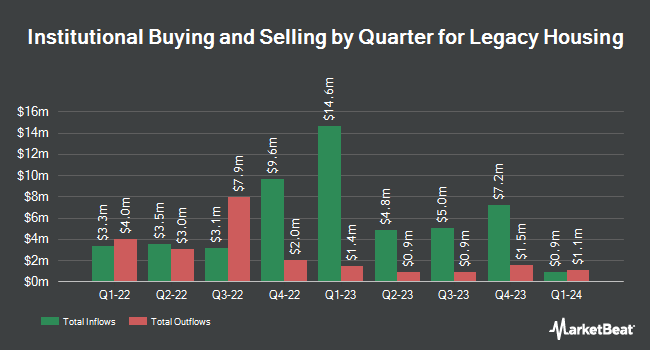

Villanova Investment Management Co LLC cut its holdings in Legacy Housing Corporation (NASDAQ:LEGH - Free Report) by 66.2% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 32,481 shares of the company's stock after selling 63,516 shares during the quarter. Legacy Housing makes up 2.3% of Villanova Investment Management Co LLC's holdings, making the stock its 11th biggest holding. Villanova Investment Management Co LLC owned approximately 0.13% of Legacy Housing worth $819,000 as of its most recent SEC filing.

Several other large investors have also recently bought and sold shares of the company. Goldman Sachs Group Inc. raised its position in Legacy Housing by 4.2% in the first quarter. Goldman Sachs Group Inc. now owns 54,434 shares of the company's stock valued at $1,373,000 after purchasing an additional 2,214 shares during the last quarter. GAMMA Investing LLC grew its stake in Legacy Housing by 6,650.0% in the first quarter. GAMMA Investing LLC now owns 2,295 shares of the company's stock valued at $58,000 after acquiring an additional 2,261 shares during the period. BNP Paribas Financial Markets grew its stake in Legacy Housing by 42.6% in the fourth quarter. BNP Paribas Financial Markets now owns 7,985 shares of the company's stock valued at $197,000 after acquiring an additional 2,385 shares during the period. PDT Partners LLC grew its stake in Legacy Housing by 29.0% in the first quarter. PDT Partners LLC now owns 19,879 shares of the company's stock valued at $501,000 after acquiring an additional 4,464 shares during the period. Finally, Quantbot Technologies LP purchased a new position in shares of Legacy Housing during the first quarter valued at approximately $116,000. 89.35% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen raised Legacy Housing from a "sell" rating to a "hold" rating in a research report on Monday, June 30th. One research analyst has rated the stock with a Hold rating, According to MarketBeat.com, Legacy Housing has a consensus rating of "Hold" and an average price target of $26.00.

Get Our Latest Research Report on Legacy Housing

Legacy Housing Stock Down 0.9%

NASDAQ:LEGH traded down $0.26 during midday trading on Tuesday, hitting $27.14. The stock had a trading volume of 8,502 shares, compared to its average volume of 79,932. Legacy Housing Corporation has a one year low of $21.58 and a one year high of $29.45. The company has a market capitalization of $647.69 million, a price-to-earnings ratio of 12.12 and a beta of 0.85. The stock has a 50-day moving average of $25.28 and a 200 day moving average of $24.35.

Legacy Housing (NASDAQ:LEGH - Get Free Report) last released its quarterly earnings results on Thursday, August 7th. The company reported $0.60 EPS for the quarter, topping the consensus estimate of $0.55 by $0.05. Legacy Housing had a return on equity of 11.11% and a net margin of 30.00%.The firm had revenue of $50.20 million during the quarter, compared to analyst estimates of $43.53 million.

Legacy Housing Company Profile

(

Free Report)

Legacy Housing Corporation engages in the building, sale, and financing of manufactured homes and tiny houses primarily in the southern United States. It manufactures and provides for the transport of mobile homes, including 1 to 5 bedrooms with 1 to 3 1/2 bathrooms; and provides wholesale financing to dealers and mobile home parks, as well as retail financing to consumers.

Recommended Stories

Before you consider Legacy Housing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Legacy Housing wasn't on the list.

While Legacy Housing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.