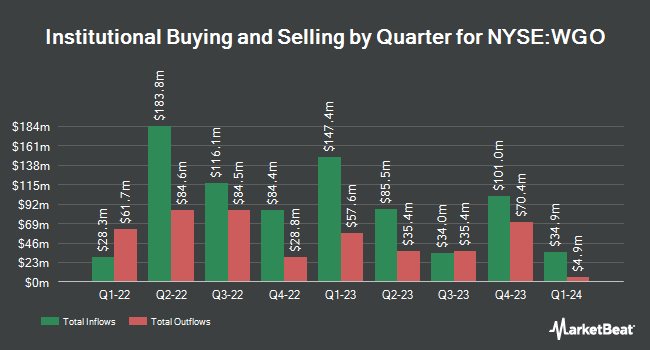

Legato Capital Management LLC trimmed its stake in Winnebago Industries, Inc. (NYSE:WGO - Free Report) by 59.6% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 9,765 shares of the construction company's stock after selling 14,395 shares during the period. Legato Capital Management LLC's holdings in Winnebago Industries were worth $337,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Farther Finance Advisors LLC increased its position in Winnebago Industries by 36,000.0% in the 1st quarter. Farther Finance Advisors LLC now owns 722 shares of the construction company's stock valued at $25,000 after acquiring an additional 720 shares during the period. Versant Capital Management Inc raised its position in Winnebago Industries by 304.9% in the first quarter. Versant Capital Management Inc now owns 826 shares of the construction company's stock valued at $28,000 after purchasing an additional 622 shares during the period. Parallel Advisors LLC grew its stake in Winnebago Industries by 629.2% in the first quarter. Parallel Advisors LLC now owns 824 shares of the construction company's stock worth $28,000 after purchasing an additional 711 shares in the last quarter. Signaturefd LLC bought a new stake in shares of Winnebago Industries during the first quarter valued at approximately $31,000. Finally, Sterling Capital Management LLC grew its position in Winnebago Industries by 823.5% during the 4th quarter. Sterling Capital Management LLC now owns 905 shares of the construction company's stock worth $43,000 after purchasing an additional 807 shares in the last quarter.

Winnebago Industries Price Performance

Shares of NYSE:WGO traded down $0.02 during midday trading on Tuesday, hitting $31.42. The company's stock had a trading volume of 112,958 shares, compared to its average volume of 782,009. The business's 50 day simple moving average is $32.08 and its 200 day simple moving average is $36.11. The company has a market cap of $880.70 million, a P/E ratio of -53.26 and a beta of 1.01. Winnebago Industries, Inc. has a 12-month low of $28.00 and a 12-month high of $65.65. The company has a debt-to-equity ratio of 0.44, a quick ratio of 0.89 and a current ratio of 2.41.

Winnebago Industries (NYSE:WGO - Get Free Report) last released its earnings results on Wednesday, June 25th. The construction company reported $0.81 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.79 by $0.02. The business had revenue of $775.10 million for the quarter, compared to analysts' expectations of $808.15 million. Winnebago Industries had a negative net margin of 0.62% and a positive return on equity of 2.86%. The company's quarterly revenue was down 1.4% on a year-over-year basis. During the same period last year, the company earned $1.13 earnings per share. On average, analysts forecast that Winnebago Industries, Inc. will post 3.41 EPS for the current year.

Winnebago Industries Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, June 25th. Investors of record on Wednesday, June 11th were paid a $0.34 dividend. The ex-dividend date of this dividend was Wednesday, June 11th. This represents a $1.36 annualized dividend and a dividend yield of 4.33%. Winnebago Industries's payout ratio is -230.51%.

Analysts Set New Price Targets

Several research analysts have recently weighed in on the stock. Robert W. Baird lowered their price objective on shares of Winnebago Industries from $38.00 to $35.00 and set a "neutral" rating on the stock in a research note on Thursday, June 26th. Wall Street Zen raised shares of Winnebago Industries from a "sell" rating to a "hold" rating in a research report on Sunday, June 29th. DA Davidson raised shares of Winnebago Industries to a "hold" rating in a research note on Monday, April 14th. BMO Capital Markets lowered their target price on shares of Winnebago Industries from $50.00 to $42.00 and set an "outperform" rating on the stock in a research note on Thursday, June 26th. Finally, Benchmark dropped their price objective on shares of Winnebago Industries from $60.00 to $42.00 and set a "buy" rating for the company in a research note on Monday, June 30th. Five analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $42.33.

Check Out Our Latest Research Report on WGO

Winnebago Industries Company Profile

(

Free Report)

Winnebago Industries, Inc manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities. The company operates through three segments: Towable RV, Motorhome RV, and Marine. It provides towable products that are non-motorized vehicles to be towed by automobiles, pickup trucks, SUVs, or vans for use as temporary living quarters for recreational travel, such as conventional travel trailers, fifth wheels, folding camper trailers, and truck campers under the Winnebago and Grand Design brand names.

See Also

Before you consider Winnebago Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Winnebago Industries wasn't on the list.

While Winnebago Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.