Level Four Advisory Services LLC increased its position in APA Corporation (NASDAQ:APA - Free Report) by 69.6% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 380,102 shares of the company's stock after purchasing an additional 156,010 shares during the quarter. Level Four Advisory Services LLC owned 0.11% of APA worth $7,990,000 as of its most recent filing with the Securities and Exchange Commission.

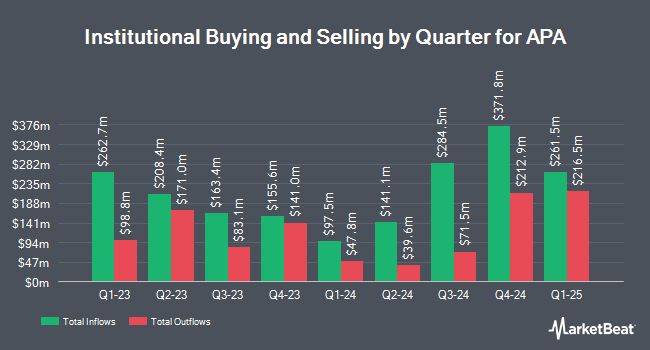

Several other institutional investors and hedge funds have also made changes to their positions in APA. Dimensional Fund Advisors LP boosted its stake in shares of APA by 46.8% in the first quarter. Dimensional Fund Advisors LP now owns 9,080,787 shares of the company's stock valued at $190,876,000 after purchasing an additional 2,894,543 shares during the period. Freestone Grove Partners LP bought a new position in APA during the 4th quarter valued at $30,767,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in APA by 29.1% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,297,871 shares of the company's stock valued at $122,328,000 after acquiring an additional 1,195,212 shares during the last quarter. Nuveen LLC bought a new position in APA during the 1st quarter valued at $22,533,000. Finally, Charles Schwab Investment Management Inc. boosted its stake in APA by 8.1% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 13,932,980 shares of the company's stock valued at $292,871,000 after acquiring an additional 1,046,893 shares during the last quarter. 83.01% of the stock is currently owned by hedge funds and other institutional investors.

APA Stock Performance

Shares of APA stock traded up $1.01 during trading hours on Friday, reaching $21.64. The stock had a trading volume of 7,026,645 shares, compared to its average volume of 7,472,351. The company has a debt-to-equity ratio of 0.62, a current ratio of 0.80 and a quick ratio of 0.80. APA Corporation has a twelve month low of $13.58 and a twelve month high of $29.47. The firm has a 50-day simple moving average of $19.49 and a 200-day simple moving average of $18.94. The firm has a market capitalization of $7.74 billion, a PE ratio of 7.24, a price-to-earnings-growth ratio of 6.14 and a beta of 1.23.

APA (NASDAQ:APA - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The company reported $0.87 earnings per share for the quarter, topping analysts' consensus estimates of $0.45 by $0.42. APA had a net margin of 10.53% and a return on equity of 20.98%. The business had revenue of $2.18 billion for the quarter, compared to analysts' expectations of $2.03 billion. During the same quarter last year, the company earned $1.17 EPS. The company's revenue for the quarter was down 14.4% compared to the same quarter last year. As a group, equities analysts forecast that APA Corporation will post 4.03 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of research analysts have commented on APA shares. Piper Sandler increased their price objective on shares of APA from $21.00 to $22.00 and gave the company a "neutral" rating in a research note on Thursday, August 14th. Mizuho reduced their price objective on shares of APA from $20.00 to $19.00 and set an "underperform" rating on the stock in a research note on Tuesday, May 13th. Scotiabank reiterated a "sector perform" rating and set a $22.00 price objective (up from $14.00) on shares of APA in a research note on Friday, July 11th. UBS Group increased their price objective on shares of APA from $21.00 to $23.00 and gave the company a "neutral" rating in a research note on Wednesday. Finally, Cowen reiterated a "hold" rating on shares of APA in a research note on Thursday, August 7th. Three equities research analysts have rated the stock with a Buy rating, fourteen have assigned a Hold rating and three have assigned a Sell rating to the company. According to MarketBeat.com, APA has a consensus rating of "Hold" and an average price target of $23.94.

Read Our Latest Analysis on APA

APA Profile

(

Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

See Also

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.