Jackson Square Partners LLC reduced its position in shares of LendingClub Corporation (NYSE:LC - Free Report) by 31.9% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,935,248 shares of the credit services provider's stock after selling 905,128 shares during the period. LendingClub makes up about 2.7% of Jackson Square Partners LLC's investment portfolio, making the stock its 18th largest position. Jackson Square Partners LLC owned approximately 1.69% of LendingClub worth $19,972,000 at the end of the most recent quarter.

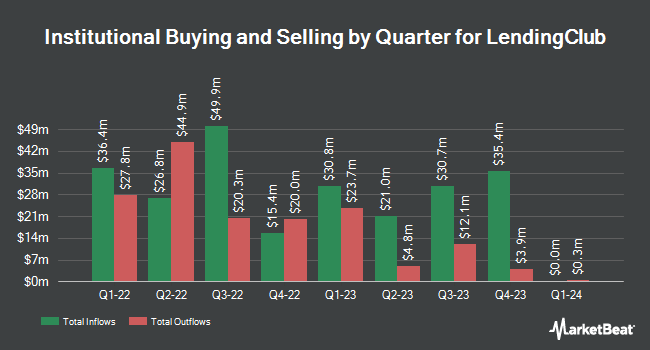

A number of other hedge funds have also recently bought and sold shares of the company. Wellington Management Group LLP increased its stake in LendingClub by 353.1% in the 4th quarter. Wellington Management Group LLP now owns 3,799,585 shares of the credit services provider's stock worth $61,515,000 after purchasing an additional 2,961,050 shares in the last quarter. Driehaus Capital Management LLC increased its stake in LendingClub by 229.1% in the 4th quarter. Driehaus Capital Management LLC now owns 3,588,799 shares of the credit services provider's stock worth $58,103,000 after purchasing an additional 2,498,318 shares in the last quarter. Balyasny Asset Management L.P. increased its stake in LendingClub by 196.5% in the 4th quarter. Balyasny Asset Management L.P. now owns 2,131,253 shares of the credit services provider's stock worth $34,505,000 after purchasing an additional 1,412,568 shares in the last quarter. Nuveen Asset Management LLC increased its stake in LendingClub by 2.8% in the 4th quarter. Nuveen Asset Management LLC now owns 1,839,360 shares of the credit services provider's stock worth $29,779,000 after purchasing an additional 49,996 shares in the last quarter. Finally, Senvest Management LLC increased its stake in LendingClub by 3.4% in the 4th quarter. Senvest Management LLC now owns 1,529,587 shares of the credit services provider's stock worth $24,764,000 after purchasing an additional 50,000 shares in the last quarter. 74.08% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on LC shares. Stephens started coverage on LendingClub in a research note on Thursday, June 12th. They issued an "overweight" rating and a $15.00 price target on the stock. Piper Sandler set a $15.50 price target on LendingClub and gave the stock an "overweight" rating in a research note on Wednesday, July 30th. Citizens Jmp began coverage on LendingClub in a research note on Monday, July 7th. They issued a "market perform" rating on the stock. Citigroup began coverage on LendingClub in a research report on Monday, July 7th. They set a "market perform" rating for the company. Finally, Keefe, Bruyette & Woods raised their price objective on LendingClub from $14.00 to $16.50 and gave the stock an "outperform" rating in a research report on Wednesday, July 30th. Four analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $16.57.

View Our Latest Stock Report on LC

Insider Buying and Selling

In other LendingClub news, CFO Andrew Labenne sold 17,955 shares of LendingClub stock in a transaction on Wednesday, July 30th. The stock was sold at an average price of $16.65, for a total value of $298,950.75. Following the completion of the transaction, the chief financial officer owned 178,111 shares in the company, valued at approximately $2,965,548.15. The trade was a 9.16% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Scott Sanborn sold 5,250 shares of the business's stock in a transaction on Thursday, July 17th. The stock was sold at an average price of $12.98, for a total value of $68,145.00. Following the completion of the transaction, the chief executive officer directly owned 1,283,175 shares in the company, valued at approximately $16,655,611.50. This represents a 0.41% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 44,205 shares of company stock worth $601,561. 3.19% of the stock is currently owned by company insiders.

LendingClub Stock Performance

Shares of LendingClub stock traded down $0.28 during trading on Friday, hitting $15.02. 1,208,883 shares of the stock traded hands, compared to its average volume of 2,597,665. The company has a fifty day moving average price of $12.48 and a two-hundred day moving average price of $11.76. LendingClub Corporation has a twelve month low of $7.90 and a twelve month high of $18.75. The stock has a market cap of $1.72 billion, a P/E ratio of 23.47 and a beta of 2.46.

LendingClub (NYSE:LC - Get Free Report) last posted its earnings results on Tuesday, July 29th. The credit services provider reported $0.33 earnings per share for the quarter, topping the consensus estimate of $0.15 by $0.18. LendingClub had a return on equity of 5.66% and a net margin of 8.36%. The firm had revenue of $248.44 million during the quarter, compared to analyst estimates of $227.04 million. During the same period in the previous year, the company earned $0.13 EPS. The company's revenue for the quarter was up 14.1% on a year-over-year basis. On average, equities research analysts expect that LendingClub Corporation will post 0.72 EPS for the current fiscal year.

LendingClub Profile

(

Free Report)

LendingClub Corporation, operates as a bank holding company, that provides range of financial products and services in the United States. It offers deposit products, including savings accounts, checking accounts, and certificates of deposit. The company also provides loan products, such as consumer loans comprising unsecured personal loans, secured auto refinance loans, and patient and education finance loans; and commercial loans, including small business loans.

Read More

Before you consider LendingClub, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingClub wasn't on the list.

While LendingClub currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report