s investment portfolio, making the stock its 29th biggest holding.

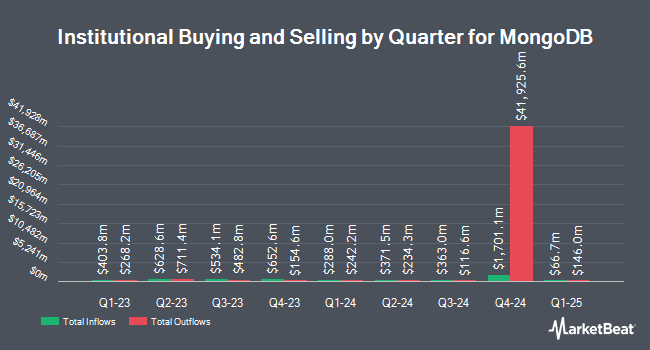

Several other institutional investors and hedge funds have also recently modified their holdings of the company. Two Sigma Investments LP acquired a new stake in MongoDB during the fourth quarter worth about $768,000. Versant Capital Management Inc increased its position in MongoDB by 237.2% during the first quarter. Versant Capital Management Inc now owns 607 shares of the company's stock worth $106,000 after purchasing an additional 427 shares during the last quarter. GAMMA Investing LLC increased its position in MongoDB by 19,491.2% during the first quarter. GAMMA Investing LLC now owns 33,501 shares of the company's stock worth $5,876,000 after purchasing an additional 33,330 shares during the last quarter. Rhumbline Advisers increased its position in MongoDB by 0.4% during the first quarter. Rhumbline Advisers now owns 97,481 shares of the company's stock worth $17,098,000 after purchasing an additional 343 shares during the last quarter. Finally, Fulton Bank N.A. increased its position in MongoDB by 10.9% during the first quarter. Fulton Bank N.A. now owns 1,356 shares of the company's stock worth $238,000 after purchasing an additional 133 shares during the last quarter. Institutional investors and hedge funds own 89.29% of the company's stock.

MongoDB Price Performance

NASDAQ MDB opened at $321.53 on Thursday. The stock has a 50-day moving average of $273.70 and a two-hundred day moving average of $218.70. The company has a market cap of $26.16 billion, a P/E ratio of -328.09 and a beta of 1.50. MongoDB, Inc. has a 1-year low of $140.78 and a 1-year high of $370.00.

Insiders Place Their Bets

In related news, CAO Thomas Bull sold 1,000 shares of the business's stock in a transaction that occurred on Monday, September 8th. The stock was sold at an average price of $326.25, for a total transaction of $326,250.00. Following the completion of the sale, the chief accounting officer owned 11,598 shares in the company, valued at $3,783,847.50. The trade was a 7.94% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Hope F. Cochran sold 1,174 shares of the business's stock in a transaction that occurred on Wednesday, September 17th. The stock was sold at an average price of $327.93, for a total value of $384,989.82. Following the sale, the director owned 24,308 shares of the company's stock, valued at approximately $7,971,322.44. The trade was a 4.61% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 106,163 shares of company stock worth $31,862,322. Corporate insiders own 3.10% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on MDB. BMO Capital Markets raised their price objective on shares of MongoDB from $315.00 to $365.00 and gave the stock an "outperform" rating in a research report on Thursday, September 18th. Rosenblatt Securities reissued a "buy" rating and set a $290.00 price objective on shares of MongoDB in a research report on Friday, August 22nd. William Blair reissued an "outperform" rating on shares of MongoDB in a research report on Thursday, June 26th. Piper Sandler raised their price objective on MongoDB from $345.00 to $400.00 and gave the stock an "overweight" rating in a research report on Thursday, September 18th. Finally, Royal Bank Of Canada reissued an "outperform" rating and set a $350.00 price objective on shares of MongoDB in a research report on Thursday, September 18th. One analyst has rated the stock with a Strong Buy rating, twenty-eight have given a Buy rating and nine have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $342.69.

Check Out Our Latest Stock Report on MongoDB

MongoDB Company Profile

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

Want to see what other hedge funds are holding MDB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MongoDB, Inc. (NASDAQ:MDB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.