LeConte Wealth Management LLC bought a new stake in Robinhood Markets, Inc. (NASDAQ:HOOD - Free Report) during the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm bought 2,979 shares of the company's stock, valued at approximately $279,000.

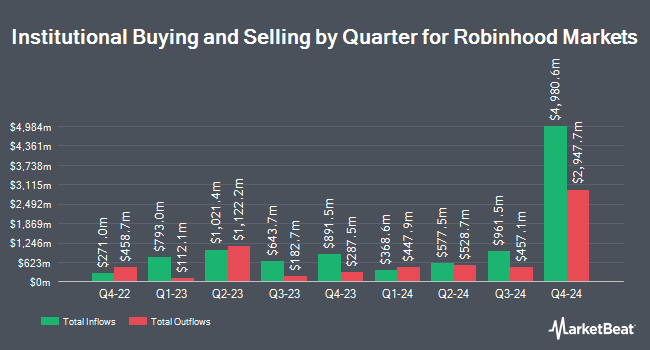

A number of other hedge funds and other institutional investors have also bought and sold shares of the company. Vanguard Group Inc. raised its position in Robinhood Markets by 8.6% in the 1st quarter. Vanguard Group Inc. now owns 74,241,080 shares of the company's stock valued at $3,089,914,000 after buying an additional 5,874,701 shares during the last quarter. Kingstone Capital Partners Texas LLC acquired a new stake in Robinhood Markets in the 2nd quarter valued at approximately $951,479,000. AGF Management Ltd. raised its position in Robinhood Markets by 286.0% in the 1st quarter. AGF Management Ltd. now owns 5,743,715 shares of the company's stock valued at $239,053,000 after buying an additional 4,255,862 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in Robinhood Markets by 2.8% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 4,851,352 shares of the company's stock valued at $201,913,000 after buying an additional 131,620 shares during the last quarter. Finally, Northern Trust Corp increased its position in shares of Robinhood Markets by 4.2% during the 1st quarter. Northern Trust Corp now owns 4,061,398 shares of the company's stock worth $169,035,000 after purchasing an additional 163,823 shares during the last quarter. Institutional investors and hedge funds own 93.27% of the company's stock.

Wall Street Analysts Forecast Growth

HOOD has been the topic of several recent analyst reports. Citigroup boosted their price target on Robinhood Markets from $120.00 to $135.00 and gave the stock a "neutral" rating in a research report on Tuesday. KeyCorp boosted their price target on Robinhood Markets from $60.00 to $110.00 and gave the stock an "overweight" rating in a research report on Tuesday, July 1st. Cantor Fitzgerald boosted their price target on Robinhood Markets from $100.00 to $118.00 and gave the stock an "overweight" rating in a research report on Thursday, July 31st. Compass Point boosted their price target on Robinhood Markets from $64.00 to $96.00 and gave the stock a "buy" rating in a research report on Friday, June 27th. Finally, Morgan Stanley boosted their price target on Robinhood Markets from $43.00 to $110.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 15th. Eleven analysts have rated the stock with a Buy rating, six have assigned a Hold rating and one has issued a Sell rating to the company. Based on data from MarketBeat, Robinhood Markets presently has an average rating of "Moderate Buy" and a consensus price target of $104.06.

Get Our Latest Stock Report on HOOD

Insiders Place Their Bets

In related news, insider Daniel Martin Gallagher, Jr. sold 225,000 shares of the business's stock in a transaction that occurred on Friday, August 1st. The stock was sold at an average price of $99.97, for a total transaction of $22,493,250.00. Following the transaction, the insider directly owned 591,887 shares of the company's stock, valued at approximately $59,170,943.39. The trade was a 27.54% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Meyer Malka sold 1,093,288 shares of the business's stock in a transaction that occurred on Thursday, August 28th. The stock was sold at an average price of $103.87, for a total value of $113,559,824.56. Following the transaction, the director directly owned 3,976,234 shares in the company, valued at $413,011,425.58. The trade was a 21.57% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 5,681,462 shares of company stock valued at $581,726,917 over the last 90 days. 14.47% of the stock is owned by insiders.

Robinhood Markets Trading Up 0.5%

HOOD stock opened at $126.80 on Thursday. The firm has a market capitalization of $112.68 billion, a PE ratio of 64.37, a PEG ratio of 4.68 and a beta of 2.36. Robinhood Markets, Inc. has a 1-year low of $22.05 and a 1-year high of $130.07. The business's 50 day simple moving average is $109.90 and its 200 day simple moving average is $77.57.

Robinhood Markets (NASDAQ:HOOD - Get Free Report) last posted its earnings results on Wednesday, July 30th. The company reported $0.42 earnings per share for the quarter, topping analysts' consensus estimates of $0.30 by $0.12. The business had revenue of $989.00 million for the quarter, compared to analyst estimates of $893.93 million. Robinhood Markets had a return on equity of 17.48% and a net margin of 50.13%.The firm's revenue was up 45.0% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.21 EPS. As a group, sell-side analysts predict that Robinhood Markets, Inc. will post 1.35 EPS for the current fiscal year.

Robinhood Markets Company Profile

(

Free Report)

Robinhood Markets, Inc operates financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds (ETFs), American depository receipts, options, gold, and cryptocurrencies. The company offers fractional trading, recurring investments, fully-paid securities lending, access to investing on margin, cash sweep, instant withdrawals, retirement program, around-the-clock trading, and initial public offerings participation services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Robinhood Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Robinhood Markets wasn't on the list.

While Robinhood Markets currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report